Is QuantumScape Stock a Buy Now?

Key Points

QuantumScape develops solid-state lithium-metal batteries aimed at providing greater energy density, faster charging, and enhanced safety compared to traditional lithium-ion batteries.

Volkswagen has invested approximately $380 million over the years and is a major shareholder.

It recently expanded its collaboration agreement with Volkswagen's battery company, PowerCo, to manufacture its QSE-5 battery technology.

QuantumScape (NYSE: QS) is making moves. Last month, the company hit another milestone on its journey to commercialize its breakthrough battery technology, marking steady progress toward a future where electric vehicles (EVs) can drive farther and charge faster than ever before. The stock has surged 133% since June.

Yet, with the company still in its early stages and facing crucial milestones, investors considering buying QuantumScape should consider the following first.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

What QuantumScape does

QuantumScape designs solid-state lithium‑metal battery architecture, focusing on developing and commercializing next-generation batteries for electric vehicles and other applications. It believes this technology will enable a new category of batteries that has greater energy density, faster charging, and improved safety compared to conventional lithium-ion cells.

Its technology breakthrough, particularly the recent rollout of its Cobra separator process, has already advanced into baseline production, offering a 25-times improvement in heat treatment speed, compared to its prior Raptor process. Simply put, this increased efficiency and productivity are important milestones in helping QuantumScape scale up production.

Volkswagen has been a key partner in its development

A key aspect of its business is its relationship with Volkswagen, which owns a 26% voting interest in the battery maker. The German automaker has been a major investor, with cumulative investments of approximately $380 million over more than a decade.

QuantumScape and PowerCo SE, Volkswagen Group's battery company, have a strategic collaboration and licensing arrangement to industrialize QuantumScape's QSE-5 battery technology. PowerCo SE was formed by Volkswagen in 2022 to consolidate its activities in the development and production of battery cells.

Image source: Getty Images.

QuantumScape's agreement with PowerCo last year marked a significant move, helping it transition to a more capital-light business model. Thanks to the agreement, PowerCo has a non-exclusive license agreement to manufacture battery cells with the QSE-5 technology.

In the second quarter, QuantumScape expanded its agreement with PowerCo, which includes new cash payments of up to $131 million over two years for joint commercialization activities. These are in addition to a previously announced $130 million royalty pre-payment that will be due upon satisfactory technical progress and execution of the full licensing agreement.

Understanding QuantumScape's cash situation

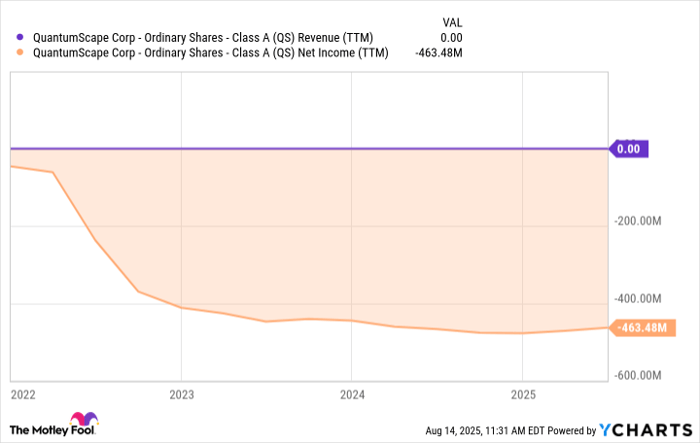

The PowerCo news, along with the ongoing development of its Cobra process, are steps in the right direction for QuantumScape. However, the company remains speculative, without a steady revenue source right now. It continues to rack up losses as it spends on research and development, among other expenses. In the second quarter, it reported a net loss of around $114 million.

For this reason, cash on hand is essential, and QuantumScape holds around $797 million in liquid assets. The company believes it has enough to fund its operations through 2029, six months longer than previously guided, largely thanks to its expanded deal with PowerCo. That said, the company continues burning capital with no meaningful income, and if its capital needs increase for any reason, it may be forced to raise additional capital by diluting shareholders.

QS Revenue (TTM) data by YCharts; TTM = trailing 12 months.

Another aspect to pay attention to is the broader electric vehicle (EV) sector, where QuantumScape would want to see ongoing EV adoption. If the market doesn't develop as expected, it could hurt long-term demand trends for the company.

Not only that, but it faces competition from other battery developers. Established automakers like Toyota and BMW, along with upstarts like Nio, are increasingly investing in in-house battery development.

Is QuantumScape a buy?

If the battery maker can continue to validate developing technology, scale up production capabilities with PowerCo, and capture additional deals with original equipment manufacturers, it has the potential to deliver excellent returns. That said, it is still in its early stages. Next, it needs to scale up production and have its batteries undergo field testing, which will be on the docket in 2026.

QuantumScape's technology could be a breakthrough for EVs and other battery-powered applications. But it remains a few years away from generating any meaningful revenue and will continue to incur costs as it works closer to commercial production. Until QuantumScape delivers go-to-market success or sustained revenue -- and given the stock's recent surge -- it remains a high-risk stock with a long road ahead.

Should you invest $1,000 in QuantumScape right now?

Before you buy stock in QuantumScape, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and QuantumScape wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $668,155!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,106,071!*

Now, it’s worth noting Stock Advisor’s total average return is 1,070% — a market-crushing outperformance compared to 184% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 13, 2025

Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool recommends Bayerische Motoren Werke Aktiengesellschaft and Volkswagen Ag. The Motley Fool has a disclosure policy.