Huge News for AST SpaceMobile Stock Investors

Key Points

AST SpaceMobile is about to bring satellite internet directly to smartphones.

The company has huge growth potential, but it requires a lot of upfront investments.

Shares of the aerospace company look expensive after their recent monster run.

Everyone has heard about the vaunted Starlink internet. But what if I told you there was an even better option for global satellite internet connectivity launching soon?

Enter AST SpaceMobile (NASDAQ: ASTS). This pre-revenue upstart in satellite internet services has developed a technology to beam internet access directly to devices anywhere in the world, without a clunky terminal. Based on its satellite development progress, shares of AST SpaceMobile have soared in recent years, going from under $5 to $44.50 as of Aug. 20.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

On Aug. 11, AST SpaceMobile released its second-quarter earnings report and updated investors with huge news: Its service is slated to launch later in 2025 in the United States. From there, it plans to go global. Does that make AST SpaceMobile stock a buy today?

Satellite internet straight to smartphones

With large arrayed satellites around 700 square feet in area, AST SpaceMobile can make a direct connection to a smartphone or any other internet-enabled device. This is a huge development compared to traditional technologies, which either require a wired connection to a home, clunky terminals like Starlink, or land-based cellular towers.

In order to get the product in the hands of customers, AST SpaceMobile is partnering with the major telecommunications providers such as AT&T and their equivalent carriers in other countries to bring direct connection satellite internet as an add-on service you can pay for through your internet bill. According to management, its partners have 3 billion combined existing customers that it can upsell this internet service to.

But when will the service be ready? Sooner than you think. As of the latest quarterly update, AST SpaceMobile said it will enable satellite internet connectivity in the United States at some point in 2025, leading to between $50 million and $75 million in revenue in the back half of the year. The company generates close to zero revenue today. This revenue will include commercial contracts as well as deals with the United States government.

There are six satellites in orbit today, with plans to get 45 to 60 in orbit through 2026 to enable service in other markets such as Japan, the United Kingdom, and Canada. Eventually, the service will be available in all markets globally.

Image source: Getty Images.

Huge investments, but a large opportunity

Running some quick estimates, you can see how large the potential market opportunity is for AST SpaceMobile as the only provider of direct internet connectivity for telecommunications providers today.

For example, if it can drive 100 million customers to sign up for AST SpaceMobile's service at $10 a month in revenue sharing for the company, that is $12 billion in annual revenue. It will not show up immediately, but you can see why management is confident it can quickly scale up revenue to a $100 million annual run rate in the United States from a standing start this year. Remember, too, it has an existing partnership with the U.S. government that will bolster sales.

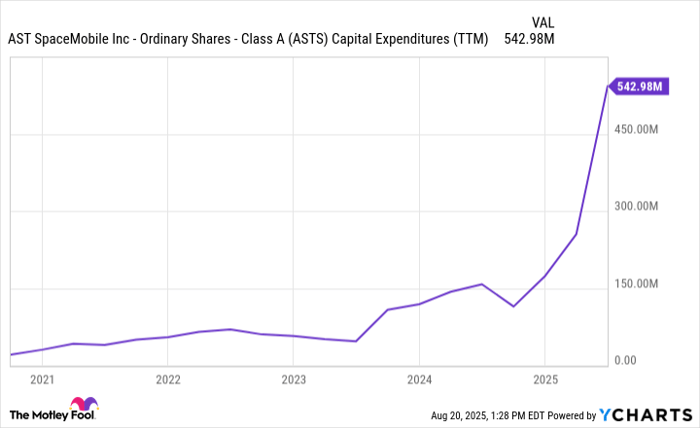

Growth potential for AST SpaceMobile is enormous. However, getting this satellite constellation up and running -- along with developing the technology and manufacturing -- has been an expensive ordeal. Over the past 12 months alone, AST SpaceMobile has spent $543 million on capital expenditures while generating close to zero in revenue.

The next few quarters will require heavy spending as well to get even more satellites into orbit. This is why the company just raised $575 million in a convertible debt offering, giving it over $1.5 billion in balance sheet liquidity to spend on its constellation development.

ASTS Capital Expenditures (TTM) data by YCharts

Should you buy AST SpaceMobile stock?

Today, AST SpaceMobile trades at a market capitalization of $16 billion. Including potential dilution through money-raising events like common stock offerings and eventual debt conversions, AST SpaceMobile's market cap will likely be $20 billion or higher in a few years assuming the stock price does not move.

Valuing this stock is difficult. If you are confident that the global internet connectivity will lead to tens of millions of customers and billions in revenue, then AST SpaceMobile stock may be a buy at today's prices. It will cost money to maintain and upgrade this satellite fleet -- perhaps hundreds of millions of dollars a year -- but it will not be overly expensive and every incremental customer added to the service will come with extremely high profit margins. This could make AST SpaceMobile highly profitable one day.

But that does not mean you should buy a pre-revenue stock trading at a market cap of $20 billion. Even if the company eventually scales to $1 billion in annual earnings power, that is a price-to-earnings ratio (P/E) of 20 based on a $20 billion market cap. AST SpaceMobile is a fascinating business, but investors should avoid buying the stock at this elevated price.

Should you invest $1,000 in AST SpaceMobile right now?

Before you buy stock in AST SpaceMobile, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AST SpaceMobile wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $649,657!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,090,993!*

Now, it’s worth noting Stock Advisor’s total average return is 1,057% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 18, 2025

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.