Why C3.ai Stock Lost 25% in February

C3.ai (NYSE: AI) was among the losers last month, as shares of the artificial intelligence (AI)-focused software-as-a-service (SaaS) company fell on a weakening macroeconomic environment and an earnings report that didn't seem to live up to investor expectations.

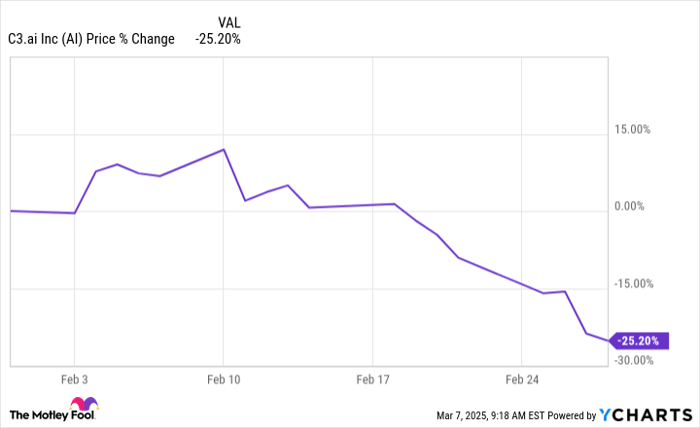

By the end of the month, C3.ai had lost 25%, according to S&P Global Market Intelligence. As you can see from the chart, the stock fell sharply in the second half of the month.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

C3.ai pulls back

C3.ai emerged as an early winner in the AI boom, in part because of its titular association with AI and management's framing of it as the AI-for-the-enterprise company.

However, the company has not yet turned a profit, and after that initial jump in 2023, the stock has been largely range-bound, as its valuation seems to have put a ceiling on the stock.

In February, it began to pull back like a lot of other high-priced unprofitable growth stocks, as macro-level data showed consumer confidence rapidly weakening, and investors seemed to grow wary of a brewing trade war.

After declining in five of the last six sessions, C3.ai then fell 10% on Feb. 27 even as it beat analyst estimates in its report. Revenue in the fiscal third quarter rose 26% to $98.7 million, which was ahead of the consensus at $98.1 million. The company also touted expanded partnerships with Microsoft, Amazon Web Services, and McKinsey. It closed 66 agreements in the quarter, which was a 72% increase from a year ago.

On the bottom line, the company continues to be deeply unprofitable on a generally accepted accounting principles (GAAP) basis, with an operating loss of $87.6 million, but it does spend heavily on share-based compensation. After adjustments, it reported a per-share loss of $0.12, a slight improvement from $0.13 in the quarter a year ago and better than the consensus at a per-share loss of $0.25.

Image source: Getty Images.

What's next for C3.ai?

The company's fourth-quarter guidance called for continued growth, with management forecasting $103.6 million-$113.6 million, or 25.5% growth at the midpoint, essentially the same pace as it reported in the fourth quarter.

C3.ai's revenue growth has been encouraging, but its reliance on stock-based compensation, which is diluting shareholders by nearly 10% on a year-over-year basis, is concerning.

While that strategy might make sense for an unprofitable growth stock, investors still seem rightfully skeptical that C3.ai has a path to profitability as its GAAP losses are widening.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $286,710!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,617!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $488,792!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of March 3, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jeremy Bowman has positions in Amazon. The Motley Fool has positions in and recommends Amazon and Microsoft. The Motley Fool recommends C3.ai and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.