This Powerhouse Growth ETF Could Help You Turn $200 per Month Into $1.3 Million While Barely Lifting a Finger

When many people picture investing in the stock market, they often imagine researching individual companies and buying them one at a time. With enough time and research, you'll have a well-diversified portfolio filled with at least a couple dozen individual stocks.

While this approach can lead to life-changing wealth, there's another option that could supercharge your savings with far less effort: buying exchange-traded funds (ETFs).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Image source: Getty Images.

An ETF is a single investment that includes many stocks with a similar theme. S&P 500 ETFs include all of the stocks listed in the S&P 500 index, for example, while industry-specific ETFs only include stocks from a particular sector of the market.

Growth ETFs contain stocks with the potential for faster-than-average growth, and there's one powerhouse fund that could turn just $200 per month into $1.3 million or more over time.

Building wealth with little effort

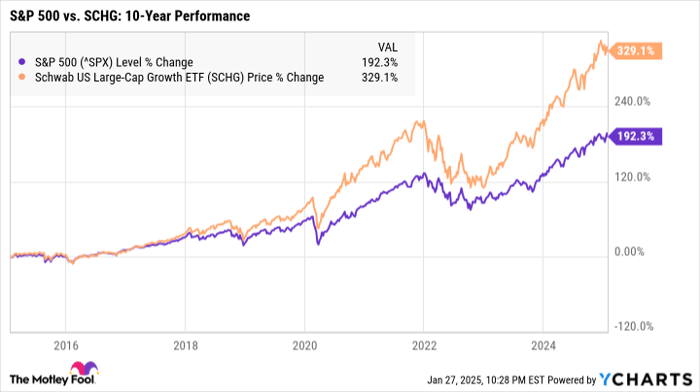

Growth ETFs can help you build long-term wealth, and one fantastic option is the Schwab U.S. Large-Cap Growth ETF (NYSEMKT: SCHG).

This fund contains 229 large-cap stocks, which are stocks from companies valued at more than $10 billion. Large-cap stocks often have decades-long track records of recovering from tough economic times, so while there are no guarantees that these companies will survive over the long term, they're generally more stable than their smaller counterparts.

The Schwab U.S. Large-Cap Growth ETF also leans on heavy hitters to make up the bulk of its composition. Nvidia, Apple, and Microsoft are the top three holdings, and combined, they make up around 33% of the entire fund. Also, the tech industry as a whole accounts for close to half of this ETF.

Relying on powerhouse stocks can sometimes be a double-edged sword, however. When the market is thriving and superstar stocks like Nvidia are seeing tremendous growth, that will reflect in this ETF. Case in point: In the past year alone, this ETF has earned annualized returns of close to 34%.

But when one-third of this fund is dedicated to just three stocks, it limits your diversification -- increasing your risk if those companies face turbulence.

Monthly contributions can go a long way

Perhaps the best way to generate wealth in the stock market is to consistently invest small amounts for as long as you can. Despite the market's short-term ups and downs, its long-term outlook is promising.

Since this ETF's launch in 2009, it's earned an average rate of return of 16.60% per year. Let's say you're investing $200 per month while earning a 16% average annual return. Depending on how many years you can give your money to grow, here's approximately what you could earn in total:

| Number of Years | Total Portfolio Value |

|---|---|

| 20 | $277,000 |

| 25 | $598,000 |

| 30 | $1,273,000 |

| 35 | $2,690,000 |

Data source: author's calculations via investor.gov.

At this rate, it would take roughly 30 years to accumulate $1.3 million. But if you had even a few more years to invest, you could earn exponentially more.

Before you buy, keep in mind that there's always a chance this ETF may underperform going forward. It may or may not be able to keep up with its 16% average annual returns, and there will likely be some years you don't see positive returns at all. That's a risk you'll take with any investment, but especially growth ETFs.

Even with lower returns, though, you could still build a substantial amount of wealth. For example, investing $200 per month at a 12% average annual return (which is only slightly higher than the market's historic 10% annual average) could add up to just over $1 million after 35 years.

Whether or not you choose to invest in a growth ETF will depend mainly on your risk tolerance. The Schwab U.S. Large Cap Growth ETF can experience greater volatility with reduced diversification, but as part of a well-balanced portfolio, it could also help supercharge your earnings over time.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $307,065!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,532!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $524,132!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of January 27, 2025

Katie Brockman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.