Is SoundHound AI Stock a Buy Now?

Shares of SoundHound AI (NASDAQ: SOUN) have been on a wild ride over the past year. The provider of artificial intelligence (AI)-based voice tech saw its stock hit a 52-week low of $3.50 last April, but by December, shares soared to a high of $24.98.

That upward trajectory made an about-face in 2025, especially after AI darling Nvidia sold its stake in the company. As a result, SoundHound stock plunged more than 45% this year through the end of February.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Does its share-price fall mean now is a good time to buy SoundHound stock? Or is the decline a warning sign to stay away? To figure out if the company is a good investment for the long haul, let's examine SoundHound in more depth.

SoundHound's positives

SoundHound supplies a voice-activated AI platform for businesses. This technology is used to enable in-car voice commands, answer customer service calls, and accept fast-food drive-through orders.

The company transformed its business in 2024 with some key acquisitions. These purchases enabled the company to diversify its revenue, expanding into industries beyond automotive, which previously accounted for 90% of its income.

Now, no single vertical market contributes more than 25% of the company's total revenue. This means the company is no longer dependent on a single industry and is more resilient to economic downturn in a given sector.

Its customers include automakers Stellantis and Hyundai, drug manufacturer Teva Pharmaceuticals, and tech company Fujitsu. And in the fourth quarter of 2024, SoundHound added one of the largest electric utilities in the U.S. as a customer.

Thanks to the acquisitions, SoundHound generated record revenue of $34.5 million in Q4, a 101% increase over the prior year. It wrapped up 2024 with a total of $84.7 million in sales, which represented an 85% year-over-year increase.

SoundHound is confident its 2024 prosperity will continue in 2025, forecasting between $157 million and $177 million in sales for this year. That's not only a significant jump up from 2024's $84.7 million, it's also a big increase from SoundHound's original estimate of $100 million introduced a year ago. This illustrates the strong business growth the company is experiencing.

SoundHound's challenges

SoundHound's sales success didn't lead to profitability, however. The company exited 2024 with a full-year net loss of $350.7 million. This is a 294% increase compared to 2023's loss of $88.9 million due to costs associated with its acquisitions.

Moreover, the purchases eroded SoundHound's gross margin as it took over less profitable businesses. The company's 2024 gross margin dropped to 48.9% from the healthy 75.4% it enjoyed in 2023.

That said, SoundHound management believes the company can achieve operational efficiencies that will "drive meaningful improvement in our gross margins, ultimately driving us back to the 70%-plus levels we have historically realized," said CFO Nitesh Sharan.

To buy or not to buy SoundHound stock

SoundHound is successfully expanding its business, but as its roller-coaster share price reveals, it's a volatile stock. Nvidia's sale of its SoundHound investment was interpreted by Wall Street as a bad sign and caused a sell-off.

Nevertheless, Wall Street's reaction was unwarranted. SoundHound is one of Nvidia's partners in the latter's automotive technology business and will participate in Nvidia's GTC conference in March.

Although SoundHound is not yet profitable, its goal to return to over 70% gross margin is an indication of its intention to trim costs, improve operational efficiency, and eventually reach profitability.

The company was willing to take a short-term hit to gross margin in exchange for substantial expansion of its business. That was a smart decision by SoundHound's management, since its long-term growth potential is strengthened with the acquisitions as demonstrated by its optimistic 2025 full-year outlook.

Also, the company exited 2024 with an excellent balance sheet. Its Q4 assets totaled $553.9 million with a cash pile of $198.2 million. Total Q4 liabilities were $371.3 million with no debt despite last year's acquisitions. That illustrates the company's financial prudence.

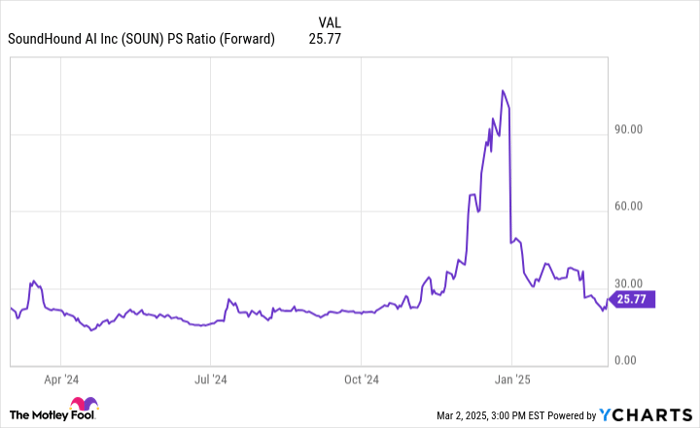

As a result of its many strengths, SoundHound is a worthwhile long-term investment. Moreover, the company's recent share-price decline, combined with strong estimated 2025 sales, caused its stock's forward price-to-sales (P/S) ratio to drop to levels similar to a year ago before its share price took off.

Data by YCharts.

The P/S ratio measures how much investors are willing to pay for every dollar of revenue. Its drop suggests SoundHound stock is more reasonably valued as of the time of writing.

This makes now a promising time to buy shares. Still, because it is a volatile stock, only investors with a high risk tolerance should consider investing in SoundHound AI.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $300,764!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,730!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $524,504!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of March 3, 2025

Robert Izquierdo has positions in Nvidia and SoundHound AI. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Stellantis. The Motley Fool has a disclosure policy.