2 No-Brainer High-Yield Stocks to Buy With $100 Right Now

If you have $100 and are looking to generate some long-term income from an investment, you don't have to settle for the 1.2% yield on offer from the S&P 500 index. You can do much better than that without taking on a huge amount of business risk.

Look no further than Enbridge (NYSE: ENB) and Enterprise Products Partners (NYSE: EPD). Both stocks trade for well below $100 a share and they are both clearly dedicated to providing a reliable, and growing, income stream to investors. Here's what you need to know.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

You don't have to settle

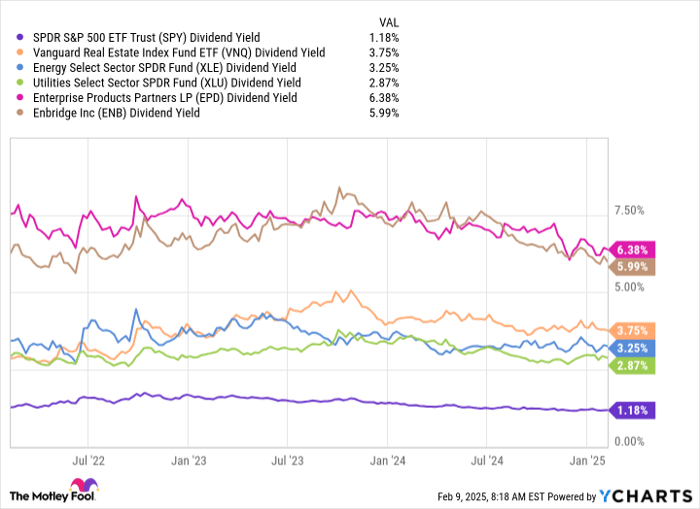

As noted above, the S&P 500 index has a miserly 1.2% yield. You can do better than that if you focus on select sectors. For example, the utility sector is offering roughly 3%. The broader energy sector's yield is around 3.3% today. And real estate investment trusts, on average, have a 3.8% yield. These three sectors are all known for paying generous dividends, but you can still do better if you focus down even further and look at individual companies.

SPY Dividend Yield data by YCharts

Two particularly attractive dividend stocks right now are Enbridge, which has a huge 6% dividend yield, and Enterprise Products Partners, a master limited partnership (MLP) yielding 6.4%. If you are thinking you have to take on huge risks to get oversize yields like that, you are mistaken. Both of these midstream giants are conservatively run, kind of boring, and highly reliable.

To back up that last statement all you need to do is look at their dividend paying histories. Enterprise's distribution has been increased annually for 26 consecutive years. Enbridge's dividend, in Canadian dollars, has been hiked each year for three decades and counting. Streaks like these don't happen by accident, they require companies that have solid business plans that get executed well in good markets and bad ones.

What's at the core of Enbridge and Enterprise?

Enbridge and Enterprise both fall into the energy sector, which is known for being volatile because of the variability of oil and natural gas prices. But that isn't actually an issue that impacts the midstream (pipelines), which is where these two businesses operate, to the same extent as the upstream (energy production) or the downstream (chemicals and refining). Simply put, midstream companies like Enbridge and Enterprise help connect the upstream to the downstream and the rest of the world.

They own energy infrastructure like pipelines, storage, and transportation assets. These cost a lot of money to build but then can throw off reliable income for decades. The key is that Enbridge and Enterprise charge fees for the use of their assets, which is what creates the steady income streams they use to pay dividends.

As two of the largest midstream companies in North America, the portfolio of assets Enbridge and Enterprise own would be nearly impossible to recreate or replace. And the U.S. energy sector would come to a virtual standstill if either of these industry leaders suddenly stopped serving their customers. It would, quite literally, throw the sector into a state of chaos.

But there's more to like here. Both Enbridge and Enterprise operate in a conservative, shareholder-friendly fashion. The regular dividend increases are one example of that, but an even better one is their financial strength. Both have investment-grade-rated balance sheets. They simply aren't out there taking on giant risks in an effort to prop up a dividend payment that isn't sustainable over the long term.

To the contrary, Enbridge and Enterprise have the financial wherewithal to support their dividends right through energy sector downturns.

Don't try to be fancy, start while you have the cash

Here's the problem that some dividend-focused investors might have with Enbridge and Enterprise. Their yields were much higher a few years ago when the energy sector was deeply out of favor. Don't get so fixated on those yields that you miss out on the still generous income streams available to you today. While Enbridge and Enterprise could see their yields return to those levels, it is also possible that they never see those heights again.

You would be better off buying now and adding to your position if the yields spike anew. Indeed, after owning these two midstream giants for a little while, you'll see just how capable they are at managing through the energy cycle and likely start to see downturns as particularly attractive opportunities to buy more shares.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $340,048!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,908!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $554,019!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of February 3, 2025

Reuben Gregg Brewer has positions in Enbridge. The Motley Fool has positions in and recommends Enbridge and Vanguard Real Estate ETF. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.