Will the "Trump Put" Save Nvidia?

Since President Donald Trump won the 2024 election in early November, U.S. stocks rose in anticipation that he will institute pro-business policies. It hasn't been all smooth sailing on Wall Street, though. The emergence of the Chinese artificial intelligence chatbot DeepSeek and Trump's tariff proposals threw some wrenches into the works, although those headwinds have thus far proven short-lived.

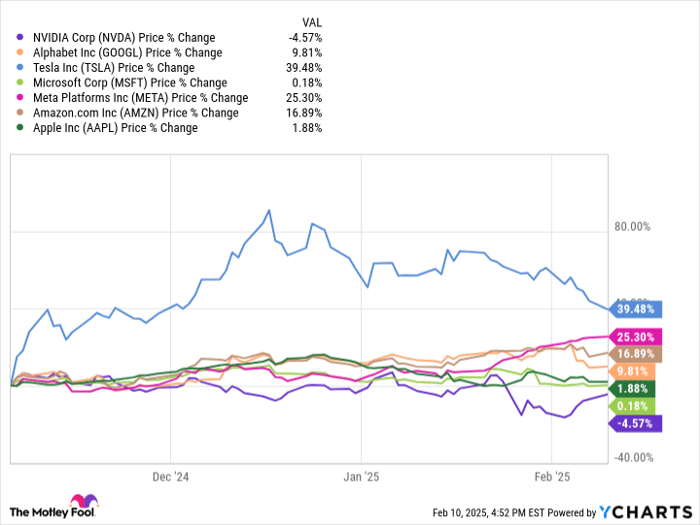

The high-flying stocks in the Magnificent Seven by and large participated in the upward trend. Tesla and Meta Platforms led the way higher as CEOs Elon Musk and Mark Zuckerberg have cozied up to Trump.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

However, Nvidia (NASDAQ: NVDA) has not fared as well in the past few months, and its situation may well get worse from here.

What does the 'Trump put' mean?

The "Trump put" is a theory among some investors that with Trump in the White House, the downsides for the stock market are limited, because he views Wall Street's performance as a reflection on him. As such, the premise goes, he won't want to do anything that would effectively tank the market, and will promote policies that boost share prices. Moreover, in theory, if one of his policies starts to drag down the market, he's likely to reverse it.

We have already seen some evidence of a Trump put with the opening stages of his tariff plans. Trump initially imposed steep tariffs on China, Mexico, and Canada, and the stock market fell. The Dow Jones Industrial Average dropped by more than 600 points on the day of the announcement. Trump soon struck short-term deals with Canada and Mexico to at least pause those tariffs for a month and the Dow recouped much of its losses.

However, Trump is also showing signs that his broader tariff plans are still intact. His previously announced 10% tariff on Chinese imports went into effect and China retaliated with tariffs of its own. Furthermore, he put 25% tariffs on all aluminum and steel imports. The market has yet to bat an eyelash at these new tariffs, but remember that Trump floated the idea of a 60% tariff on Chinese imports while he was on the campaign trail; if he stops at 10%, that would be a less drastic outcome.

Nvidia could use a hand

Since Nov. 5, no stock in the Magnificent Seven performed as poorly as Nvidia. Part of its decline was triggered by the debut of DeepSeek's new AI models. Based on the small Chinese company's public statements, it's possible that new generative AI models could be developed at a much lower cost than expected, and be trained using older chips. However, Nvidia also faced issues due to export restrictions on some of its more advanced chips.

That headwind actually began to intensify in early January under former President Joe Biden, whose administration proposed further restrictions on which countries U.S. chipmakers could sell some of their most powerful products to, and in what quantities. Restrictions have already been placed on countries like China and Russia. This new proposal, however, would impact 120 countries including Mexico, Portugal, Israel, and Switzerland, and could limit the volumes of sales of chips used for data centers. These new rules are aimed at closing loopholes that countries like China have been exploiting to gain access to next-generation chips made using U.S. technology. Nvidia has called the proposal misguided.

Trump will ultimately have the final say here. Meanwhile, the Commerce Department is in the midst of a 120-day comment period before he decides on what changes to the trade framework will go into effect. However, both administrations actually appear aligned on this issue.

Additionally, following the DeepSeek news, some lawmakers called on Trump to put export controls on the older Nvidia chips that the Chinese company allegedly used to build its large language model, which supposedly cost less than $6 million to develop and train compared to more than $100 million for OpenAI's ChatGPT. In the nine-month period that ended Oct. 27, China accounted for about 13% of Nvidia's total revenue, Singapore made up 19%, and Taiwan made up 16.8%.

It's not yet clear how Trump will proceed on export restrictions or tariffs, but the Trump put premise is going to be put to the test. Nvidia is one of the largest-weighted companies in the benchmark S&P 500. If the company starts to really struggle, the whole market is likely going to feel some pain.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $803,695!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 7, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.