Should You Buy the Dip on C3.ai's Stock?

Key Points

C3.ai's CEO and founder, Tom Siebel, has announced his decision to step down once a new CEO is in place.

C3.ai could go two different ways with its CEO search.

C3.ai (NYSE: AI) has had a rough week. On July 24, the stock plummeted more than 10% after the abrupt announcement of a CEO search. This is a big deal because CEO Tom Siebel was one of the founders of C3.ai. He has numerous accolades, and C3.ai isn't his only success story, so his stepping away from the company is not great news for shareholders.

But is this an opportunity to scoop up the stock of a promising AI play at a discount, or something else?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Some companies wouldn't be the same without their leadership

Not all CEO departures are the same. Abrupt ones without any forewarning are the most concerning. While this departure falls into this category, it's for an unfortunate reason. Siebel was diagnosed with an autoimmune disease and has begun the search for his replacement. While he has mostly recovered from this disease, he believes that he cannot handle the rigorous demands of being the CEO of a rapidly growing AI company, which is why a new person is needed to lead C3.ai.

While this is sad, investors need to understand that this happens from time to time in the market and assess if they were investing in C3.ai for the company or its leadership. There are countless examples of companies that wouldn't be the same without their leader. One prime example is Tesla's (NASDAQ: TSLA) Elon Musk. Whether you love him, don't like him, or are neutral doesn't matter -- the company would be different without him at the helm.

So, is it worth scooping up C3.ai shares at a discount without Siebel at the helm?

C3.ai is delivering strong growth at the cost of profitability

C3.ai provides turnkey AI solutions for its customers, making it a great option to get up and running in the AI game. Additionally, it has won several government contracts to develop AI solutions within the U.S. Defense Department.

This has led to strong growth for the company, with C3.ai's revenue rising 25% year over year in fourth-quarter fiscal year 2025 (ending April 30). It also expects strong growth for FY 2026, with revenue expected to be about $466 million, up 20% from FY 2025's $389 million.

That projection is unlikely to shift with a new CEO eventually at the helm, so the big change will be where C3.ai heads after this year.

C3.ai is at a crossroads as a company, and who Siebel and the board decide to bring on as a replacement will give investors a clue about what direction C3.ai is heading. Right now, it's a growth-at-all-costs business. This is evidenced by its poor profitability.

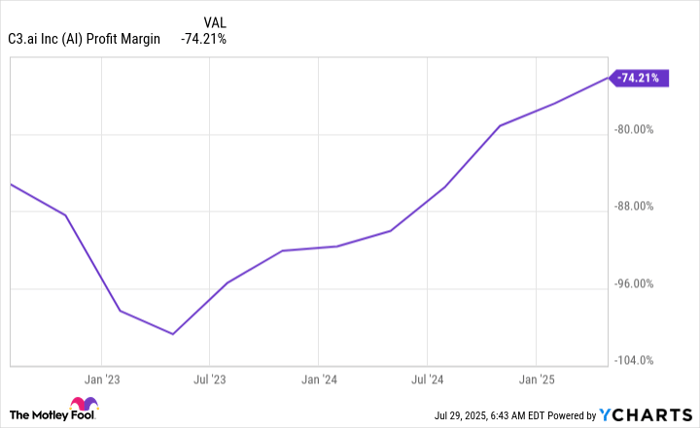

AI Profit Margin data by YCharts.

While C3.ai has made some improvements in its profitability, it remains a long way from turning a profit.

Who C3.ai decides to bring on as CEO will clue investors in as to where the company is heading next. It could bring on an operations-focused CEO who works toward shifting the company to be profitable, potentially at the cost of some revenue growth. Another option is to bring on a CEO who's growth-oriented and maintains C3.ai's current path.

I think it would be smart to strike a balance between these two traits, but I'll have to wait and see who C3.ai brings on before I can make a final decision.

As a result, I think investors should be patient and see who C3.ai decides to hire, then make a call from there. If you already own shares, there's no reason to sell. But I'd be cautious about adding until there is some clarity regarding who will lead the company.

Should you invest $1,000 in C3.ai right now?

Before you buy stock in C3.ai, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and C3.ai wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $625,254!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,090,257!*

Now, it’s worth noting Stock Advisor’s total average return is 1,036% — a market-crushing outperformance compared to 181% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of July 29, 2025

Keithen Drury has positions in Tesla. The Motley Fool has positions in and recommends Tesla. The Motley Fool recommends C3.ai. The Motley Fool has a disclosure policy.