Best Stocks in the World? This ETF Is Crushing the S&P 500 in 2025.

The U.S. stock market hasn't exactly started 2025 on a high note. Through the first week of March, the S&P 500 has fallen by 2%, and the tech-heavy Nasdaq Composite is down by 6%.

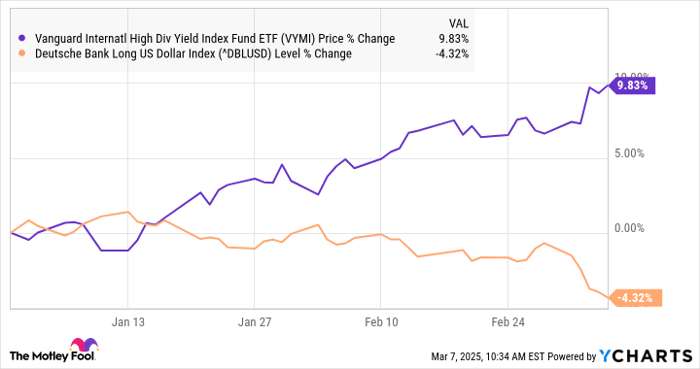

However, there is one area of the market that is generally outperforming: international stocks. One ETF that has done quite well is the Vanguard International High Dividend Yield Index ETF (NASDAQ: VYMI), which has gained more than 10% so far this year.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

With that in mind, here's a rundown of what investors should know about this ETF, why it has performed so well in 2025, and why it could still be an excellent opportunity for long-term investors right now.

The Vanguard International High Dividend Yield ETF

As the name suggests, this ETF invests in international companies that have above-average dividend yields. To clarify, it owns stocks of companies based outside the United States, although as you'll see in a bit, many of them are also listed on U.S. stock exchanges.

It's also worth noting that you might see some ETFs described as "international," while others may use the word "global." The difference is that international funds invest only in companies based outside the U.S., while global funds invest in the U.S. as well as other markets around the world.

More specifically, the Vanguard International High Dividend Yield Index ETF tracks the FTSE All-World ex U.S. High Dividend Yield Index, which is a weighted index of about 1,450 stocks. And although every company is based outside the U.S., some of the top holdings are household names to Americans, including Toyota, Nestlé, Shell, and Toronto-Dominion Bank, all of which are among the ETF's 20 largest holdings.

About 44% of the portfolio is based in Europe, with 26% in the Asia-Pacific region and 21% in emerging markets. As of this writing, the ETF has a 4.4% dividend yield.

The Vanguard International High Dividend Yield ETF has an expense ratio of 0.17%, which is a bit higher than some other Vanguard index funds but is still relatively cheap. This means that for every $10,000 in assets, your annual investment fees are $17. To be clear, this isn't a fee you have to pay -- it will simply be reflected in the performance over time.

Why has this ETF performed so well in 2025?

There are a few factors that have driven the International High Dividend Yield ETF higher in 2025. Currency tailwinds are one big explanation: The U.S. dollar has generally weakened against many foreign currencies so far this year, especially over the past couple of weeks.

Plus, interest rates have generally fallen recently. For example, in the U.K. (the second largest market represented in the ETF), bond yields, especially on the short-term end, have fallen significantly since the beginning of 2025. Without turning this into an economics lesson, with all other factors being equal, a falling-rate environment is typically a positive catalyst for dividend stocks.

Despite the strong performance, international high-dividend stocks still look remarkably cheap. The average stock in the Vanguard International High Dividend Yield ETF has a price-to-earnings (P/E) multiple of 11.8 and trades for 1.4 times book. Meanwhile, the average stock in the U.S. counterpart, the Vanguard High Dividend Yield ETF (NYSEMKT: VYM), has a P/E and price-to-book of 19.8 and 2.8, respectively.

The bottom line is that if you're looking for income and diversification in your portfolio, the Vanguard International High Dividend Yield Index ETF could be worth a closer look right now.

Should you invest $1,000 in Vanguard International High Dividend Yield ETF right now?

Before you buy stock in Vanguard International High Dividend Yield ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard International High Dividend Yield ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $690,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of March 3, 2025

Matt Frankel has positions in Vanguard International High Dividend Yield ETF. The Motley Fool has positions in and recommends Vanguard Whitehall Funds-Vanguard High Dividend Yield ETF. The Motley Fool recommends Nestlé. The Motley Fool has a disclosure policy.