Every MicroStrategy Investor Should Keep an Eye on This Number

MicroStrategy (NASDAQ: MSTR) still sells enterprise software, focused on data analytics and business intelligence. However, most investors see it as a direct bet on Bitcoin (CRYPTO: BTC) these days, and for good reason.

Under the authority of co-founder and Chairman Michael Saylor, who also served as MicroStrategy's CEO at the time, the company converted most of its cash reserves into Bitcoin in 2020. Since then, Microstrategy has sold stock and taken on new debt to finance more Bitcoin purchases, while also pumping free cash flows from the software business into even more Bitcoin buys.

According to regulatory filings, MicroStrategy now holds roughly 423,650 bitcoins on its balance sheet. They were bought at an average price of $60,324 per coin. That's a $25.6 billion investment, currently worth approximately $42.4 billion. The current value of this Bitcoin portfolio accounts for nearly half of MicroStrategy's $90.4 billion market cap.

Watch MicroStrategy's soaring share counts

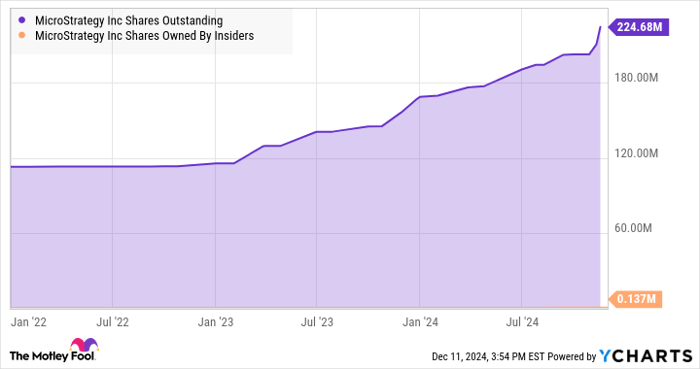

And that brings me to the metric every MicroStrategy investor should track like a Wall Street falcon. Those Bitcoin buying sprees are more expensive than they look, and shareholders are footing the bill for a large portion of them. As a result, MicroStrategy's share count has just about doubled in less than two years:

MSTR Shares Outstanding data by YCharts. Insider ownership data included to ensure the chart starts from nearly zero.

This highly dilutive strategy has real effects on MicroStrategy's stock price. The market cap grew 1,410% in the period show on the chart, while the price per share rose by 657%. Nobody complains about a sevenfold return in two years, but MicroStrategy plans to borrow about $21 billion from shareholders over the next three years, while signing a similar amount of debt papers.

So you should keep a close eye on MicroStrategy's share count before hitting the "buy" button. The Bitcoin-buying plan may or may not create wealth in the long run, but the underlying financing moves will definitely undermine shareholder returns along the way.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $361,233!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $46,681!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $505,079!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 9, 2024

Anders Bylund has positions in Bitcoin. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.