Is Rocket Lab Stock a Buy Below $45?

Key Points

Rocket Lab is vying to compete directly with SpaceX.

The company has long-term ambitions to sell space capabilities to third parties.

Rocket Lab stock still has potential but comes with a lot of downside risks.

With the stock market soaring, it may seem like you've missed the boat on some amazing investing opportunities. This is the feeling you might get when looking at Rocket Lab (NASDAQ: RKLB), a space flight stock that is up 80% year to date (YTD) and up massively since the start of 2023. With a market cap over $20 billion, you might think the easy money has already been made in this stock.

But is that actually true? Rocket Lab is a highly ambitious company that aims to build a vertically integrated space company like SpaceX and is well on its way to achieving its goals. SpaceX is valued at $400 billion or more, which is 20x the value of Rocket Lab today. Let's see if Rocket Lab still has room to run with the share price below $45.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Building the next SpaceX?

In the last decade, no company has been able to match SpaceX's capabilities in reliable rocket launches. For both commercial and government customers, the Elon Musk company is a monopoly in medium-sized rocket launches with its Falcon program, charging over $50 million per launch for customers.

Rocket Lab is the only company close to narrowing this gap. It is testing a new rocket called the Neutron which will have similar capabilities to the Falcon 9 launch system. A full test flight is scheduled for sometime this year, with paid commercial flights coming soon thereafter. Combined with Rocket Lab's other products, such as its small Electron rocket, satellite manufacturing, space software, and payload products, the company will have full capabilities to match SpaceX and try to win away contracts from customers who previously had nowhere else to go but SpaceX.

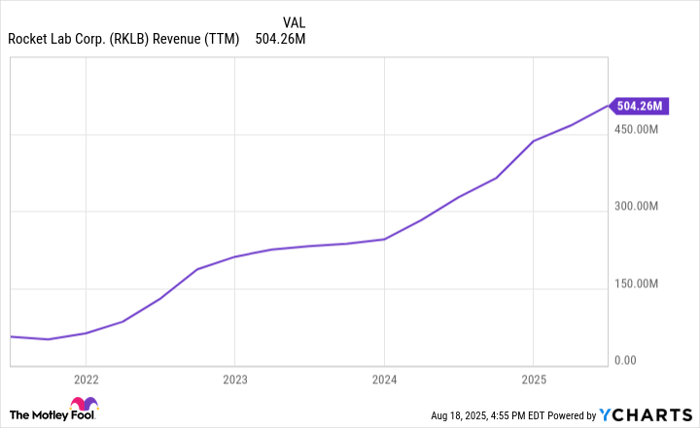

Spending on the space economy is estimated to reach $1 trillion by 2030 and will center around companies that can reliably launch payloads into orbit. Today, Rocket Lab is only generating $500 million in annual revenue. But by the next decade, if everything goes right, that number could be well into the billions.

Image source: Getty Images.

Taking inspiration from cloud computing

Adding large payload capabilities with the Neutron can help Rocket Lab's revenue keep climbing higher in the next few years. Just 10 launches a year at a $50 million price point would double Rocket Lab's current sales, and that is before including any space systems and satellite revenue from launch contracts.

In the longer term, Rocket Lab plans to take inspiration from the cloud-computing market to begin building and selling its in-house capabilities to third parties. This could include satellite internet capabilities, solar energy arrays, communication systems, or any sort of data analysis that customers want back on earth. Instead of paying millions upon millions of dollars to Rocket Lab to launch a satellite into orbit, Rocket Lab is going to pre-launch capabilities into space and then sell the capabilities to the customers, which is similar to data centers for cloud-computing infrastructure players.

This is both similar to and slightly different from SpaceX's Starlink internet service. SpaceX built Starlink to sell itself, while Rocket Lab is going to build capabilities for third parties to outsource. It will be many years until this constellation is up and running, but given how fast a service link Starlink is growing, this should make Rocket Lab investors salivate. This next leg of the business could help Rocket Lab eventually hit $10 billion or more in annual sales, although that won't occur for at least a decade or longer.

RKLB Revenue (TTM) data by YCharts.

Is Rocket Lab a buy below $45?

Rocket Lab is a company that has executed brilliantly in the last decade. I expect further execution in its product roadmap over the next 10 years as well. The company has its Neutron rocket, space systems, and the eventual constellation to sell third-party services that could make the company one of the largest space contractors in the world alongside SpaceX.

If you believe in the Rocket Lab growth story, then there may still be some upside left with the stock below $45 and at a market cap of $20 billion. However, there is still a lot of risk with this stock, especially with so much future growth priced into this business with $500 million in annual sales. Rocket testing is a dangerous business, as people have seen with the recent Starship blowups at SpaceX. The Neutron is not guaranteed to work right away and could require many tests before it proves to customers it can operate safely to deliver payloads to orbit.

As a result of these downside risks, Rocket Lab may not be a great stock to buy even though it is still valued at just a fraction of SpaceX. My recommendation: Keep this exciting and high-flying stock on your watchlist for the time being.

Should you invest $1,000 in Rocket Lab right now?

Before you buy stock in Rocket Lab, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rocket Lab wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $650,499!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,072,543!*

Now, it’s worth noting Stock Advisor’s total average return is 1,045% — a market-crushing outperformance compared to 182% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 18, 2025

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Rocket Lab. The Motley Fool has a disclosure policy.