Prediction: 1 Stock That Will Be Worth More Than Oracle 5 Years From Now

The fast-growing adoption of artificial intelligence (AI) has given Oracle (NYSE: ORCL) a nice boost over the past couple of years, with shares of the company that's known for providing database management systems more than doubling during this period.

That's not surprising. AI has opened a whole new growth opportunity for Oracle as customers have been renting its cloud infrastructure to train and deploy AI models and applications. As a result, Oracle has been able to build a massive revenue pipeline that should allow it to deliver strong growth over the next five years.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

It is worth noting that Oracle's impressive run on the stock market over the past couple of years has brought its market cap to $492 billion, recently making it the 15th most valuable company in the U.S. However, there's another company that has significantly outpaced Oracle's returns in the past couple of years thanks to AI.

Let's take a closer look at that name and see why it may be able to overtake Oracle's market cap in the next five years.

Booming AI software demand has supercharged this tech stock

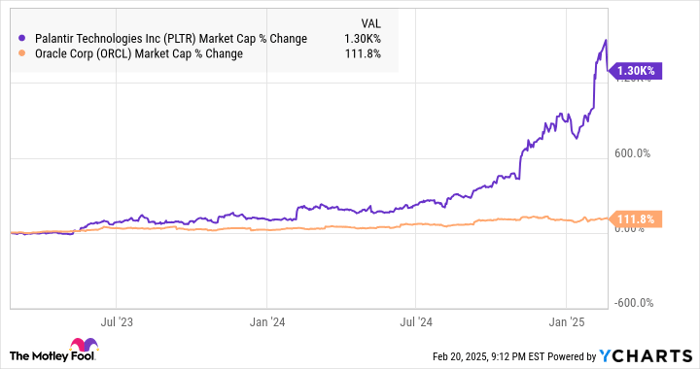

Software specialist Palantir Technologies (NASDAQ: PLTR) delivered phenomenal returns of 1,150% over the past couple of years, which is way higher than the gains clocked by Oracle. This remarkable run brought Palantir's market cap to $249 billion as of this writing. Not surprisingly, Palantir's market cap growth has outpaced Oracle's by a massive margin.

PLTR Market Cap data by YCharts

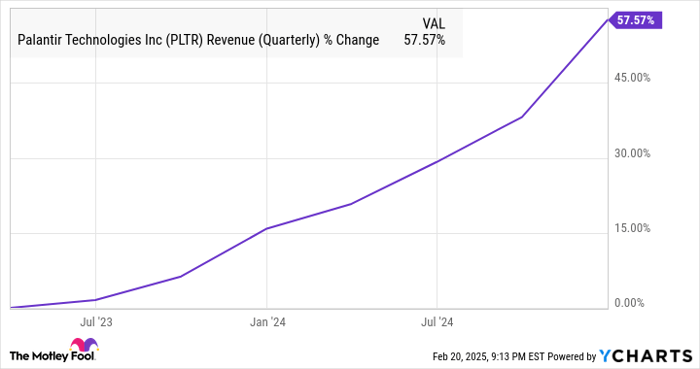

AI played a central role in this massive jump in Palantir's stock price over the past couple of years. Customers looking to integrate AI software into their operations have been flocking toward Palantir's Artificial Intelligence Platform (AIP), leading to an acceleration in the company's growth. This is evident in the chart below.

PLTR Revenue (Quarterly) data by YCharts

The good part is that Palantir's growth likely will keep getting better over the next five years considering the huge end-market opportunity the company is tapping. According to one estimate, the global generative AI software market could jump fourfold between 2024 and 2030, generating an annual revenue of $391 billion.

Palantir reported 29% revenue growth in 2024 to $2.87 billion, indicating that it has massive room for growth over the next five years. More importantly, Palantir is on its way to making the most of this huge opportunity thanks to its fast-growing customer base and its ability to win more business from existing customers.

For example, the company's overall customer base shot up by an impressive 43% in the fourth quarter of 2024. Even better, the increasing size of the contracts that Palantir signed led to an impressive 40% year-over-year jump in its remaining deal value (RDV) last quarter to $5.4 billion. That number is well ahead of the company's $3.75 billion revenue estimate for 2025, suggesting that it could deliver better-than-expected results going forward.

