How Much Will Garmin Stock Pay Out in Dividends in 2025?

Garmin (NYSE: GRMN) has been somewhat of a surprise stock market winner in 2024. Shares of the GPS-enabled device and wearables maker have soared 60% year to date with only a handful of trading days remaining.

The market-beating results came as the company shocked investors and analysts with its revenue and earnings growth throughout the year. Garmin's third-quarter revenue soared 24% versus the prior-year period. It now projects full-year sales will grow 17% compared to 2023.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

The sharp rise in the stock may be deterring dividend investors, though, since Garmin's dividend yield has drifted down to 1.4%. But overlooking Garmin as a good dividend investment would be a mistake.

A dividend with room to grow

Garmin's sales and profits are growing for several reasons. It has a top brand offering trusted products, and the company serves specialized market segments, including aviation and marine users, which contribute higher margins thanks to lower competition and more technical product requirements. The company expects operating profit this year to reach 24.0%, up from 20.9% in 2023.

At its last shareholder meeting, Garmin raised its quarterly dividend by about 3% to $0.75 per share. So shareholders can currently earn $300 annually for every 100 shares they own.

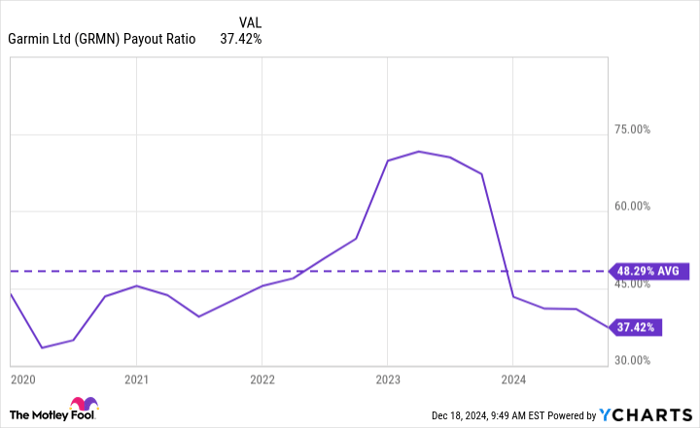

But it could move higher in 2025, given the company's strong financial position. Garmin's payout ratio is only 37.4%, well below its five-year average. That leaves plenty of room to grow the dividend.

Data by YCharts.

Garmin also had about $3.5 billion in cash and marketable securities and essentially no debt as of the end of the third quarter.

While it's hard to say exactly whether Garmin shareholders will get a payout bump in 2025 -- the company broke its streak of annual dividend increases last year -- the company is undoubtedly well-positioned to do so. And given the strength of its business, the stock offers plenty of return potential too.

Should you invest $1,000 in Garmin right now?

Before you buy stock in Garmin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Garmin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $825,513!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 16, 2024

Howard Smith has positions in Garmin and has the following options: short January 2025 $200 calls on Garmin and short January 2025 $220 calls on Garmin. The Motley Fool has positions in and recommends Garmin. The Motley Fool has a disclosure policy.