Why I Continue Piling Into These 2 High-Yielding ETFs for Passive Income

Key Points

The Schwab U.S. Dividend Equity ETF holds 100 top high-yielding dividend stocks.

The JPMorgan Equity Premium Income ETF generates income by writing options.

These funds are a great complement to my existing passive investment strategy.

My goal is to gain financial independence through passive income. I'm building a portfolio of income-generating investments that can eventually fully cover my basic living expenses. By achieving that target, I can alleviate the stress of relying on my paycheck to meet my financial needs.

I strategically invest in many income-generating assets, including exchange-traded funds (ETFs). I recently bought more shares of the Schwab U.S. Dividend Equity ETF (NYSEMKT: SCHD) and the J.P. Morgan Equity Premium Income ETF (NYSEMKT: JEPI). SCHD targets reliable, dividend-paying stocks, while JEPI aims to deliver options income. These high-yielding ETFs enhance the income potential of my portfolio, which is why I continue adding to my positions.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

The top 100 dividend stocks in one fund

Investing in high-quality, high-yielding dividend stocks is a central component of my passive income strategy. I seek companies with steadily growing dividends and above-average yields backed by strong financials. These provide me with sustainable and steadily rising passive dividend income.

The Schwab U.S. Dividend Equity ETF helps complement my portfolio by passively providing me with greater access to the top high-yielding dividend stocks. The fund tracks the Dow Jones U.S. Dividend 100 Index, which measures the returns of 100 top dividend stocks. The index screens for companies based on four dividend quality characteristics:

- Cash flow to total debt.

- Return on equity.

- Dividend yield.

- Five-year dividend growth rate.

As of the index's annual reconstitution last March, its holdings averaged a 3.8% yield and 8.4% annualized dividend growth over five years. Strong financials support their growing payouts, positioning these companies to continue raising their dividend payments.

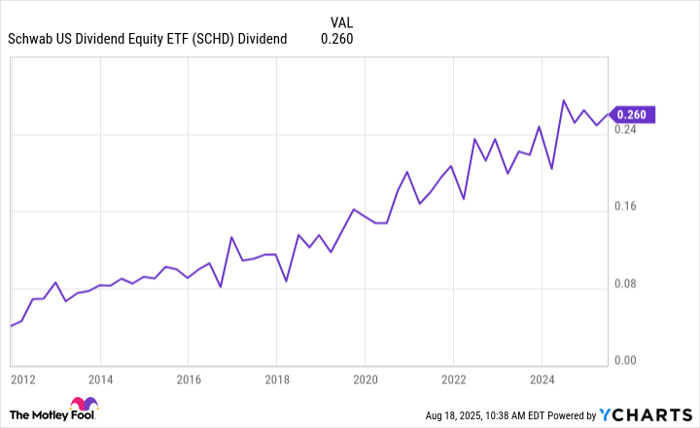

This fund's commitment to high-quality, high-yielding dividend growth stocks has consistently rewarded investors. Year after year, it has distributed increasing amounts of cash, demonstrating its ability to generate growing passive income.

SCHD Dividend data by YCharts.

Today, the fund offers a compelling 3.9% yield -- significantly higher than the S&P 500's current 1.2% yield. This attractive starting yield, coupled with its reliable growth potential, gives me every reason to continue buying more shares of this top ETF.

A nice income option

I also utilize options to generate income, such as selling covered calls on stocks I own or cash-secured puts to possibly buy at a lower price. Options trading can be lucrative, but it is an active strategy. That's why I also hold ETFs, such as the JP Morgan Equity Premium Income ETF, to generate additional passive income from options. Over the last 12 months, it has had an income yield of 8.1%.

The JPMorgan Equity Premium Income ETF has a simple strategy for generating options income. It writes out-of-the-money (i.e., above the current market price) call options on the S&P 500 Index. As an options writer, the fund receives the options premium (the value of the option). It distributes these net payments to fund investors each month as the options expire. While this income fluctuates from month to month, it tends to be higher following periods of market volatility.

The fund also holds a defensive stock portfolio, providing it with upside exposure to the stock market. This has added to its total return. Since its inception in May 2020, the fund has delivered an average annualized return of 11.5%.

With this ETF's powerful income stream and additional return potential from capital appreciation, it perfectly aligns with my strategy for building lasting wealth while generating passive income.

Piling into these ETFs to pump up my passive income

The Schwab U.S. Dividend Equity ETF and JPMorgan Equity Premium Income ETF work well together as part of my income strategy. SCHD provides me with a passive stream of growing dividend income from leading U.S. companies, while JEPI generates lucrative income through its options strategy. This combination enables me to easily boost my income and diversify the ways I earn it, which motivates me to continue piling into these high-yielding ETFs as I have more cash to invest.

Should you invest $1,000 in Schwab U.S. Dividend Equity ETF right now?

Before you buy stock in Schwab U.S. Dividend Equity ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Schwab U.S. Dividend Equity ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $668,155!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,106,071!*

Now, it’s worth noting Stock Advisor’s total average return is 1,070% — a market-crushing outperformance compared to 184% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 18, 2025

Matt DiLallo has positions in JPMorgan Equity Premium Income ETF and Schwab U.S. Dividend Equity ETF. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.