A Gold Mining Stock to Watch as the Metal Soars

Key Points

Geopolitical tensions have helped push gold higher.

Fortuna Mining has gotten out of Burkina Faso, but is exploring in other areas.

It's currently a golden era for gold.

The yellow metal has soared to new all-time highs this year and is dragging a gold mining stock worth watching up with it. Indeed, the price of gold is up 28% year to date, compared with about 10% for the S&P 500.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Gold is considered a safe haven investment that typically performs better when risk assets like stocks are falling. It tends to move in the opposite direction of broad indexes like the S&P 500.

But the recent run-up in the price of gold has not been driven by investors avoiding market risk (indeed, both gold and the S&P 500 are up significantly over the past 52 weeks). Instead, the precious metal's current rise began soon after Russia invaded Ukraine in early 2022 and the U.S. froze Russia's foreign exchange reserves.

Pushing gold

Spooked by that sanction, the central banks of many countries, including Russia, China, and India began massive purchases of gold in order to diversify away from the dollar -- and minimize the ability of the U.S. to weaponize the greenback. Central banks are reportedly buying 80 metric tons of gold a month, about $8.5 billion at current prices.

Plus, multiple policy actions by the Trump administration have weakened the dollar, pushing down its value relative to other major currencies. They include a new tariff regime, which has turned many international investors off of dollar-based assets and caused the greenback to fall, as well as Trump's "big, beautiful bill," which will significantly increase U.S. deficits and has sent many investors elsewhere. In fact, Trump has repeatedly said he wants a weaker dollar because it will boost exports.

As a result, the U.S. Dollar Index (DXY), which compares the dollar to a basket of other major currencies, is down almost 10% year to date. And because gold is priced in dollars globally, when the dollar falls it boosts demand for gold -- and consequently its price rises.

U.S. investors looking to get in on the gold rush and build a hedge against a potential stock market pullback, correction, or outright bear market can look to gold-related stocks as well as the metal itself.

Shine your light on this miner

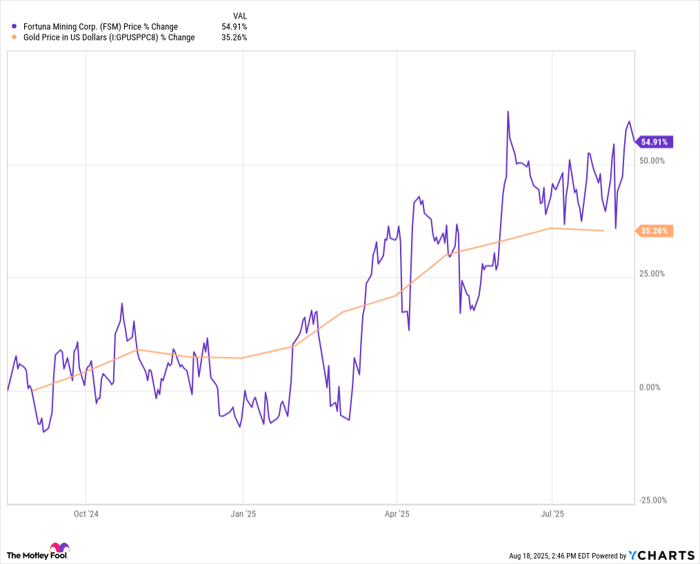

One of the best gold mining stocks is Fortuna Mining (NYSE: FSM), which is up 70% year to date through Aug. 15 and about 155% over the past 18 months.

Based in Vancouver, Canada, Fortuna currently operates three mines in Cote d'Ivoire, Argentina, and Peru. And it's exploring additional sites in Senegal, Cote d'Ivoire, Argentina, Mexico, and Peru.

The company produced about 370,000 ounces of gold last year, 13% more than the year before. In the most recent quarter, production from ongoing operations came to about 62,000 ounces, 10% higher than the same quarter last year.

Overall production has been down this year but only because of the company's divestiture in the Yaramoko mine in Burkina Faso. That exit is considered a big positive for Fortuna, given that the mine had just a year of reserves remaining and civil strife in the country threatens foreign operations.

Fortuna released second-quarter results released on Aug. 6, and the stock dropped 12% the next day, but has since rebounded.

Image source: Getty Images.

On the good news front, just ahead of its earnings report, Fortuna announced that its Diamba Sud mine in the West Africa country of Senegal contains an estimated 724,000 ounces of gold, which is 53% higher than last year's estimate. In addition, there are potentially another 285,000 ounces in the mine that have not yet been confirmed.

Fortuna's stock often moves on announcements of newly discovered reserves and also rises as the price of gold does, though over the past year it has outpaced gold.

There are many gold miner stocks, but Fortuna is considered one of the best due to operation efficiency, strong organic growth and financials, and disciplined management. Investors will want to watch the development of its Senegal project closely.

Gold is hot at the moment for geopolitical reasons. Investors can use gold miner stocks both to hedge against a possible correction in the market and to rack up some serious gains.

Should you invest $1,000 in Fortuna Mining right now?

Before you buy stock in Fortuna Mining, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Fortuna Mining wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $668,155!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,106,071!*

Now, it’s worth noting Stock Advisor’s total average return is 1,070% — a market-crushing outperformance compared to 184% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 18, 2025

Matthew Benjamin has no position in the stocks mentioned in this article. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.