Is MicroStrategy a Buy Now?

MicroStrategy (NASDAQ: MSTR) changed its name to Strategy on February 5 to reflect the shift in its primary business model from an enterprise software company to the largest corporate holder of Bitcoin. Since buying its first Bitcoin in August 2020, Strategy stock is up nearly 1,800%, outperforming every company in the S&P 500, including Nvidia.

Today, Strategy holds 478,740 Bitcoins worth over $41 billion, yet its market capitalization is $65 billion as of this writing. So, let's examine the reason behind the company's business model pivot and whether its long-term plans justify the discrepancy between its Bitcoin holdings and stock valuation.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Why did Strategy start buying Bitcoin?

Strategy primarily concentrated on its core operations as a business-to-business enterprise software provider until 2020. However, with sluggish revenue growth and surplus cash, former CEO and current executive chairman Michael Saylor allocated $250 million of the company's funds to Bitcoin, making Strategy the first publicly traded company to take this unprecedented step.

The move has been a success, with Strategy acquiring 478,740 Bitcoin for approximately $31.1 billion at an average price of $65,033 per Bitcoin. If the company were to liquidate its holdings when Bitcoin trades near $87,000, it would see a profit of approximately $10 billion.

However, it is unlikely to sell its Bitcoin, partly because its core business continues to falter. In 2024, it generated a total revenue of $463.5 million, representing a 6.6% year-over-year decline.

Here is how Strategy affords its Bitcoin purchases

With Strategy's software business showing little growth, investors should consider how the company plans to continue acquiring Bitcoin. So far, management has primarily raised capital through a mix of debt issuance, common stock offerings, and convertible notes.

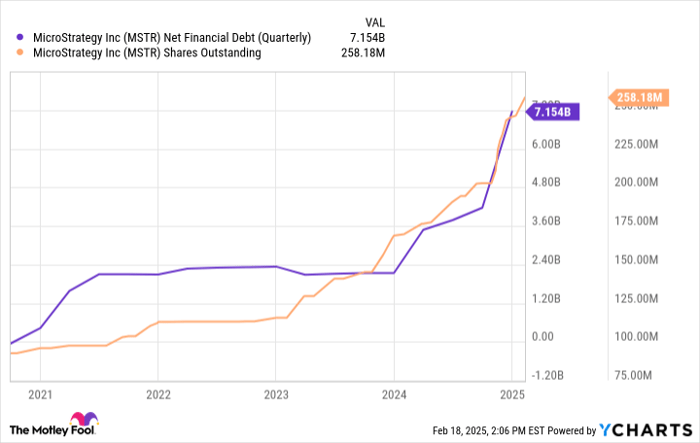

Notably, Strategy had approximately $531 million in net cash prior to its business model pivot, which has worsened to a net debt of $7.2 billion as of Q4 2024. Additionally, the company's outstanding shares skyrocketed 178.6% to 258.1 million since August 2020, meaning one share has been diluted by approximately 64% in less than five years.

As for how Strategy plans to raise funds for Bitcoin in the near term, the company has at least $6.2 billion at its disposal from convertible notes -- loans that allow the noteholder to convert their loan into an equity stake in the company. Additionally, Strategy recently launched the public offering of 7.3 million shares of preferred stock, which will net the company approximately $563 million.

Put it all together, Strategy could have at least $7 billion to purchase more Bitcoin in 2025 and beyond.

MSTR Net Financial Debt (Quarterly) data by YCharts

Here is the risk of Strategy's Stock

The obvious risk to Strategy is that the price of Bitcoin plunges for a prolonged period. Beyond owning an asset worth less than Strategy paid for it, holders of Strategy's convertible notes might be unwilling to convert their debt into Strategy stock, leaving the company with no choice but to repay the loan in cash. Without strong Bitcoin prices to support favorable loan conditions, Strategy's debt could escalate rapidly.

The good news is that management claims all of its 478,740 Bitcoins are unencumbered, meaning it wouldn't face a margin call if the price of Bitcoin plummeted.

Still, considering Strategy's underlying software business generating meaningful profit (its operating activities lost $53 million in 2024), the company would likely need to take out additional convertible notes to pay the interest. While many of Strategy's current notes have favorable interest rates, it still spent $61.9 million in net interest expense in 2024.

But if Bitcoin continues to perform well, the holders of Strategy's convertible notes and common shares will continue to see dilution. The company assumes its shares will be diluted to 289.4 million by 2032, which would be 12% higher than its current count.

Is Strategy stock a buy, hold, or sell?

If Bitcoin continues to rise (and it's worth noting that the price fell by $10,000 in recent days), the risks of owning Strategy stock will largely disappear. Still, in the best-case scenario, its shares will continue to be diluted, so let's do some simple math to illustrate the stock's uphill battle at its current valuation.

As mentioned, Strategy currently holds $41 billion worth of Bitcoin yet has a market capitalization of $65 billion. If you calculate with management's assumed diluted shares of 289.4 million and add in its net debt of $7.2 billion, then you get an adjusted enterprise value of $103.5 billion, well more than double its Bitcoin holdings.

Of course, Strategy is likely to purchase additional Bitcoin, but it will continue to come at the cost of either debt or further shareholder dilution. So, even if you're a Bitcoin bull, buying the cryptocurrency directly or through a Bitcoin ETF makes more sense.

Should you invest $1,000 in Strategy right now?

Before you buy stock in Strategy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Strategy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $798,425!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 24, 2025

Collin Brantmeyer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.