Could Investing $10,000 in QuantumScape Make You a Millionaire?

Key Points

Electric vehicle batteries are the biggest turnoff for would-be buyers.

QuantumScape, however, may have a solution to this challenge.

The problem is, several bigger companies are developing similar solutions of their own.

Most investors understand that lottery-like windfall gains on stocks are relatively rare. Every now and then though, they do happen. Amazon and Nvidia are prime examples of what's possible, even if not probable. The key is identifying a company with the right product or service while it's still on the verge of explosive demand.

Does QuantumScape (NYSE: QS) have the potential to produce enormous rewards for its shareholders? Maybe.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

What's QuantumScape?

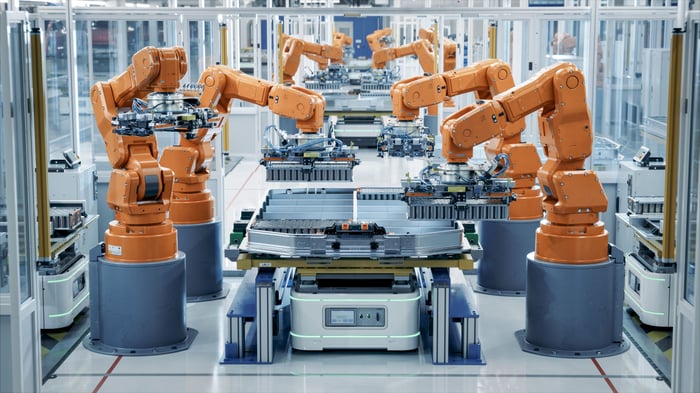

QuantumScape is developing better batteries for electric vehicles (EVs). Specifically, it's working on so-called solid-state lithium batteries. What's that mean? To fully appreciate it you have to understand where this aspect of the EV business is right now.

In its early days when electric vehicles were still relatively uncommon and aimed at more affluent consumers, their cost and efficiency wasn't a major concern. As they become more common and more affordable though, the industry as well as consumers recognize that in many ways the lithium-based batteries powering them are the big stumbling block. Their driving range is still not quite what would-be owners are looking for, and they don't last forever. These giant battery packs are also still fairly expensive to replace even though their cost has come down in recent years.

Image source: Getty Images.

QuantumScape's technology addresses at least the first two of these three concerns (driving range and durability) while the third (cost) is likely to be dealt with soon enough. By changing the chemistry of lithium-ion batteries to a solidified one that doesn't require a conventional anode -- which are a very costly component of conventional lithium batteries -- driving ranges are extended on the order of 15% to 40%. Solid-state lithium batteries are also expected to be capable of storing 95% of their initial storage capacity even after being driven for 300,000 miles. They're also generally safer; liquid lithium batteries, as it turns out, are far more easily ignited than solid-sate lithium batteries.

And their cost? That's the tricky part. It's still not exactly clear how much they'll cost when manufacturing them at scale since QuantumScape isn't yet manufacturing them at scale. To date it's only made prototypes for EV makers to test them. Like any other new technology, they'll likely be initially expensive should solid-state batteries become the norm. Also like any other technology though, the more you make, the cheaper they get.

The future is promising

The chief challenge for interested investors isn't QuantumScape's likely production cost of its solid-state lithium batteries though. It's the plausible potential of this technological leap itself. Investors have heard stories of game-changing solutions before, too many of which ended up being busts. Names like Theranos, Groupon, and meal kit company Chef'd come to mind. Those companies as we once knew them no longer even exist.

Solid-state lithium batteries, however, are no joke. Although they may not be the final leap needed to fully usher in the era of battery-powered vehicles, they certainly could push the EV football much further downfield for the next several years.

That's what automobile manufacturer Volkswagen's (OTC: VWAGY) involvement suggests, anyway. Not only is it a key licensing partner for a product that has yet to generate any actual commercial revenue, it's also QuantumScape's single biggest shareholder, owning more than 10% of the company. It's noteworthy simply because Volkswagen is the world's fifth-biggest EV manufacturer. That's an important vote of confidence in the potential of this improved battery technology.

This might help seal the deal: Industry research outfit Straits Research believes the worldwide solid-state lithium battery market is set to grow at an average yearly pace of more than 36% though 2033, mostly driven by the improvements they offer electric vehicles even though there aren't actually any EVs yet using this tech.

Don't treat QuantumScape as just another growth prospect

So back to the initial question: Could investing $10,000 in QuantumScape stock today make you a millionaire the same way that similarly sized investments did for a handful of Nvidia and Amazon shareholders?

Never say never. But probably not.

This answer to the specific wording of the question itself, however, paints a potentially misleading picture of QuantumScape's upside; most of the market's most promising stocks are unlikely to turn $10,000 into a seven-figure sum within a lifetime. That's asking a lot of any ticker! This particular stock's unlikelihood of producing this sort of return doesn't mean it's not worth owning though. Even a tenfold increase on your investment over the course of the next several years would make it worth buying now. And that's certainly a plausible outcome here.

Just be realistic about the risk you're taking. This isn't the same as investing in an established business like Coca-Cola, or even Amazon. Anyone who's buying into pre-commercialized QuantumScape here is ultimately making a bet that solid-state lithium batteries are the future just because they're better, and will eventually become affordable.

And even if they are the affordable future, bear in mind that it's possible another player like BYD or China's Contemporary Amperex Technology (which are already among the world's biggest EV battery manufacturers) could figure out a way of replicating or even surpassing QuantumScape's solution. Indeed, if and when solid-state lithium batteries enter the mainstream, you can count on those deeper-pocketed rivals to step up their developmental games.

That's where this prospect differs from Amazon or Nvidia -- no competitor was in a position to counter their rapid growth with a competitive alternative. There are other players already in the business with the wherewithal to keep QuantumScape's growth in check though, and it remains to be seen if Volkswagen's involvement will be enough to make its smaller battery-development partner viable.

Still, plenty of investors have done pretty well with trades that seemed even more unlikely at the time, like Carvana, Monster Beverage, and the aforementioned Amazon. Again, never say never. It only takes one. You simply need to suffer a few of the wrong ones to finally plug into the right one.

This aggressive approach to stock-picking of course isn't for everyone though, which is why QuantumScape might not be right for you.

Should you invest $1,000 in QuantumScape right now?

Before you buy stock in QuantumScape, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and QuantumScape wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $670,781!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,023,752!*

Now, it’s worth noting Stock Advisor’s total average return is 1,052% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 25, 2025

James Brumley has positions in Coca-Cola. The Motley Fool has positions in and recommends Amazon, Monster Beverage, and Nvidia. The Motley Fool recommends Volkswagen Ag. The Motley Fool has a disclosure policy.