Where Will Lemonade Be in 1 Year?

Key Points

Lemonade's customer base has grown 41% in the past two years.

The crucial loss ratio has improved significantly in the same period, dropping from 94% to 70%.

The stock remains volatile, with plenty of long-term growth potential on the table.

I bought my first Lemonade (NYSE: LMND) shares in December 2020, near the stock's all-time peak. The computerized insurance service looked fantastic at the time, and I expected big things from Lemonade in the long run.

Well, Lemonade's automated insurance revolution wasn't as unstoppable as I had expected. The company's loss ratio soared, revenues slumped, and the stock price plunged. That specific position is down 54% as of Aug. 15, 2025.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

But you know what? I still saw great long-term promise in a customer-friendly insurance service driven by artificial intelligence (AI). So, I doubled down on my Lemonade investment in 2021 and 2022. More recently, the bullish investment thesis has started to play out. All things considered, my total Lemonade holdings have gained 16% so far, despite the unprofitable 2020 investment.

Lemonade is making great strides these days, but where will it go next? Let's see what the company and stock might achieve by the summer of 2026.

Lemonade's recent progress (less pulp and more sugar)

Before looking ahead, let's review Lemonade's recent progress.

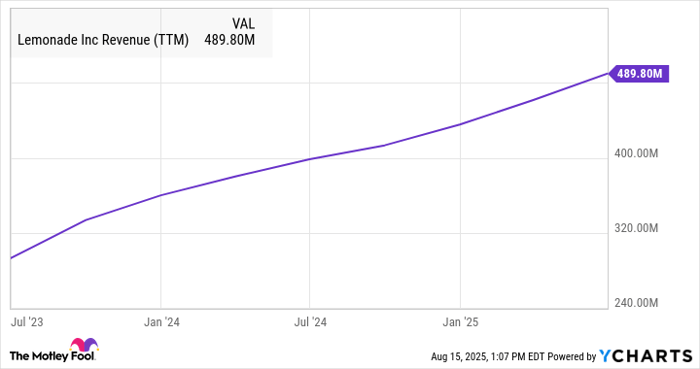

First and foremost, lots of customers are signing up for Lemonade's car, pet, life, and homeowner insurance plans. The company had 2.69 million clients at the end of June, a 41% increase in two years. Over the same period, the in-force premium balance rose from $687 million to $1.08 billion -- a 57% jump. The premium per customer is up, and the gross loss ratio has fallen from 94% to 70% (and lower is better). Lemonade's revenues are soaring:

LMND Revenue (TTM) data by YCharts. TTM = trailing 12 months.

In other words, the once-struggling business is humming on most of its cylinders. Back in the day, Lemonade explained that it would take some time to train its AI-based insurance claim systems on real-world customer data. The gains posted so far are the results of a growing customer list, and the data-driven benefits should continue to stack up in the future, too.

Image source: Getty Images.

Growing pains and room to improve

Mind you, Lemonade's business improvement remains a work in progress. Free cash flow is still negative, though management expects a positive full-year reading by the end of 2025. The car insurance service is only available in 10 U.S. states so far, and Lemonade's homeowners insurance has been approved in 28 states. The European portfolio of renters and homeowners insurance plans is only live in five countries today, with 27 more on the "coming soon" list.

The lessons learned and AI training completed in existing markets tend to transfer smoothly into new geographic targets, with minor tweaks based on the local risk profile. They don't get a lot of earthquakes and hurricanes in France, for example. In the long run, I see no reason why Lemonade shouldn't be a global business.

What's next for Lemonade?

Where will Lemonade be in a year, then?

Your guess is as good as mine -- maybe mixing up a batch of sweet profits, or perhaps still getting the citrusy recipe just right. What's clear is that Lemonade's blend of AI and insurance is finally starting to hit the right notes for investors, but it's not a finished product yet. In fact, it's still early in Lemonade's effort to shake up the insurance industry with AI tools. A few more markets should open up by next summer, and the customer sign-up figures should speed up. These are bullish developments, leaving plenty of room for even greater gains in the long run.

If you like your investments with a twist (and can stomach some sour notes along the way), Lemonade could be worth a sip in 2025. I wouldn't aim for big gains by next summer, but buckle down at the dinner table to enjoy great long-term returns. Investing is a marathon, not a sprint.

Should you invest $1,000 in Lemonade right now?

Before you buy stock in Lemonade, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lemonade wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $668,155!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,106,071!*

Now, it’s worth noting Stock Advisor’s total average return is 1,070% — a market-crushing outperformance compared to 184% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 13, 2025

Anders Bylund has positions in Lemonade. The Motley Fool has positions in and recommends Lemonade. The Motley Fool has a disclosure policy.