2 High-Yield Midstream Stocks to Buy Hand Over Fist and 1 to Avoid

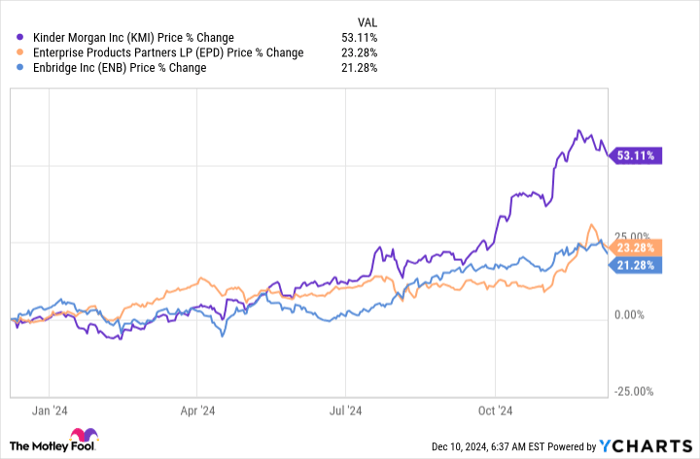

When Wall Street gets its teeth into a story, it can lead to strange outcomes. For example, Kinder Morgan (NYSE: KMI) has seen a material price advance and now yields a relatively tiny 4.1%. You can do over two percentage points better with investments in its midstream energy peers Enterprise Products Partners (NYSE: EPD) or Enbridge (NYSE: ENB).

And that's just the top-level view of why these two midstream giants are better choices than Kinder Morgan. Here's what you need to know.

The Kinder Morgan rally overlooks some important facts

Units of Kinder Morgan have risen around 50% over the past year, more than twice as much as Enterprise or Enbridge. Although you can argue about whether or not that swift advance was justified, what is very clear at this point is that Kinder Morgan's 4.1% yield is notably below the 6.4% you would get if you bought Enterprise and the 6.2% dividend yield from Enbridge.

If you are looking for a high-yield midstream investment, Kinder Morgan simply doesn't stack up as well on the income side of the equation. But don't stop there, because Kinder Morgan has some other negatives that need to be considered when it comes to distributing cash to unitholders.

First off, in late 2015, it told investors to expect a dividend increase of as much as 10%. And a couple of months later, it announced that the dividend would instead be cut by roughly 75%.

The next big letdown came in 2020 when it had told investors to expect a dividend increase of 25%. But when push came to shove, the master limited partnership only came up with a 5% hike.

The connecting factor here is that, in both periods, the energy sector was facing headwinds. So just when unitholders would most want management to live up to its word, they were disappointed.

Enbridge and Enterprise provide reliable income streams

By comparison, Enterprise Products Partners has increased its distribution every year for 26 consecutive years. Enbridge has increased its dividend every year for 30 consecutive years. That means these two competitors to Kinder Morgan passed along increases in both 2016 and 2020, despite the headwinds in the energy sector.

If dividend consistency is important to you, this fact alone should be enough to convince you to avoid Kinder Morgan and dig into Enterprise and Enbridge. But there's more to like about each of them.

Both Enterprise and Enbridge are North American midstream giants, with vital infrastructure assets that would be difficult to replace or displace. They provide integral services -- via the pipeline, storage, transportation, and processing assets they own -- that the energy sector simply can't operate without. The fees they charge for the use of their assets provide reliable income in both good energy markets and bad.

Both Enterprise and Enbridge have investment-grade balance sheets and well-covered distributions. This basically means that these two industry leaders can handle a lot of adversity before they would have to reduce the cash they pass on to investors. That fact is borne out in their strong disbursement histories.

Perhaps the most notable difference is that Enterprise is squarely focused on the midstream sector. It would be a fairly direct replacement for Kinder Morgan.

Enbridge's portfolio is a bit more complex, with natural gas utilities and renewable energy assets in it. That makes it a bit of a broader energy play, but one that comes with a clean energy hedge. If that sounds like a good thing, you might favor it over Enterprise.

Good price performance isn't enough to make an investment a buy

Just because a stock goes up rapidly doesn't mean that it is worth owning, even though the lemming-like behavior of Wall Street denizens might make it look like you are missing out on something. In fact, a rapid rise can, in some instances, make an investment less desirable because it quickly prices in a lot of good news (and reduces the yield, in the case of income stocks).

If you are looking at Kinder Morgan right now, step back and consider the value you are getting as an income investor. You'll probably find that you would be better off with Enterprise or Enbridge.

Should you invest $1,000 in Enterprise Products Partners right now?

Before you buy stock in Enterprise Products Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enterprise Products Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $841,692!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 9, 2024

Reuben Gregg Brewer has positions in Enbridge. The Motley Fool has positions in and recommends Enbridge and Kinder Morgan. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.