Here's What I'm Doing With My Nvidia Shares After DeepSeek's Groundbreaking Innovation

Nvidia (NASDAQ: NVDA) stock took a haircut recently after China-based startup DeepSeek announced the success of its R1 model at building a fraction of the currently expected cost. Compared to the billions of dollars U.S. companies are investing to win the artificial intelligence (AI) race, DeepSeek reportedly did it for just $5.6 million. This caused Nvidia's stock to plummet by nearly 20%,

However, I think that's an overreaction. Although there are some valid concerns, I think this decline represents a buying opportunity for investors. After all, DeepSeek's model was still trained on Nvidia GPUs.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Nvidia GPUs were used to train DeepSeek's R1 model

While the news headlines were filled with claims that DeepSeek trained its AI model for just $5.6 million, that's not a fair assessment. That figure doesn't include any hardware costs, or any of the pre-training costs that it took to arrive at that point. This is a key caveat that many investors are forgetting. Still, DeepSeek had a real efficiency breakthrough that the domestic AI hyperscalers haven't discovered yet.

As for the hardware, DeepSeek used Nvidia H800 GPUs, which are modified from typically used H100 GPUs to abide by U.S. export restrictions. With a large number of consumers trying out DeepSeek's AI model, it undoubtedly had to purchase more GPUs to run all of the workloads, which is another catalyst for Nvidia's stock.

Domestically, AI companies aren't going to cancel their Nvidia orders just because a competitor exceeded their performance. Instead, they'll continue increasing their computing power alongside making the models more efficient, which will increase the pace of innovation overall.

Furthermore, DeepSeek's model likely only has consumer implications. There are questions about the security of the AI model and what information it collects from users. As a result, it's unlikely that any business will build its AI model on DeepSeek's platform.

In my opinion, DeepSeek's efficiency breakthrough shouldn't be seen as a threat to Nvidia's business. Instead, it should be seen as a catalyst, as AI models are getting closer to becoming more mainstream and widely used.

With that in mind, I'm looking to increase my stake in Nvidia stock, as there are just too many growth tailwinds to ignore.

Nvidia's stock is on sale after the DeepSeek scare

For its fiscal 2026 (ending January 2026), Wall Street analysts expect Nvidia's revenue to rise by 52%. That number may or may not change depending on how Nvidia's management comments on GPU demand during its next earnings call (likely at the end of February). But, for the reasons I laid out above, Nvidia likely won't see its growth trajectory affected.

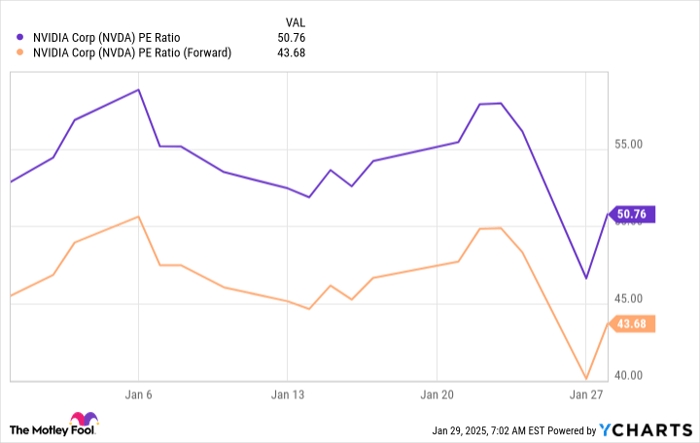

NVDA PE Ratio data by YCharts.

As a result of the drop, Nvidia's stock is also on sale. At the time of writing, the stock trades for 44 times forward earnings, which isn't the cheapest valuation in the world. However, it still represents pretty good value for a company that's expected to grow at a strong pace over the next few years.

While some may be scared to take a position in Nvidia's stock (an understandable view), I think it's time to take advantage. There's nothing wrong with waiting on the sidelines for more news, but the stock may recover by then. It's a guessing game of risk management, and I think the risk-reward profile for Nvidia is promising here.

As a result, I will be adding more Nvidia shares if the stock price stays down.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $735,852!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 3, 2025

Keithen Drury has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.