Down 65% From Its 52-Week High, Is e.l.f. Beauty Stock a Buy?

Shares of cosmetics company e.l.f. Beauty (NYSE: ELF) are tanking. The stock is in such a tailspin that it hasn't traded this low since early 2023. It's in a freefall as investors appear to be worried about not only slowing sales numbers but also what effect tariffs may have on its future.

The hype is clearly gone, and investors are heading for the exits. But before potentially rushing to make a rash decision just based on the stock movement alone, let's take a closer look at the business and whether it could make for an underrated buy right now given the heavy selling.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Business is still growing, but e.l.f.'s growth rate is slowing

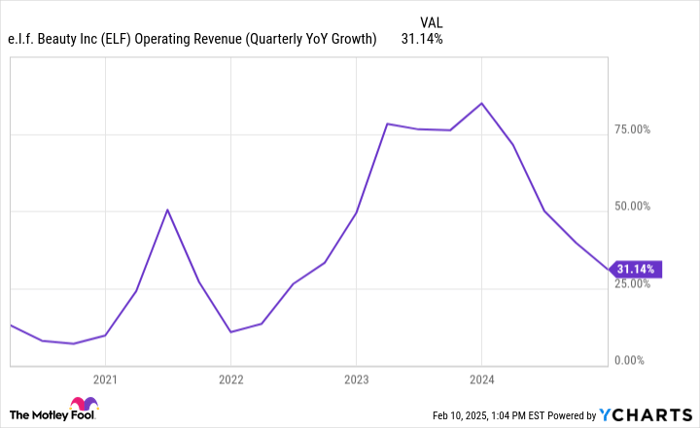

E.l.f.'s business has been booming in recent years, and the cosmetic stock has built up an impressive track record of solid growth. Last week, it released its earnings numbers, which reinforced that fact, with e.l.f.'s sales growing and gaining market share for a 24th consecutive quarter.

However, the company's 31% revenue growth for the last three months of 2024 was actually a slower rate than what it has averaged in recent periods.

ELF Operating Revenue (Quarterly YoY Growth) data by YCharts.

And due to a rise in other expenses, largely due to unfavorable foreign exchange rates, the company's pre-tax income also declined by 14%, to $26.3 million. That still represents a decent 7% of revenue ($355.3 million), which is a good sign that e.l.f.'s margins are strong, and the bottom line can increase along with sales over time.

Company cuts guidance, but tariffs may pose a greater risk ahead

E.l.f. is anticipating more of slowdown, however. The cosmetics company adjusted its guidance for fiscal 2025 (which ends in March), now projecting a growth rate of between 27% and 28% versus the 28% to 30% range it was previously expecting. The company says that there was a weak start to the new year, leading to management being a bit more conservative on its near-term outlook.

Another problem which could weigh on the business and the stock is the threat of tariffs on China, where the company manufactures 80% of its cosmetics. When e.l.f.'s CEO said he was relieved that the new tariffs on China were only 10%, that underscores just how vulnerable the stock may be to the possibility of heightened tariffs down the road. Tariffs could result in price increases for e.l.f.'s products, which could drastically hurt their competitiveness in the market and overall demand.

Is e.l.f.'s stock too risky to buy?

As of Feb. 10, e.l.f.'s stock has declined by 42% since the beginning of the year. Trading at around $70, it's nowhere near its 52-week high of more than $221. Today, investors can buy the stock for a multiple of 17 times its estimated future profits (based on analysts' expectations).

The biggest risk facing the stock today isn't a modest adjustment to its guidance but the threat of tariffs, and that seems to be weighing on its valuation heavily. There may be challenges for the business in the short term, but in the long run, tariffs may be removed or the company can adapt and source its products from different parts of the world.

It may seem like a risky buy right now, but I wouldn't be too worried about the business just yet. Now could be an opportune time to load up on e.l.f.'s stock while its valuation looks cheap.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $344,352!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,103!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $543,649!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of February 3, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends e.l.f. Beauty. The Motley Fool has a disclosure policy.