Better Growth Stock: Archer Aviation or Rocket Lab USA, Inc.?

Innovative growth stocks can deliver life-changing returns for patient investors who identify transformative companies early. The challenge lies in finding these opportunities before the broader market fully prices in their potential.

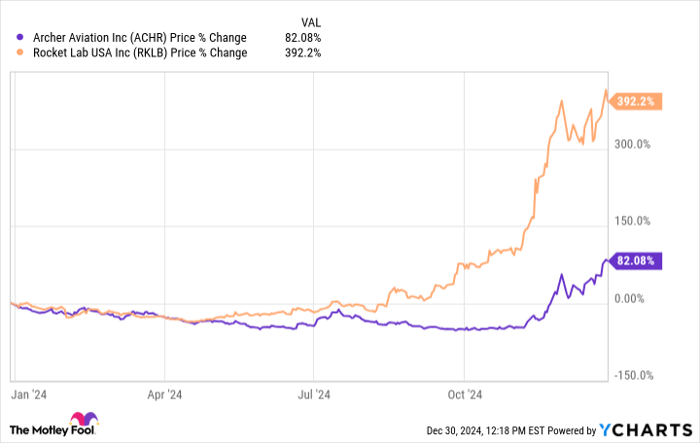

Two emerging aerospace companies perfectly illustrate this dynamic. In 2024, one of these companies has rocketed higher in response to the achievement of multiple key milestones, while the other has only recently started to gain traction among investors.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Image source: Getty Images.

Specifically, Rocket Lab USA, Inc. (NASDAQ: RKLB) stock has soared 392%, while Archer Aviation, Inc. (NYSE: ACHR) has gained 82% year to date, as of Dec. 27, 2024. Let's examine their core value propositions and growth profiles to determine which innovator offers better potential returns over the next five years.

Space success commands a premium

Rocket Lab has become a dominant force in small satellite launches, with Electron now ranking as the third most frequently launched rocket globally in 2024. The company's growing revenue and robust order backlog demonstrate strong customer demand, particularly from commercial satellite operators and government agencies seeking reliable access to space.

Beyond launch services, Rocket Lab continues expanding its space-systems division, manufacturing critical satellite components and spacecraft for NASA and other customers. While the development of its larger Neutron rocket could open new market opportunities, much of this potential growth appears reflected in the current stock price. Trading at 22.6 times 2025 projected sales after its dramatic rise this year, Rocket Lab commands a rich premium relative to aerospace peers.

Revolutionizing aerospace and defense

Archer leads a new wave of electric vertical take-off and landing (eVTOL) aircraft developers aiming to transform urban transportation. The company has secured crucial partnerships with Stellantis for manufacturing expertise and United Airlines for commercial operations, providing a clear path to market.

A recent alliance with defense technology innovator Anduril marks a potential turning point. This partnership extends beyond simple military applications, combining Archer's advanced aircraft design with Anduril's cutting-edge autonomous systems and artificial intelligence capabilities. The result could revolutionize military aviation through autonomous operation and advanced battlefield awareness.

The partnership gains additional significance through Anduril's deep connections within the defense industry and track record of securing major government contracts. This collaboration positions Archer to simultaneously address both commercial and military markets, a dual-track strategy that could dramatically accelerate the eVTOL pioneer's growth trajectory.

Different paths to value creation

While Rocket Lab has proven its business model works, capturing significant market share in space launches and systems, this success comes at a price. The stock's meteoric rise in 2024 suggests investors have already priced in much of its near-term growth potential.

Archer presents a different value proposition despite its strong performance this year. The market appears slow to recognize the full implications of its Anduril partnership, particularly its potential to accelerate both technological development and market adoption. Combining urban air mobility and autonomous military systems creates multiple paths to value creation.

Better aerospace stock to buy?

While both companies represent the future of aerospace, their return potential differs dramatically. Rocket Lab's success has been richly rewarded by the market, potentially limiting near-term upside. Archer, despite its gains in 2024, still scans as undervalued thanks to its dual commercial and military strategies.

The Anduril partnership, in particular, positions Archer as a potential leader in autonomous military systems, a development that its current $5 billion market cap doesn't seem to fully reflect. Defense contracts, after all, will likely contribute billions to its revenue haul over the next five years alone.

As a result, Archer presents a more compelling growth opportunity for stock investors over the next five years in this head-to-head match-up.

Should you invest $1,000 in Rocket Lab USA right now?

Before you buy stock in Rocket Lab USA, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rocket Lab USA wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $839,670!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 30, 2024

George Budwell has positions in Archer Aviation and Rocket Lab USA. The Motley Fool recommends Rocket Lab USA and Stellantis. The Motley Fool has a disclosure policy.