My 3 Favorite Stocks to Buy Right Now

Key Points

On the surface, Roblox is just another video game. Dig deeper though. It’s so much more.

Yes, Apple botched its foray into personal AI. It’s not going to make the same mistake again, though.

Pharma giant Pfizer has struggled since the end of the pandemic, but it's time to start looking forward.

I'll admit it: There aren't a lot of stocks I'm interested in adding to my portfolio right now. Either they're too expensive, or their future's too cloudy, or they're clearly vulnerable. Or some combination of all three. It happens.

This backdrop, however, only makes the small handful of names I'm still interested in all the more compelling. Here's a rundown of my top three picks among these prospects right now.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

1. Roblox

The video gaming business can be brutal, with the constant threat of a newer or better game displacing demand for an existing hit title. So when one particular game remains popular year after year, it pays to take notice.

Roblox (NYSE: RBLX) is that game. OK, it's not a game as much as it is a platform where amateur game designers can create their own online game, and then allow other gamers to pay those designers for access to their virtual world.

Last quarter alone, the company shelled out $316 million worth of fees to these game developers -- about 29% of total revenue of just under $1.1 billion, which was up 21% year over year. An average of 111.8 million different people played at least one Roblox game every day for the three-month stretch in question as well, up 41%.

That's not the impressive part of the bullish thesis here, though. What's truly impressive is how long this company's been able to maintain this sort of growth in an industry where demand for a particular game is relatively short-lived. See, Roblox was launched in 2006. It's pretty much grown every year since then, with no end in sight.

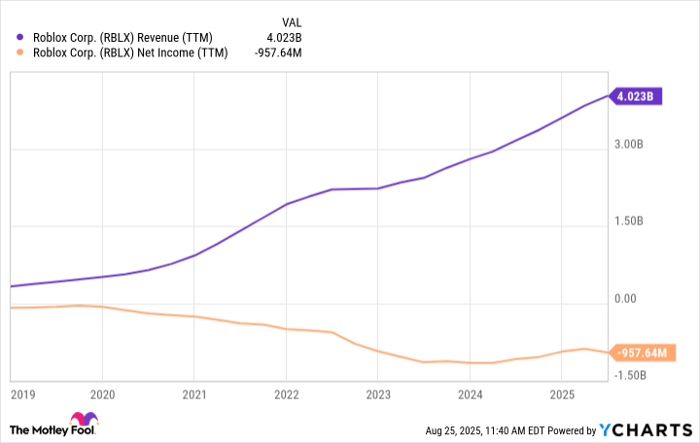

RBLX Revenue (TTM) data by YCharts

The key to this growth is the nature of the platform itself; players always have a new experience, because developers are forever building new virtual worlds or updating their existing game rooms. Of course, it doesn't hurt that many of these online worlds have turned into something of a community for their fans.

Now, as the graphic shows, Roblox isn't yet profitable -- one of the nuances that can make the stock a bit unpredictable. The company lost $280 million last quarter, in fact, up 34% from the loss reported for the comparable quarter a year earlier.

The analyst community seems pretty convinced Roblox is turning the profit corner though, with losses expected to start shrinking beginning next year. Even though actual net profits are still years down the road, the vast majority of analysts still currently rate this ticker a strong buy based on this eventual distant swing to a profit.

2. Apple

Yes, Apple (NASDAQ: AAPL) missed the mark with its foray into the consumer-facing artificial intelligence (AI) arena. Although the buzz surrounding Apple Intelligence when it was introduced last June was palpable then, what was released in October was underwhelming, by virtue of missing many of its touted features. It was also only available on the very newest of iPhones, which most iPhone fans didn't yet own (and still don't).

Worse, the company now reports that the AI-powered version of Siri it wished it had released late last year now won't be ready for launch until early next year. And shareholders have paid the price. The stock's currently trading about where they were a year ago.

Image source: Getty Images.

For investors, that can take what they've learned about Apple over the course of the past 20 years and use it to predict what's likely for the next 20 though, this temporary weakness is a buying opportunity.

The fact is, Apple on a bad day is still a better investment than most other stocks on their best day. Sure, the company made a mistake. It's capable of correcting it though, and is willing to do so. Indeed, there's a case to be made that the somewhat embarrassing gaffe ensures Apple will do everything in its power to impress the world when it gets a second chance to do so in the months ahead.

The opportunity is enormous, too. Although most personal uses of AI right now are for more efficient web-browsing rather than actual improved personal efficiency, the software and underlying hardware capable of running it are still finding their footing. As refinements in both continue to be made, Precedence Research believes the worldwide intelligent virtual assistant market will grow at an average annualized pace of 24% through 2034. This growth is likely to be led by North America too, where iPhones are particularly popular.

3. Pfizer

Finally, I'm adding Pfizer (NYSE: PFE) to the list of my three favorite stocks to buy right now. If you know anything at all about the pharmaceutical company then you almost certainly know the drugmaker's struggled since the wind-down of the COVID-19 pandemic.

While its treatment (called Paxlovid) along with the vaccine it co-developed with BioNTech led the company to record-breaking revenue of $100 billion in 2022, last year's top line of $63.6 billion underscores how much the pharma giant has struggled to offset the loss of those pandemic-prompted sales. That's why the stock's now down nearly 60% from its late-2021 peak.

As the old adage goes, though, it's always darkest before dawn. Translation: This steep and prolonged sell-off is a buying opportunity. What's not being priced in by backwards-looking investors is all that Pfizer has done in the meantime to rekindle its revenue growth.

Between 2022's acquisitions of Biohaven Pharmaceuticals and Arena Pharmaceuticals, along with 2023's acquisition of Seagen at the same time, it's continued the development of drugs that were already in its own pipeline, and the company aims to have eight new blockbuster oncology drugs alone on the market by 2030.

And that's just cancer. All told, Pfizer's got 28 different phase 3 drug trials underway right now, any and all of which could be approved by then. In the meantime, the pharmaceutical giant is en route to culling more than $7 billion in annual operating expenses by 2027.

It's going to be a while before this company reaches the $100 billion annual revenue mark again. The sellers have arguably overshot their target though, dragging Pfizer stock down to less than 10 times this year's expected per-share earnings of $3.08, and pumping up its dividend yield (based on a reasonably well-protected dividend, by the way) up to nearly 6.7%.

You're being pretty well-rewarded in the meantime while waiting for the rest of the market to figure out this iconic pharma company's still got plenty of upside ahead.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $661,220!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,114,162!*

Now, it’s worth noting Stock Advisor’s total average return is 1,069% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 25, 2025

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Pfizer, and Roblox. The Motley Fool recommends BioNTech Se. The Motley Fool has a disclosure policy.