Also, Palantir's existing customers tend to increase their adoption of AIP after signing the initial contract. That's one of the reasons why there was a 56% year-over-year increase in the company's total contract value (TCV) last quarter to $1.8 billion. So, it won't be surprising to see Palantir's RDV growth remaining solid over the next few years as more companies adopt generative AI software and sign bigger deals with the company.

One key reason why Palantir has been able to attract customers toward its AIP is because the company has been ranked as the top provider of AI software by third-party research firms. So, the stage seems set for Palantir to keep growing at an incredible pace over the next five years, but will it be able to deliver enough upside to overtake Oracle?

Can this red-hot stock become more valuable than Oracle?

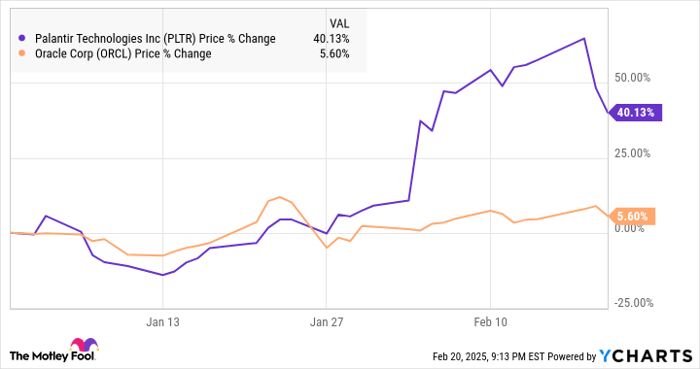

If Palantir manages to sustain its remarkable rally on the back of outstanding growth, it may not take five years for the software specialist to overtake Oracle's market cap. After all, Palantir's market cap would have to grow by 97% to reach Oracle's levels, and Palantir has reduced the gap between their value by a huge margin in 2025 already.

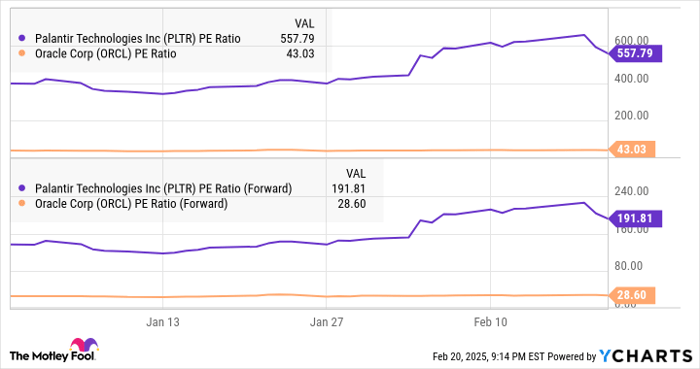

Of course, some might point out Palantir is trading at extremely lofty multiples right now when compared to Oracle, and that could limit the former's upside.

PLTR PE Ratio data by YCharts

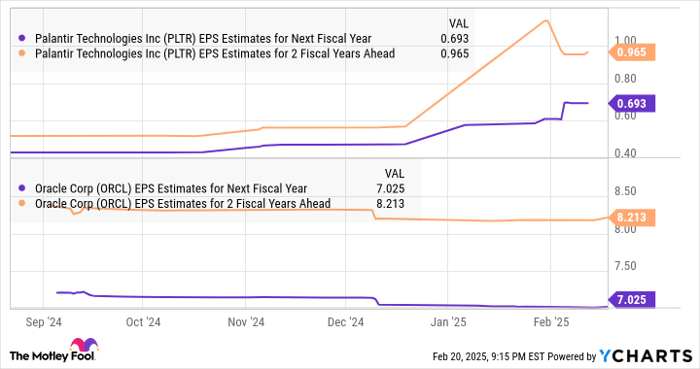

However, if you look past the valuation, compare the growth rates of the two companies, and take into consideration Palantir's leading position in the AI software platforms market, there is a strong possibility that it may be able to justify its valuation in the long term. Palantir's earnings growth, for instance, is expected to be triple Oracle's in the current fiscal year. That trend is expected to continue in the future as well.

PLTR EPS Estimates for Next Fiscal Year data by YCharts

So, the market could reward Palantir's stronger earnings growth with more upside when compared to Oracle stock over the next five years, and that could help Palantir become a more valuable company.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $823,858!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 24, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Oracle and Palantir Technologies. The Motley Fool has a disclosure policy.