Q2 2025 Earnings Season Preview: The First Test Under Trump’s Tariffs — Could Low Expectations Bring Surprises?

TradingKey - Mid-July will mark the first earnings season since President Donald Trump’s tariff policy took effect, offering investors a glimpse into how American companies are handling the impact of trade tensions.

Analysts believe that with low expectations heading into Q2, it may be easier for companies to deliver positive surprises — particularly those with strong pricing power or efficient cost controls.

According to LSEG, analysts expect S&P 500 earnings growth of 5.8% YoY in Q2, down sharply from 13.7% in Q1.

Some estimates suggest that earnings per share (EPS) growth for S&P 500 companies will slow from 12% in Q1 to just 4% in Q2, reflecting the toll of higher tariffs on corporate margins.

How Are Tariff Costs Affecting Companies?

On April 2, President Trump announced sweeping new tariffs on dozens of countries, followed by a temporary suspension period ending on July 9 — giving U.S. firms and trade partners time to negotiate better terms.

Analysts say that while corporate sales and profits are slowing compared to Q1, they remain resilient — and not yet in recessionary territory.

The key question for this earnings season is: How are companies managing the added costs from tariffs? Are they absorbing the burden internally, passing them to consumers, or cutting costs elsewhere?

Goldman Sachs noted that so far, tariff hikes have had limited impact on overall sales forecasts at the index level, but warned that some firms could see margin pressure if they cannot shift costs effectively.

The bank estimated that around 70% of the direct tariff costs have been passed on to consumers — helping cushion the blow to profitability.

Lower Forecasts May Be a Blessing

Over recent months, analysts have steadily lowered their Q2 earnings forecasts, reflecting caution over tightening financial conditions and policy uncertainty.

According to FactSet, between March and June, analysts cut EPS forecasts for 10 out of 11 sectors. The total downward revision of 3.6% in H1 2025 was greater than the average revisions seen in the past five or ten years — which were 3.3% and 2.4%, respectively.

But this doesn’t necessarily signal bad news. With low expectations, many companies may find it easier to beat estimates — as has historically been the case for S&P 500 firms.

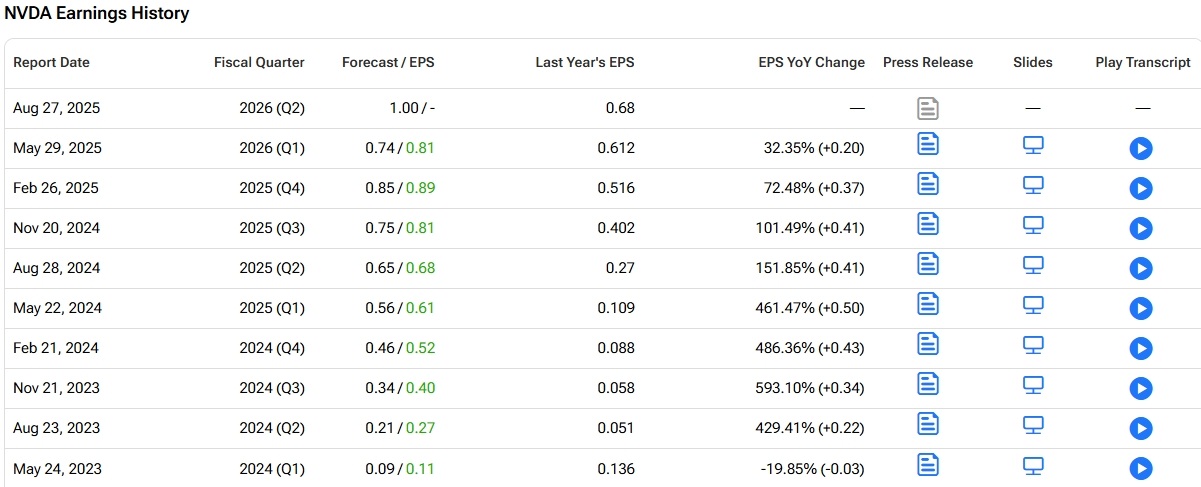

Data from Tipranks shows that AI leader NVIDIA (NVDA.US) and retail giant Walmart (WMT.US) have beaten analyst EPS forecasts for at least nine consecutive quarters.

NVDA Estimated vs. Actual Earnings, Source: Tipranks

Moreover, despite slower earnings growth last quarter, the weaker U.S. dollar — which fell 11% in the first half of 2025, marking its worst performance in over half a century — has improved the competitiveness of U.S. exports, offsetting some of the damage from tariffs.

Chase Investment Counsel pointed out that many Fortune 500 companies derive nearly half of their revenue from overseas markets, which could offer unexpected upside and help counterbalance concerns over future tariffs.

Valuation Support and Forward Guidance Matter

With earnings trends still unclear, equity bulls continue to push the market forward — the S&P 500 hit record highs in early July, raising questions about whether fundamentals can support current valuations.

Currently, the forward P/E ratio for the S&P 500 stands at 22x, above the 10-year average of 18x.

Charles Schwab highlighted that with ongoing uncertainty around trade, tariffs, and interest rates, earnings guidance and surprises will be more important than usual this season.

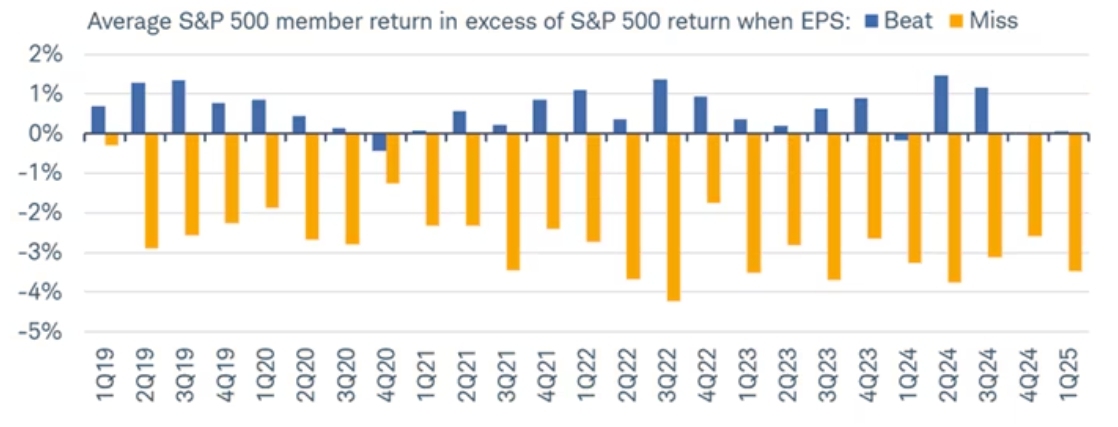

The firm also noted that investor reactions to earnings results are asymmetric: downside misses tend to drag stocks down more sharply than upside beats lift them.

Market Reaction to Earnings Surprises, Source: Charles Schwab, Bloomberg