What All Retirees Need to Know About Social Security in 2025

Key Points

The full retirement age for those who turned 66 in 2025 is two months higher than for thos ewho turned 66 in 2024.

President Trump's "big, beautiful bill" will provide some retirees with a $6,000 to $12,000 tax deduction beginning now through 2028.

The wage base limit increased by $7,500.

Social Security is undoubtedly a lifesaving financial lifeline for millions of Americans, but it's far from the easiest program to keep up with. That's been the case since monthly benefits began in 1940, and there's no reason to believe that'll change anytime soon.

Trying to keep up with Social Security changes can be a lot to digest, but focusing on the most impactful and key ones can help you stay informed without being overwhelmed. Moving into the second half of the year, here are four key changes to be aware of.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

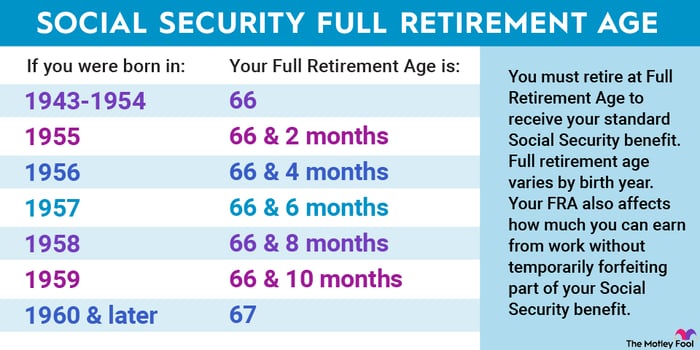

1. The full retirement age has increased by two months

Your full retirement age (FRA) is when you become eligible to receive your base monthly Social Security benefit, known as the primary insurance amount (PIA). Starting this year, FRA is 66 years and 10 months for people born in 1959, a two-month increase from the FRA of people born in 1958.

This is noteworthy because your benefits will either be decreased or increased, depending on when you claim benefits, relative to your FRA. If you claim benefits before your FRA, the monthly amount will decrease by 5/9 of 1% for each month early, up to 36 months. After 36 months, benefits are further reduced by 5/12 of 1% monthly.

For example, if your FRA is 66 and 10 months and you claim benefits at 62 (the earliest age at which you can claim), your monthly benefit will be reduced by roughly 29.17%

Delaying benefits past your full retirement age will increase them by 2/3 of 1% each month (8% annually), until you turn 70.

Image source: The Motley Fool.

2. Some Social Security recipients will receive a tax deduction

President Donald Trump's "big, beautiful bill," which was recently signed into law, includes changes that could save retirees money on taxes. The bill doesn't eliminate the federal Social Security tax (despite some claims that it does), but it does offer a temporary deduction for some people 65 and older.

Beginning now until 2028, qualified people 65 and older will receive a $6,000 deduction, and married couples will receive a $12,000 deduction. To qualify for the full deduction, single filers must have a modified adjusted gross income (MAGI) below $75,000, and couples must have a MAGI below $150,000.

To qualify for a partial deduction, single filers must have a MAGI between $75,000 and $150,000, and couples must have a MAGI between $150,000 and $250,000. Anyone earning above those limits isn't eligible for the deduction.

Eligible individuals can claim the deduction regardless of whether they take the standard deduction or itemize their deductions. (This isn't the case with most deductions.)

3. Some workers will pay more in Social Security payroll taxes

To be eligible to receive Social Security, you (or your spouse if claiming spousal benefits) need to pay into the Social Security system via Social Security payroll taxes. The total tax is 12.4%, with employers and employees each paying 6.2%.

However, not all of your income is subject to this tax. It's only up to a limit, called the "wage base limit." Beginning this year, the wage base limit has increased to $176,100, up from $168,600 in 2024. This means that some people will pay more in taxes because a larger portion of their income is eligible for taxation.

For example, if you earned $175,000 in 2024, $6,400 of it would've been exempt from Social Security taxes. If you earn the same amount this year, the full $175,000 would be subject to the tax.

4. The earnings limit for facing the retirement earnings test increased

If you're at least at your FRA, you can work and earn as much as you want with no problem. However, if you claim benefits early, earning over a certain amount will subject you to Social Security's retirement earnings test (RET).

For those who won't reach their FRA in 2025, the earnings limit increased to $23,400, $1,080 more than in 2024. Earning more than that will reduce your annual benefits by $1 for every $2 over.

For those reaching FRA this year, the limit increased to $62,160, $2,640 more than in 2024. Earning more than that will reduce benefits by $1 for every $3 over.

Thankfully, the reduced benefits aren't permanently lost. When you finally reach your FRA, Social Security recalculates your benefits in a way that gradually adds back the withheld amount over your lifetime.

The $23,760 Social Security bonus most retirees completely overlook

If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.

One easy trick could pay you as much as $23,760 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after. Join Stock Advisor to learn more about these strategies.

View the "Social Security secrets" »

The Motley Fool has a disclosure policy.