Bitcoin or Gold? The Answer Might Surprise You.

Key Points

Bitcoin is volatile and has returned more than 21,000% since 2008.

Gold is steady and has risen about 150% in value over the same period.

As a bullish investor with a long time horizon, I’d rather add Bitcoin to my portfolio.

Inflation hedges gold and the cryptocurrency Bitcoin (CRYPTO: BTC) have posted significant gains since 2020. Each has a reputation for being a store of value, maintaining value through economic downturns. Each is finite in quantity and touted as an investment that can help you weather inflation.

During the pandemic alarm, gold climbed steadily, but Bitcoin dropped aggressively. Many analysts pointed to the dip as proof that Bitcoin isn't, in fact, a store of value.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

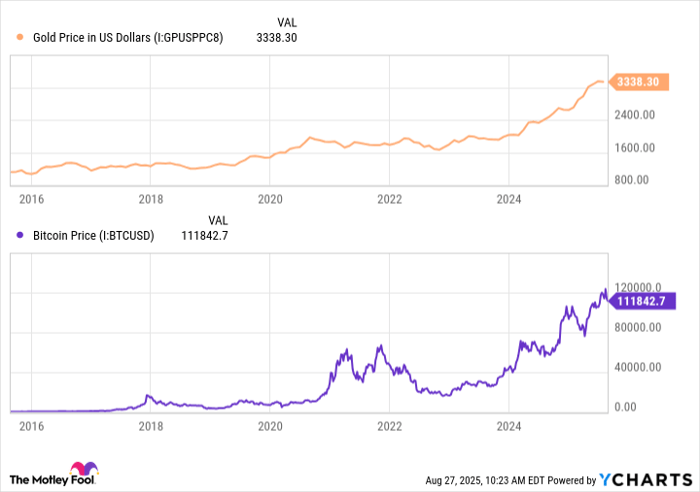

Fast-forward five years, and the picture reverses. Bitcoin has performed 10 times better than its older, shinier rival. But despite impressive gains, it remains extremely volatile.

Image source: Getty Images.

The biggest cryptocurrency won't climb straight

Bitcoin has built a reputation as the most valuable cryptocurrency in the world, with a market cap over $2 trillion. In fact, Bitcoin is so big, it makes the second-largest cryptocurrency, Ethereum, look like small potatoes. Ethereum's market cap is roughly $500 billion as of this writing.

Despite its volatility, Bitcoin is considered one of the safest cryptocurrencies. It's decentralized and cryptographically secured. It's also scarce with a finite supply of 21 million Bitcoins.

Thus far, buyers have come in droves. A combination of security and scarcity has led analysts like Cathie Wood to declare the coin as a store of value to rival gold. Wood has been so bold as to predict Bitcoin will rise from under $150,000 to $710,000 by 2030. She points to Bitcoin becoming less volatile as another reason to hold it over gold.

Though Bitcoin has, indeed, become less volatile over the years, it's still much more prone to shakiness than gold. The graph of Bitcoin's wild swings is erratic, especially when you chart it next to the price of gold.

Gold Price in US Dollars data by YCharts

Bitcoin dropped from roughly $65,000 to roughly $16,000 from March 2021 to November 2022, briefly losing more than 60%. Yikes!

Had you invested a large chunk of savings into Bitcoin and needed to sell during that downturn, you might have lost more than half your savings. Its short term is unpredictable. That's one reason many investors prefer gold, which is unlikely to drop 50% or more when you need it most.

The safest store of value...isn't all that valuable?

Gold is like an old friend; it needs no introduction. One of the most trusted stores of value, it rocks a market cap of over $20 trillion, about 10 times that of Bitcoin.

The SPDR Gold Trust (NYSEMKT: GLD), which tracks the price of gold, hasn't fallen more than 25% since 2020. The squiggly line that represents the value of a GLD share is a (relatively) smooth curve, up and to the right. Smooth is what you want to see when there's a chance you might sell your holdings within the next year -- or five.

Despite serving as a store of value for millennia, gold has a problem. It's not quite as valuable as it was, say, 17 years ago. Reason being, Bitcoin has emerged as an alternative store of value. It's secure, scarce, and decentralized, much like gold. Though its volatility leaves something to be desired, it's becoming more stable over time and I think taking away from gold.

Performance-wise, Bitcoin has outperformed gold by about 1,000% since 2020. Now take a step back. Since inception, Bitcoin has returned over 21,000% to investors. In the same period, gold has returned under 200%. Not so valuable after all, relatively speaking.

Bitcoin looks like the long-term winner

Bitcoin and gold help investors hedge against inflation, but they aren't necessarily going to appeal to the same types of people. Bitcoin is the closest thing there is to the "next generation of gold," a store of value that's secure, scarce, and decentralized.

Gold adds one more attribute: stable. It's a good fit for investors who want to avoid volatility. It's not a growth play like Bitcoin, and for some, that's fine -- stability is the priority.

I prefer Bitcoin as a store of value because it has been outperforming gold and looks like it will continue to do so, and it shares many of the same attributes as its older cousin. My time horizons are long and I plan on HODL'ing (holding on for dear life) for five years, minimum. The world's largest cryptocurrency continues to be a strong investment, and as volatility falls, as I think it will, I expect it to outperform gold during that timeline.

Should you invest $1,000 in Bitcoin right now?

Before you buy stock in Bitcoin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bitcoin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $661,220!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,114,162!*

Now, it’s worth noting Stock Advisor’s total average return is 1,069% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 25, 2025

Cole Tretheway owns shares of Bitcoin and Ethereum. The Motley Fool has positions in and recommends Bitcoin and Ethereum. The Motley Fool has a disclosure policy.