If I Could Buy Only 1 ETF in 2025, This Would Be It

Exchange-traded funds (ETFs) are great additions to any portfolio. I use them to gain exposure to market segments where I don't have a lot of expertise or where it's easier to invest in an ETF than to actively manage that part of my portfolio.

I currently hold several ETFs and routinely add to those positions. However, if I could buy only one this year, it would be the JPMorgan Nasdaq Equity Premium Income ETF (NASDAQ: JEPQ). Here's why it's my top ETF to buy in 2025.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Income and upside

The JPMorgan Nasdaq Equity Premium ETF has a dual mandate. The ETF strives to distribute income to investors each month while providing them with lower-volatility exposure to the Nasdaq-100 index, which holds 100 of the top nonfinancial stocks that trade on the Nasdaq Stock Exchange.

The fund has a two-pronged investment strategy to aid it in delivering on that goal:

- Equity portfolio: The ETF holds a portfolio of Nasdaq-100 stocks. However, it doesn't mirror that index. Instead, the fund's managers combine an applied data science approach to fundamental research to construct an equity portfolio that should produce lower-volatility returns than the index.

- Options overlay: The fund's managers have a disciplined options overlay strategy. They write out-of-the-money call options on the Nasdaq-100 index (i.e., those above the index's current trading level). Writing or short-selling options produce income because the fund gets paid the premium (value of the option). This strategy enables it to generate income it distributes to investors each month.

The options income can be very lucrative:

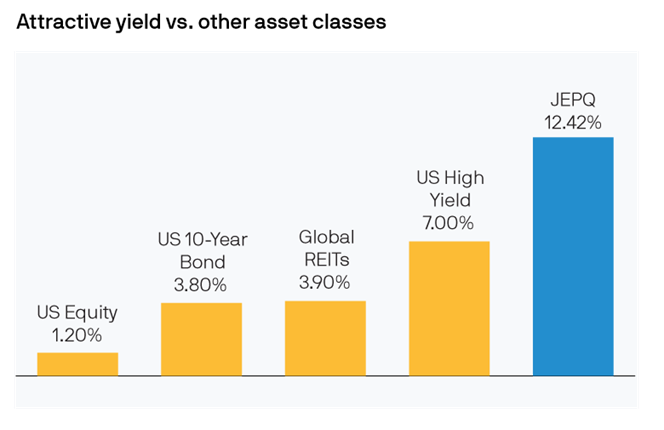

Image source: JPMorgan Asset Management. REITs = real estate investment trusts.

As the chart shows, the annualized income yield on the ETF's most recent payment is above 12%. That's significantly higher than high-yield junk bonds and other asset classes.

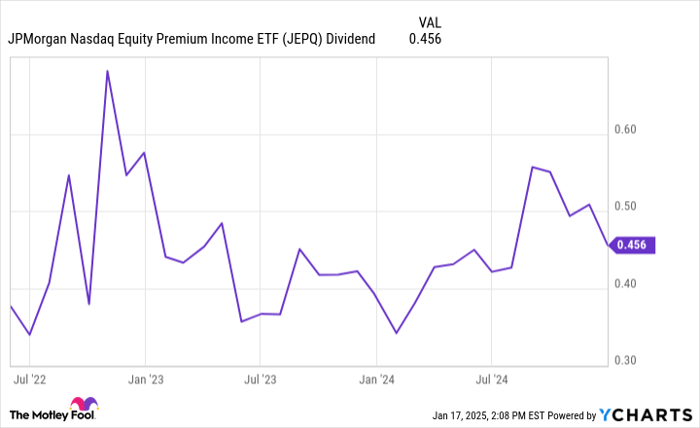

However, there is a caveat. The income stream fluctuates from month to month based on the options premium income the fund generates. That income tends to be higher following periods of market volatility because it increases the value of options premiums. We can see that in the fund's historical payments, which were higher in 2022 when the market was more volatile:

JEPQ Dividend data by YCharts.

Given the lower payments earlier last year, the fund's yield over the past 12 months is lower at 9.9%. That's still an attractive income stream, which is important to me. I like to generate passive income, which I reinvest to generate more income. My goal is to eventually produce enough passive income to cover my basic living expenses. This fund's high-yielding payout will certainly help.

Lower-volatility exposure to the top Nasdaq stocks

The other thing I like about this ETF is its focus on the Nasdaq-100 index, which features companies growing their revenue and earnings at higher rates, like those in the technology sector. Because of that, the index has significantly outperformed the S&P 500, which is more of a benchmark for the broader economy. For example, over the past 15 years, the Nasdaq-100 has delivered a 14.8% annualized return compared to 9.6% for the S&P 500. Of note, the Nasdaq-100 has been more volatile than the broader market.

What I like about the JPMorgan Nasdaq Premium Income Fund is that it offers exposure to this higher-returning market index with less volatility. It does that through a combination of its options overlay strategy and active portfolio management. As mentioned, while it holds stocks in the Nasdaq-100, it doesn't mirror that index. For example, during the third quarter, it didn't hold shares of Moderna and had a higher allocation to Oracle, which added to its results.

That strategy has enabled the fund to produce strong returns (16.9% annualized since its inception in mid-2022). While it has underperformed the Nasdaq-100's 20.5% annualized return, that's still a robust return from a less volatile investment that generates lots of income.

The best of both worlds

JPMorgan Nasdaq Equity Premium Income ETF supplies a lucrative monthly income stream, which helps satisfy my desire for passive income. It also provides lower-volatility exposure to the faster-growing Nasdaq-100, which should help grow the value of my portfolio. That combination of income and upside is why I'd buy this ETF if it were the only one I could purchase this year.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $357,084!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,554!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $462,766!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of January 13, 2025

Matt DiLallo has positions in JPMorgan Nasdaq Equity Premium Income ETF and Moderna. The Motley Fool has positions in and recommends Oracle. The Motley Fool recommends Moderna. The Motley Fool has a disclosure policy.