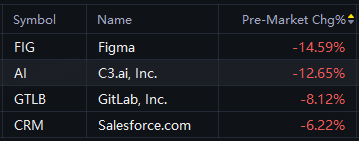

AI Software Shares Drop. Figma Falls 15%; C3.ai down 13%; Gitlab down 8%; Salesforce down 6%

AI software shares dropped in premarket trading on Thursday. Figma fell 15%; C3.ai fell 13%; Gitlab fell 8%; Salesforce fell 6%.

Figma posted a slight beat on second-quarter profit and revenue in its first financial report as a public company on Wednesday, but fell short of the lofty expectations set by AI and tech investors, sending its shares down.

The company delivered a blowout debut in July as investors rallied behind its new product lineup, revenue growth and potential to capture a significant share of the design software market.

Shares of the enterprise AI company C3.ai, Inc. fell after it announced fiscal first-quarter results and the appointment of Stephen Ehikian as its new CEO.

C3 AI reported $70.3 million in revenue for the quarter, down from $87.2 million during the same period last year. The company’s GAAP net loss widened to an 86-cent loss from a 50-cent loss a year ago.

Ehikian is a long-time tech executive who built two companies that were both acquired by Salesforce, C3 AI said. C3 AI said Ehikian assumed the new role on Sept. 1.

GitLab, Inc. shares tumbled after the web-based software development platform issued lackluster third-quarter and full-year revenue guidance. Gitlab expects third-quarter revenue of $238 million to $239 million, lower than the $242 million consensus estimate, according to LSEG. The company expects full-year revenue of $936 million to $942 million, light of the $941 million consensus estimate. Otherwise, Gitlab topped expectations in its fiscal second quarter. It also announced CFO Brian Robins will step down effective Sept. 19.

Salesforce.com forecast third-quarter revenue below Wall Street estimates on Wednesday, signaling lagging monetization for its highly-touted artificial intelligence agent platform as clients dial back spending due to macroeconomic uncertainty.

The cloud software provider also announced a $20 billion increase to its existing share buyback program, but that was unable to allay investors' concerns, sending Salesforce's shares down.