The Nasdaq Just Hit Correction Territory: This Magnificent Stock Is a Bargain Buy

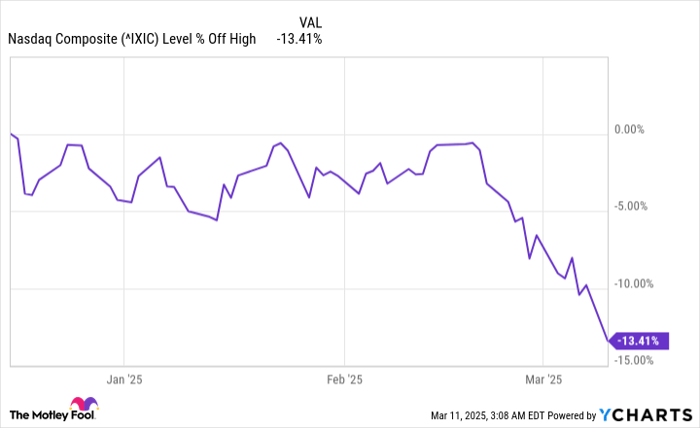

You can count on three things in life: death, taxes, and the stock market eventually experiencing a down period. Unfortunately, the latter is exactly what has happened with the Nasdaq Composite, as the index has fallen into correction territory.

A stock market correction is when a major stock market index drops between 10% and 20% from recent highs, and the Nasdaq Composite checked that box, down over 13% from its Dec. 16 record high when the market closed March 10.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Investors may not like corrections, but they're a natural part of the stock market cycle, and there's often not one singular event that causes them. They can be caused by falling market sentiment, political and economic concerns, global events, or a combination of them all and other things.

In any case, an important thing investors can do is view a market drop as an opportunity to grab shares of great companies that may have gotten a lot cheaper. One in particular, Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), seems like a bargain after recent drops.

Stock price drops don't always mean a business is slumping

As of March 10, Alphabet's stock is down 12% year to date and close to 20% from its 12-month high, which it hit on Feb. 4. The only "Magnificent Seven" stocks with a worse performance year to date are Tesla and Nvidia.

As the parent company of Google, YouTube, Waymo, DeepMind, and other subsidiaries, Alphabet has an arsenal of top-tier ventures. And despite the rough start to the year, Alphabet's business remains as strong as ever, especially financially.

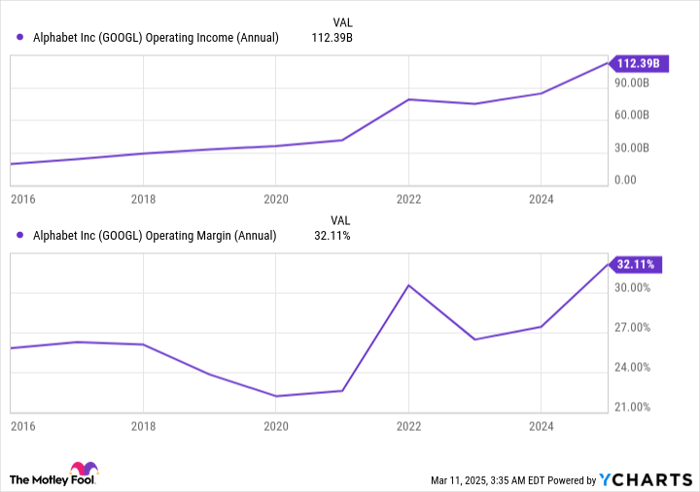

In 2024, Alphabet made over $350 billion in revenue, up 14% year over year, making it one of the premier cash cows in the business world. Maybe more impressive, though, is the 31% jump in operating income from 2023, while its operating margin also improved by 5%.

GOOGL Operating Income (Annual) data by YCharts

Google advertising continues to be Alphabet's biggest moneymaker, but segments like Google Cloud and YouTube have consistently grown and contributed their share to the pot. Both businesses combined to finish 2024 with an annual revenue run rate of $110 billion (a measure that estimates annual revenue based on the fourth quarter).

Google Cloud is a key to growth

Cloud services have become a big part of many big tech companies' businesses. Amazon's Amazon Web Services and Microsoft's Azure are the two biggest platforms by market share, but Google Cloud's 12% market share is double what it was around seven years ago.

Google Cloud's revenue grew 30% year over year in the fourth quarter to $12 billion, fueled by the demand for its cloud services, including data storage and analytics, machine learning, computing, and similar tools.

Alphabet plans to spend around $75 billion on capital expenditures in 2025, and you can bet a large chunk of that will go toward expanding its artificial intelligence (AI) capabilities and bolstering Google Cloud to make it more competitive for the long haul.

Cloud computing can be a high-margin business, but it generally requires a large scale to achieve high profitability because of the expensive fixed costs.

Alphabet's stock is a bargain

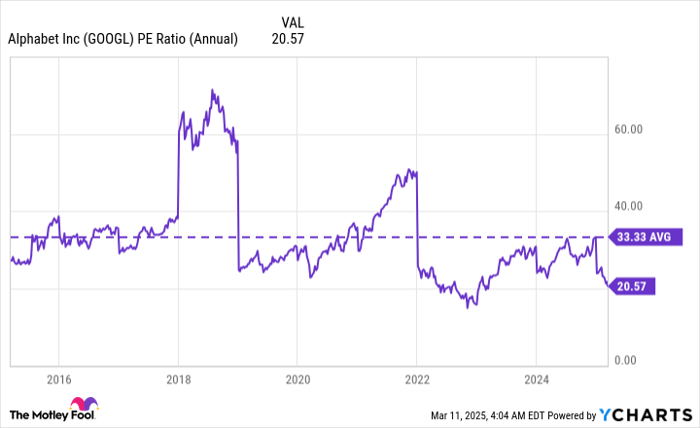

After recent drops, Alphabet's stock looks a lot more appealing. Its price-to-earnings (P/E) ratio is around 20.5 as I write this, well below its average over 10 years.

GOOGL PE Ratio (Annual) data by YCharts

Alphabet is also the cheapest of the Magnificent Seven stocks when comparing P/E ratios. And although that alone doesn't automatically make it a good investment, it shows the market may be undervaluing the company and its growth potential compared to other big tech stocks.

This isn't to say Alphabet's stock won't face any short-term troubles (especially as the broader Nasdaq does), but if you're investing for the long term, the picture looks bright.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $655,630!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of March 10, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Stefon Walters has positions in Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.