10 Reasons to Buy and Hold This High-Yield Energy Stock Forever

Key Points

This energy stock has a huge 5.8% dividend yield.

The company is focused on the most reliable part of the energy sector.

Management's biggest goal is supplying the world with the energy it needs, no matter what form that energy takes.

Enbridge (NYSE: ENB) is one of my core energy holdings. That's partly related to the lofty 5.8% dividend yield, but the real linchpin is the company's diversified energy business. Here are 10 reasons why I own Enbridge and why you might want to own it, too.

1. Enbridge has an attractive dividend yield

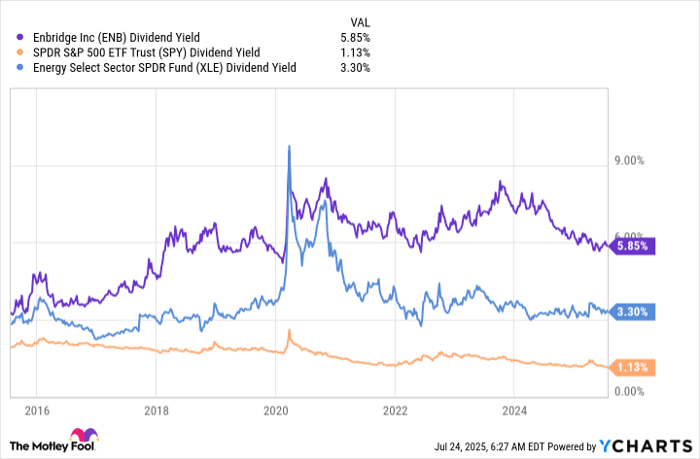

I'm a dividend investor, so Enbridge's dividend yield is important to me. At 5.8%, it is high on an absolute basis. But it is high on a relative basis, too. For example, the S&P 500 (SNPINDEX: ^GSPC) is offering only a scant 1.2% yield. And the average energy stock's yield is just 3.3% or so. If you like dividends, as I do, Enbridge is going to be attractive.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Image source: Getty Images.

2. Its dividend is reliable

I learned the hard way that buying stocks based on their yield alone is a mistake, which is why I also focus on dividend history. Focusing on companies that regularly increase their dividends quickly weeds out many poor-quality businesses. Enbridge has hiked its dividend (in Canadian dollars) for 30 consecutive years. It has proven to be a reliable dividend stock.

3. Enbridge has a strong financial foundation

Even historically reliable dividend payers sometimes cut their dividends. So, it is also important to check the balance sheet. Enbridge has an investment-grade credit rating. That means it not only has a strong financial foundation but also has access to affordable capital when it taps the debt markets.

4. It has a solid business model

On top of the foundation here, Enbridge has built a highly reliable and boring business. That's great news because it operates in the highly volatile energy sector. Essentially, it owns the infrastructure assets, such as pipelines, that move oil and natural gas around the world. It charges fees for the use of these assets, which generates the income it uses to pay that fat dividend. Given the importance of energy to modern life, demand for Enbridge's services tends to be robust regardless of commodity prices.

5. Enbridge is big enough to be an industry consolidator

There are plenty of companies that do something similar to what Enbridge does. But Enbridge happens to be one of the largest players in the midstream sector in North America. Being a roughly $100 billion market cap industry giant not only provides the company with scale but also means that Enbridge can buy up smaller peers to augment its business or expand into new businesses (more on this below). That's helped along, of course, by the company's financial strength.

6. It has plenty of levers to pull

Not only can Enbridge grow via acquisition, but its vast portfolio of assets also affords it plenty of opportunity for capital investment. In fact, internal growth is a core focus as the company looks to upgrade assets and expand capacity. And when it buys new assets, it often looks for situations where it can add value over time via additional capital investment, helping to create a virtuous and ongoing cycle of growth. Which brings up the next point: the other assets Enbridge owns.

7. Enbridge is getting regulated in a good way

Enbridge's core business is moving oil and natural gas. However, its big-picture focus is to provide the world with the energy it needs. Which is why the company has been shifting more and more toward natural gas and other cleaner energy sources.

For example, it recently bought three regulated natural gas utilities from Dominion Energy (NYSE: D). Not only are these regulated assets reliable cash-flow generators, but they also shift the business toward a cleaner fuel and provide ongoing investment opportunities. This move solidifies the company's growth prospects and makes additional dividend hikes more likely.

8. Its future isn't just about gas

The shift toward natural gas is one key reason why I like Enbridge's energy business. But the hidden value here is the company's modest exposure to renewable power.

Enbridge has been investing in clean energy for a while now and understands the business well. It owns some large offshore wind farms in Europe and other, more modest renewable power assets. This toehold prepares Enbridge for a future in which meeting the world's energy needs means focusing more on clean energy. I expect it to increase the scope of this business slowly over time, which is what I expect the world to do, too.

ENB Dividend Yield data by YCharts.

9. Enbridge is easier than an MLP

Enbridge has peers that offer similar positives, most notably Enterprise Products Partners (NYSE: EPD). But Enbridge is a traditional corporation, while Enterprise is a master limited partnership (MLP), which is significantly more complex to own. I prefer to keep my financial life as simple as possible, and dealing with the K-1 tax forms that MLPs require every year just isn't worth it to me if I can get all the benefits without the hassle from a great business like Enbridge.

10. I can skip the tax headache from owning a Canadian stock

There's one problem with Enbridge that is a bit more nuanced. As a Canadian company, U.S. shareholders have to pay Canadian taxes on the dividend income they collect. But there's a workaround: A tax treaty allows U.S. investors to avoid Canadian taxes if the shares are owned in a tax-advantaged account, such as a Roth IRA.

The ability to take advantage of this depends on your broker, who has to fill out some forms to make it happen (call them and ask about this). However, my broker has done their homework, and I can happily avoid the Canadian tax issue. The only dividend negative that I can't avoid is that the dividends U.S. investors receive will vary along with interest rates.

Enbridge checks almost all the boxes

When I look down the list of positives with Enbridge, I am very happy to be a shareholder. Is it a perfect investment? Of course not. But no company is. The balance of positives to negatives, however, is so compelling that I almost had no choice but to buy the stock. And I plan to hold it forever now that I have.

Should you invest $1,000 in Enbridge right now?

Before you buy stock in Enbridge, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enbridge wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $653,427!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,119,863!*

Now, it’s worth noting Stock Advisor’s total average return is 1,060% — a market-crushing outperformance compared to 182% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 11, 2025

Reuben Gregg Brewer has positions in Dominion Energy and Enbridge. The Motley Fool has positions in and recommends Enbridge. The Motley Fool recommends Dominion Energy and Enterprise Products Partners. The Motley Fool has a disclosure policy.