Think It's Too Late to Buy Energy Transfer? Here's the Biggest Reason There's Still Time.

Energy Transfer (NYSE: ET) has been red hot since the start of 2023. Units of the master limited partnership (MLP) have surged more than 40%, a big rally for a company known for its high-yielding distribution (6.7%, even after the price jump).

The monster price increase likely has many investors wondering if it's too late to buy the MLP. Here's the top reason there's still time.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

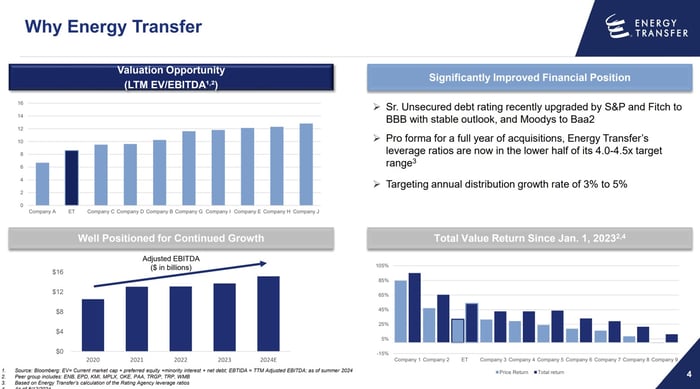

Energy Transfer has been the third-best-performing midstream company since the beginning of 2023. Despite that surge, it trades at the second-lowest valuation in its peer group:

Image source: Energy Transfer.

That bottom-of-the-barrel valuation comes even though the MLP has strong financial metrics and is growing at a healthy clip. It grew adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) by 13% last year to a partnership record $15.5 billion, by getting a boost from acquisitions, organic expansion projects, and strong market conditions.

On one hand, Energy Transfer expects its EBITDA growth rate to moderate this year to around 5% at the midpoint of its guidance range. That's because it won't get quite as big an acquisition-driven boost this year unless it closes another deal.

On the other hand, the MLP sees another growth spurt starting next year, fueled by organic expansion projects. The company invested $3 billion into capital projects last year and plans to spend another $5 billion this year.

The largest projects should start entering service in the middle of this year through the end of next year. Because of that, "we expect the majority of earnings growth from these projects to significantly ramp up in 2026 and 2027," stated co-CEO Tom Long on the fourth-quarter conference call.

Meanwhile, the MLP has several more expansion projects under development, including the first of what could be many projects to support gas demand by artificial intelligence (AI) data centers. Growing gas demand is one of three major catalysts that could fuel the company's growth through the end of the decade. Considering Energy Transfer's low valuation, that long-term growth potential means there's still time to buy the company's stock.

Should you invest $1,000 in Energy Transfer right now?

Before you buy stock in Energy Transfer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Energy Transfer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $823,858!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 24, 2025

Matt DiLallo has positions in Energy Transfer. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.