Is Tesla Stock a Bad News Buy?

Key Points

Tesla's top line was down 12% last quarter, and its growth rate has been declining in recent years.

Rising competition and macroeconomic conditions are weighing on its near-term growth prospects.

The stock trades at a high premium, but management remains bullish on its future.

Electric vehicle (EV) and technology company Tesla (NASDAQ: TSLA) is one of the largest businesses in the world, with its valuation right around $1 trillion today. And this is even as the stock is down 21% this year as of July 30.

Investor sentiment has become increasingly bearish on the business, and its latest earnings numbers didn't do anything to help that. With its recent results looking unimpressive, the stock may again come under pressure in the days and weeks to come.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Could now be a good time to add Tesla to your portfolio?

Image source: Getty Images.

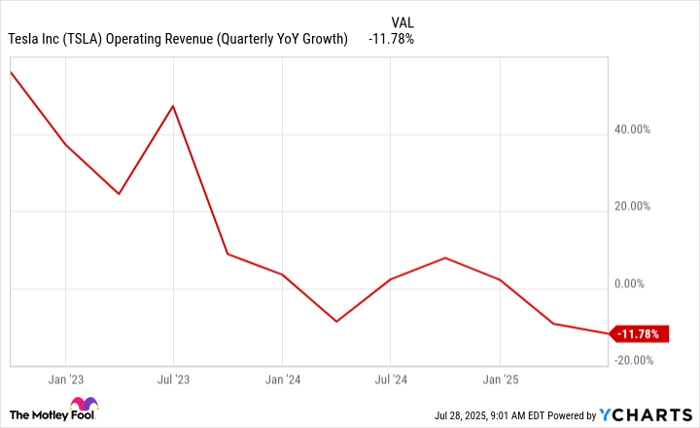

Tesla's problems summed up in a single chart

Investors have long been excited about Tesla's prospects and CEO Elon Musk's vision. From EVs to robots, the company has been evolving into a much larger business over the years. And if you're a believer in its potential, it's hard not to like Tesla as a long-term investment.

But there's also no denying that its growth faces question marks, especially as more competitors emerge in the EV market, particularly from China, where lower prices can squeeze Tesla's margins. The following chart shows that the threat is not just a hypothetical one, either. Tesla's growth rate has fallen drastically in recent years.

TSLA Operating Revenue (Quarterly YoY Growth) data by YCharts

Not only was quarterly revenue totaling $22.5 billion down by 12% in the company's most recent quarter (which ended in June), but the company's net income also fell by 16% to $1.2 billion. Tesla's results came in short of what analysts were expecting on both the top and bottom lines, leading to a drop in its share price after the earnings report.

Big promises and a big valuation

Tesla's recent results weren't great, but the carrot for investors is what may lie ahead for the business. These were some of the rosier -- if vague -- projections for the business from Tesla's recent earnings call:

- Unsupervised full self-driving will be available in "certain geographies" by the end of the year.

- Autonomous ride-hailing services will be available "in probably half the population of the U.S.," also by the end of this year.

- The Optimus version three humanoid robot will be in production next year and "it will be the biggest product ever," according to Musk, who's known for bold predictions.

Any one of these three claims becoming true could help rally Tesla's stock, which arguably needs a catalyst right now. The problem, however, is that high expectations are also baked into the stock, as it trades at around 160 times its analyst-estimated future earnings.

The bar is high for Tesla, and if it falls short of its promises, that could lead to a further decline for the stock, especially given that its recent results haven't exactly been stellar.

Should you buy Tesla stock today?

Tesla has been an exciting growth stock to own for years, and it has generated fantastic returns for investors. Although it hasn't been doing great recently, the stock is still up over 200% in five years. If Musk's vision for his company comes true, investing in Tesla stock could end up being really smart.

However, with the stock trading at such a high premium, I'd hold off on investing in it. When you're paying such a high price, you're leaving yourself with little to no margin of safety should things not go as planned. Tesla's a good stock to put on a watch list, but I wouldn't rush out to buy it right now.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $461,294!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $39,405!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $625,254!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, available when you join Stock Advisor, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of July 29, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.