NextEra Energy's Planned 2025 Dividend Hike? 10%. And Planned for 2026? That's 10%, Too.

NextEra Energy (NYSE: NEE) is offering investors a dividend yield of roughly 2.8%. The average utility stock, using the Utilities Select Sector SPDR ETF, is yielding a touch under 2.7%. From this perspective, you might think that NextEra Energy is a run of the mill utility stock. Nothing could be further from the truth. Here's why dividend growth investors should like what they see with NextEra Energy.

What does NextEra Energy do?

Most utilities focus on providing electricity or natural gas to customers. NextEra Energy does this, too. Its largest division owns regulated electric assets in the state of Florida. This state has benefited from in-migration for years. That has helped lead to slow and steady growth at NextEra Energy, since more customers means more revenue. And more customers generally makes it easier to get capital spending plans approved by regulators. If this were all that NextEra Energy did, it would be an attractive utility but not necessarily an exceptional one.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Image source: Getty Images.

What sets NextEra Energy apart from the broader utility group is that it also invests in clean energy assets. To be fair, most utilities are doing this in some form. But NextEra Energy's long-term investment in this segment has left it as one of the world's largest producers of solar and wind power. So it is both one of the largest regulated utility companies in the U.S. and one of the world's largest clean energy companies. This is the combination that sets it apart from the pack.

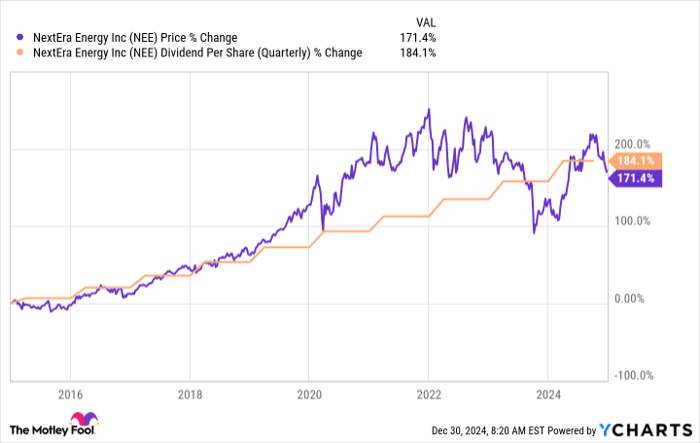

It has excelled on both fronts, too, with the foundational regulated utility business being used to support the fast-growing clean energy business. The proof is in the dividend, which has been increased at a 10% annualized rate over the past decade. But it is the consistency that is most impressive, with 10% increases over the past one-, three-, five-, and 10-year periods. If you are a dividend growth investor, this is the type of company you will want to have in your portfolio. And it might even add some valuable diversification because it resides in an industry that isn't normally a fount of dividend growth opportunities.

What does the future hold?

That said, the discussion so far has been focused on the past. The future is what matters most on Wall Street. Based on NextEra's dividend yield being slightly higher than the average utility, you might think that the future isn't likely to be as bright as the past. Think again.

NextEra is currently projecting earnings growth to fall between 6% and 8% a year through to 2027. That, in turn, is expected to support another 10% dividend hike in 2025 and a similar-sized increase in 2026! This dividend growth machine is still on track and, in fact, might look fairly attractive relative to other utilities given the yield dynamics at play.

The real growth kicker here comes from the opportunity on the clean energy side of the business, where management thinks it can build as much as 46.5 gigawatts of capacity through 2027. However, don't forget that NextEra Energy is still the owner of attractive and growing regulated utility assets in Florida. So there's attractive growth taking place on both sides of the business. Put the two together and you get an industry powerhouse that is set to keep rewarding dividend growth investors very well. It wouldn't be at all shocking to see the dividend continue to grow at an elevated rate beyond the current 2026 outlook being provided by management.

NextEra Energy is not right for all dividend investors

So far the discussion around NextEra Energy has focused on dividend growth, with only a quick reference to its roughly industry-average level yield. That should make it very attractive to dividend growth investors, for sure, but an average yield probably won't make NextEra Energy attractive to investors looking to maximize current income. So this isn't a one-size-fits-all type investment. But if you care about diversification and are focused on dividend growth, NextEra Energy should probably find a place in your portfolio so you can take advantage of its attractive yield and the 10% dividend growth planned for 2025 and 2026.

Should you invest $1,000 in NextEra Energy right now?

Before you buy stock in NextEra Energy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and NextEra Energy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $842,611!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 30, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends NextEra Energy. The Motley Fool has a disclosure policy.