ASML Could Be a No-Brainer Buy in March

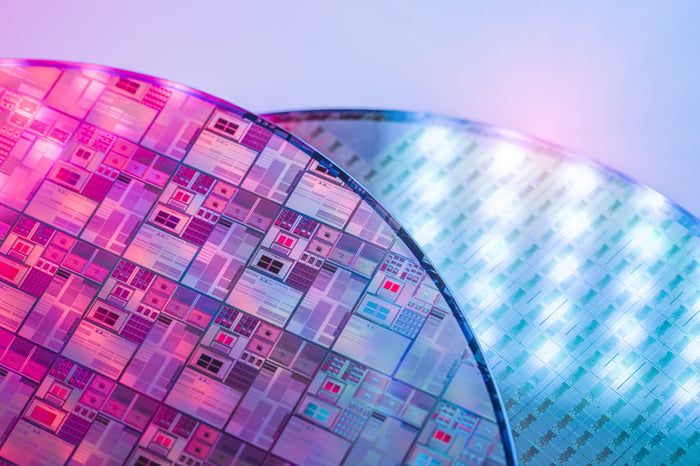

ASML Holding (NASDAQ: ASML) is one of the world's most important semiconductor equipment companies. It's the largest supplier of photolithography systems for optically etching circuit patterns onto silicon wafers.

It's also the only producer of high-end extreme ultraviolet (EUV) lithography systems for manufacturing the world's smallest, densest, and most power-efficient chips. All of the world's top foundries -- including Taiwan Semiconductor Manufacturing, Samsung, and Intel -- use those systems.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

But over the past 12 months, ASML's stock declined 25% as the Nasdaq Composite rallied nearly 20%. That pullback, which was largely driven by macro and regulatory concerns, could represent a great buying opportunity for three simple reasons.

Image source: Getty Images.

1. It's monopolized a crucial semiconductor technology

It took ASML, which is based in the Netherlands, more than two decades to develop its cutting-edge EUV technology. These massive systems require multiple planes to ship and dedicated teams for on-site assembly and testing. Its current-gen low-NA (numerical aperture) systems, which are used to produce chips as small as 2 nanometers (nm), cost about $180 million. Its new high-NA systems, which are used to produce even smaller chips, cost roughly $380 million.

ASML's entrenched position and high production costs have prevented any other smaller lithography system makers from cracking the EUV market. In other words, it's monopolized a crucial technology for developing the world's most advanced chips -- so it will remain a linchpin of the semiconductor sector for the foreseeable future.

2. Its cyclical slowdown is temporary

ASML's sales grew by the double digits from 2020 to 2023 as PC shipments accelerated during the pandemic's height, new 5G smartphones hit the market, and the AI market heated up.

|

Metric |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

|---|---|---|---|---|---|---|

|

Revenue Growth |

8% |

18% |

33% |

14% |

30% |

3% |

|

Gross Margin |

44.7% |

48.6% |

52.7% |

50.5% |

51.3% |

51.3% |

|

EPS Growth |

1% |

38% |

69% |

(2%) |

41% |

(3%) |

Data source: ASML. In euros. EPS = earnings per share.

In 2024, its revenue and earnings growth slowed down as it lapped the AI market's initial growth spurt, dealt with tighter restrictions on its system sales to Chinese chipmakers, and gradually transitioned from its low-NA EUV systems to its high-NA EUV systems. But even as it faced those headwinds, its gross margins held steady as it maintained its pricing power.

For 2025, ASML expects its revenue to rise 6% to 24% with a gross margin of 51% to 53%. Analysts expect its revenue and EPS to grow 15% and 23%, respectively.

That acceleration, which ASML mainly attributes to the robust growth of the AI market and the expansion of the memory market, suggests its cyclical downturn has ended. It also expects its sales in China -- which temporarily surged to 41% of its system sales in 2024 as its chipmakers ramped up orders in anticipation of tighter export curbs -- to drop back to a more "normal ratio" of around 20% in 2025.

ASML has already been banned from shipping its EUV systems to China since 2019. The latest restrictions, effective in late 2024, will also prevent it from selling its higher-end deep ultraviolet (DUV) systems (which are used to manufacture older chips) to Chinese chipmakers.

3. It's still reasonably valued

ASML's stock got a bit overheated last year, but it now looks reasonably valued at 29 times this year's earnings. That's probably because its valuations are being squeezed by the near-term concerns regarding the Trump Administration's unpredictable tariff plans, the threat of even tighter export curbs against Chinese chipmakers, and other macro headwinds.

But over the long term, ASML should weather these challenges and continue to dominate the lithography market with its high-NA systems. So if you expect the semiconductor market to keep expanding over the next few decades, it could be a great time to load up on ASML's stock as the bulls look the other way.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $300,764!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,730!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $524,504!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of March 3, 2025

Leo Sun has positions in ASML. The Motley Fool has positions in and recommends ASML, Intel, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: short February 2025 $27 calls on Intel. The Motley Fool has a disclosure policy.