Is Investing $100,000 Today Enough to Grow Your Portfolio to More Than $1 Million by Retirement?

If you've saved up $100,000 and can afford to invest that much into the stock market, that can potentially set you up for some great returns in the long run. But can that be enough to grow your portfolio to $1 million by the time you retire? There are a lot of variables to consider that can affect that answer, such as how many investing years you have left and what annual return you might average during that timeframe.

Below, I'll go over what you might expect from such an investment, assuming you go with a relatively safe option and try to mirror the S&P 500 (SNPINDEX: ^GSPC).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Why an S&P 500 ETF can be the best option for long-term investors

One of the easiest ways for anyone to invest in the stock market is to simply buy a position in an exchange-traded fund (ETF). ETFs can give you a ton of diversification through just a single investment, and those that track the S&P 500 give you exposure to the top stocks on the market. You won't have to worry about which stocks you are currently holding in your portfolio. As long as the overall market rises in value, so too will your investment.

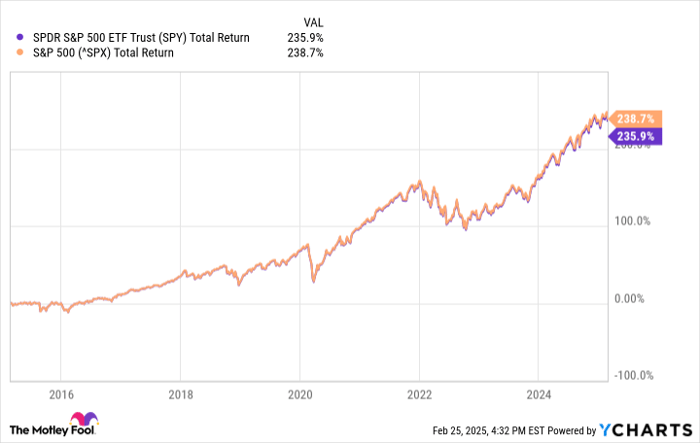

A great ETF for tracking the S&P 500 is the SPDR S&P 500 ETF Trust (NYSEMKT: SPY), which has a low expense ratio of 0.09%. As you can see from the chart below, its total returns (which include dividends) over the past decade have been nearly identical to how the broad index has performed.

SPY Total Return Level data by YCharts.

This is the type of investment you can just buy and forget about. That can be extremely valuable when you're investing a lot of money. If you're investing $100,000, you may want to spread that out over several stocks to ensure you have some good diversification, and that can complicate and lengthen the process significantly. But by putting that money into just a single S&P 500 ETF, you don't have to worry about which individual stocks to hold in your portfolio, as you'll already get plenty of diversification.

Can investing $100,000 into an S&P 500 index fund make you a millionaire?

For decades, the S&P 500 has averaged a long-run annual return of around 10%. But expecting that level of growth to continue in the years ahead might be a bit optimistic, given how hot the stock market has been in recent years. In both 2024 and 2023, it rose by more than 20%. A slowdown may be coming.

The table below considers not only how your portfolio might grow at the S&P 500's historical growth rate, but at other rates as well, including more modest averages.

| Growth of a $100,000 Investment | ||||

|---|---|---|---|---|

| Growth Rate | ||||

| Years to Retirement | 8% | 9% | 10% | 11% |

| 20 | $466,096 | $560,441 | $672,750 | $806,231 |

| 25 | $684,848 | $862,308 | $1,083,471 | $1,358,546 |

| 30 | $1,006,266 | $1,326,768 | $1,744,940 | $2,289,230 |

| 35 | $1,478,534 | $2,041,397 | $2,810,244 | $3,857,485 |

| 40 | $2,172,452 | $3,140,942 | $4,525,926 | $6,500,087 |

Calculations by author.

If you have at least 30 years until you retire, then $100,000 may be enough to get your portfolio to $1 million, even with an annual growth rate of around 8%. But if you only have 20 years to go, then you might not get to $1 million unless the markets continue to perform exceptionally well, which may be difficult over such a long timeframe.

Don't have a big balance to start with? Consider investing monthly

The benefit of building up strong savings is that you can see your portfolio rise faster than if you invest a more modest sum of money. But even if you don't have a huge lump sum to invest today, you may prefer to invest a set amount each month, as that can also set you up for some excellent gains in the long run.

Should you invest $1,000 in SPDR S&P 500 ETF Trust right now?

Before you buy stock in SPDR S&P 500 ETF Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SPDR S&P 500 ETF Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $765,576!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of February 28, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.