Here's How Many Shares of Enterprise Products Partners You Should Own to Get $5,000 in Yearly Dividends

Enterprise Products Partners (NYSE: EPD) stock is on a tear. Shares of the midstream oil and gas giant are up almost 26% in one year, as of this writing. Enterprise Products stock still yields a hefty 6.5%, thanks to steady dividend growth backed by rising cash flow.

To put some numbers to that, Enterprise Products has increased its dividend -- or "distribution," as it's called for master limited partnerships -- for 27 consecutive years. That dividend growth has contributed handsomely to the stock's returns over time.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

That's the kind of dividend stock you'd want to own -- one that offers a bankable high yield -- to earn regular passive income. Here's how you can earn $5,000 in yearly dividends from Enterprise Products stock.

Why buying Enterprise Products shares for dividends is a smart move

Having hiked its dividend by 3.9% earlier this year, Enterprise Products is paying a quarterly dividend of $0.535, or an annualized dividend of $2.14 per share. Buying 2,340 shares now will fetch you just a little over $5,000 in annual dividend income. That translates into an investment of around $77,000 at the stock's current price.

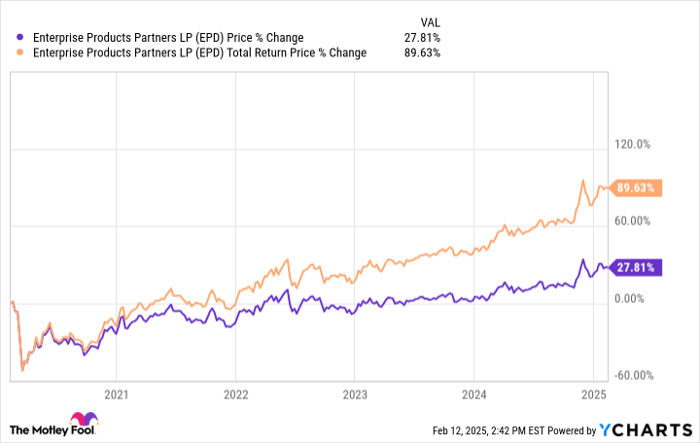

That may seem like a big investment, but I'll give you only one reason why targeting $5,000 in passive income from Enterprise Products stock is a worthy decision: That amount of passive income should grow every year and could hugely boost your total returns from the stock over time. As evidence, check out this chart reflecting Enterprise Products stock's returns in the past five years, with and without dividend reinvestment.

Enterprise Products distributable cash flow (DCF) safely covered its total dividends by at least 1.5 times since 2018. With the company generating a record DCF of $7.8 billion in 2024 and having projects worth nearly $7.6 billion under construction that should become operational over the next three years, Enterprise Products makes for a top high-yield dividend stock to buy and hold.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $340,048!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,908!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $554,019!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of February 3, 2025

Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.