Nasdaq Bear Market: Buy the Dip on This "Magnificent Seven" Stock That's Down 29%

The Nasdaq-100 and Nasdaq Composite indexes have officially entered bear market territory, down by more than 20% from their all-time highs. Many of their component stocks are down even more than that, including technology giant Alphabet (NASDAQ: GOOG), which is trading 29% below its peak as of this writing.

The company that owns Google, YouTube, and Android has been on a roller-coaster ride ever since OpenAI's ChatGPT went viral over two years ago, and at the moment, the track is sloping downward.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

However, that has created a fantastic buying opportunity for investors ready to deploy some cash: Alphabet is the one "Magnificent Seven" stock I would buy the dip on right now.

Durable cloud growth

Alphabet is a sprawling technology giant with numerous business segments, but its most promising -- at least when it comes to growth -- is Google Cloud. That division is rocking and rolling because of the rapidly increasing amounts of computing capacity needed to train and run artificial intelligence (AI) models. In the fourth quarter, Google Cloud revenue grew by 30% year over year to $12 billion, putting it close to a $50 billion annualized revenue run rate.

Profits are inflecting higher as the division scales up further. Operating income was $2 billion in Q4, a massive improvement from its $500 million loss in the same quarter two years ago. That boosted its profit margin to close to 17%. If the division scales to $100 billion in annual revenue and its profit margins grow to 20%, then Google Cloud will generate $20 billion in annual operating earnings for Alphabet. Just a few years ago, it was a drag on the bottom line, generating large operating losses.

A potential advertising slowdown, but long-term growth in AI

In the near term, there are reasons to feel concerned about the outlooks for Google Search and the company's broader advertising sales. Alphabet is now the largest seller of digital advertising space in the world, and it will likely see a hit to growth in 2025 if a tariff-induced recession materializes. There is no way for the company to avoid the impact that would have on corporate marketing budgets.

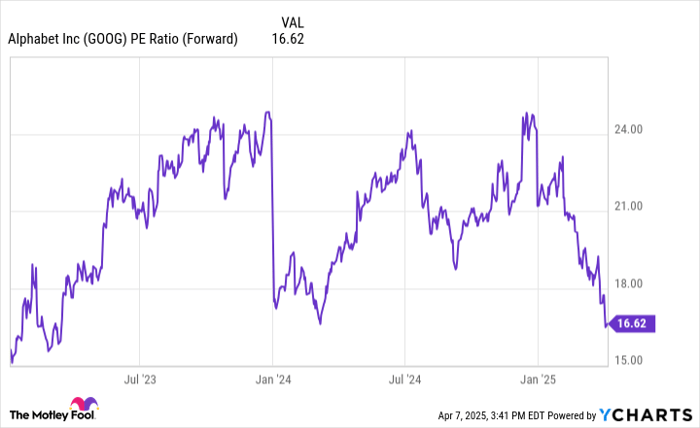

However, at the moment, it looks as though that bad macroeconomic outcome is already priced into Alphabet stock. The stock trades at a forward price-to-earnings ratio (P/E) below 17, which is well below the S&P 500's current average of 25. The company also maintains a financially conservative balance sheet and a large cash stockpile. Bankruptcy is not a concern whatsoever.

Plus, over the long term, the rising use of AI services should make its Google and YouTube properties even more valuable. If people are performing more and more queries due to the AI improvements to these platforms, that gives Alphabet more opportunities to display advertisements in conjunction with their results. It may not look like it now, but Alphabet is poised to keep delivering durable earnings growth over the next decade.

GOOG PE Ratio (Forward) data by YCharts.

Why now is the time to buy the dip on Alphabet stock

The cherry on top of the Alphabet buy thesis is that the company recently became a top returner of capital to shareholders, especially compared to its big technology peers. It just started to pay a dividend, and at the current share price, it yields 0.5%. There's plenty of room for management to boost the payouts over the next few years.

Share repurchases are a larger part of the equation. Last year, Alphabet spent more than $62 billion buying back its own stock, bringing down the number of shares outstanding -- which is a good thing for the remaining shareholders.

With the stock down by about 29% from its 2025 peak, Alphabet now can buy back its stock at much lower prices and a much more attractive earnings multiple. Instead of bringing down its share count at the 1% to 2% annual rates it has historically, it could start reducing its shares outstanding by 3% to 5% a year.

This will boost the returns of investors who hold for the long haul. Between the growth of Google Cloud growth, the potential of AI, and the company's robust capital-return program, Alphabet looks poised to deliver rapid earnings growth over the next decade, which will drive the stock price higher. Focus on that instead of the stock's crash so far this year.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 731% — a market-crushing outperformance compared to 146% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Stock Advisor.

*Stock Advisor returns as of April 5, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Brett Schafer has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet. The Motley Fool has a disclosure policy.