What Are the 3 Best Bargain Artificial Intelligence (AI) Stocks to Buy Right Now

Key Points

Taiwan Semiconductor's projected growth should translate into a higher premium than it is currently trading at.

The market is concerned that AI will disrupt Adobe's business.

Google Search is a primary target of several generative AI companies.

Finding bargains in the artificial intelligence (AI) investing world isn't easy, but they're out there. Three that I've got my eye on are Taiwan Semiconductor (NYSE: TSM), Adobe (NASDAQ: ADBE), and Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL).

All three of these trade at a hefty discount to the broader market, yet are still quite promising. If you're looking for value in the AI space, this trio is an excellent starting point.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

How do these three fit into AI?

Taiwan Semiconductor is the best-positioned of this trio. It's the primary chip fabricator for some of the leading tech companies, including Nvidia and Apple. Its chip production facilities fabricate chips that its customers have designed, placing TSMC into a neutral position in the AI race.

It performed phenomenally well over the past few years, with revenue in U.S. dollars rising an astounding 44% in the second quarter, which exceeded expectations. This strength is expected to persist for many years. Management guided at the start of 2025 that it expects its revenue to increase at nearly a 20% compound annual growth rate over the next five years. Taiwan Semi is a key player in AI technology, and it holds an enviable position.

Adobe makes leading graphics design tools that are the industry standard. Whether it's video editing or image creation, Adobe is a top option. However, investors are growing increasingly concerned that generative AI creation technologies could displace Adobe. Image and video creation using generative AI models has come a long way, and has reached a point where it's nearly indistinguishable from what humans create. As a result, many are forecasting the downfall of Adobe.

However, I think that's a bit premature. Adobe has also invested heavily in generative AI and has its own Firefly product that allows seamless integration of AI with its existing editing tools. This allows Adobe to compete in this realm while also giving creators more control over the end product than what many generative AI models do. This could keep Adobe relevant within the graphic design industry, making the forecast of its downfall somewhat inaccurate.

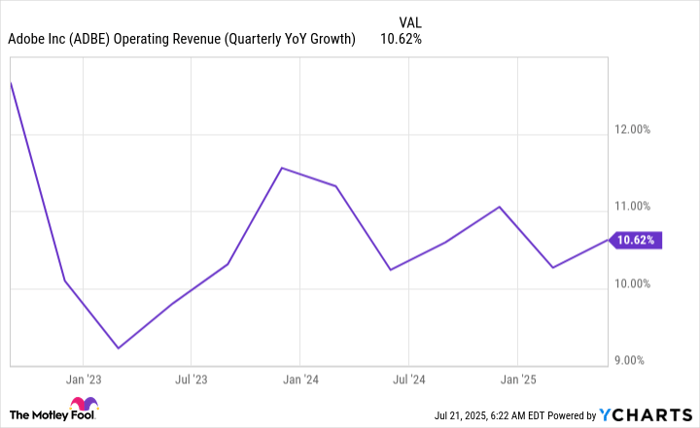

Currently, Adobe is performing well and has posted consistent revenue growth over the past few years.

ADBE Operating Revenue (Quarterly YoY Growth) data by YCharts.

If Adobe is supposed to be getting displaced, don't tell it that, as it's still growing at a healthy pace.

Last is Alphabet, the parent company of the Google Search engine. Its stock is running into the same fears as Adobe's, as investors worry that generative AI will replace Google Search. While some have made the switch, investors need to remember that Google is an ingrained habit among internet users around the globe. It would take a massive technological leap, which most users won't need anyway, to get them to switch.

Google has already implemented the popular AI search overviews feature, which seamlessly integrates search results and AI, and that could be enough to maintain the vast majority of its dominant market share. If Google Search can maintain most of its market share, the stock is poised to move higher, as it trades at a significant discount to the broader market.

How cheap is this trio?

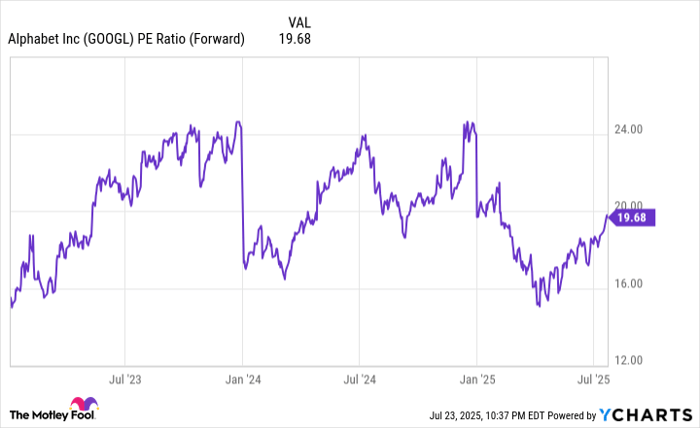

Alphabet's stock trades at a deep discount to the broader market, despite strong results.

GOOGL PE Ratio (Forward) data by YCharts.

Considering that the S&P 500 trades for 23.8 times forward earnings, this seems like a reasonable price to pay for the upside that Alphabet provides.

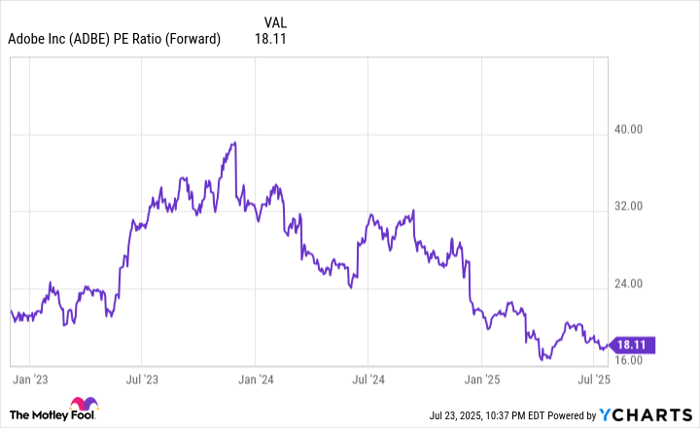

Adobe is similarly cheap, trading for 18 times forward earnings.

ADBE PE Ratio (Forward) data by YCharts.

Taiwan Semiconductor is actually more expensive than the broader market at 25 times forward earnings. However, it's expected to grow at essentially double the pace of the market over the next five years, so this slight premium to the market seems a bit low. As a result, I'm confident labeling Taiwan Semiconductor as a bargain buy right now.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $636,628!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,063,471!*

Now, it’s worth noting Stock Advisor’s total average return is 1,041% — a market-crushing outperformance compared to 183% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of July 21, 2025

Keithen Drury has positions in Adobe, Alphabet, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Adobe, Alphabet, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.