1 Magnificent High-Yield Stock Down 38% to Buy and Hold Forever

Anyone who has ever dealt with a package lost in transit can empathize with the frustration facing shareholders of United Parcel Service (NYSE: UPS). At the time of this writing, UPS stock is down 38% from its all-time high, largely due to weaker shipping demand over the past few years.

Despite this underperformance, recent company results suggest UPS is turning things around. Investors have the opportunity today to take delivery of this beaten-down industry leader that offers a hefty 5% dividend yield.

Let's explore why UPS could be a great addition to your portfolio.

An improved outlook into 2025

The attraction of UPS as an investment starts with the recognition that global logistics and supply chains are more important than ever. The company delivers more than 22 million packages daily through an extensive infrastructure network across more than 200 countries that can't be easily replaced. Beyond any quarterly financial noise, there's some confidence that UPS will play a critical role in the growing global economy decades from now.

That being said, the company has been navigating a historically challenging period. Compared to the pandemic-era business boom that saw a record number of shipments fueled by a surge in e-commerce, UPS has struggled to manage the ensuing slowdown while dealing with the impact of high inflationary cost pressures that impacted profitability. Disappointing trends since early 2022 explain the stock price weakness over the period.

The good news for investors is that the worst conditions for UPS appear to now be in the rearview mirror. The company's third quarter saw both revenue and profit growth for the first time in 18 months. Revenue increased by 5.6% year over year, while $1.80 in adjusted earnings per share (EPS) increased by 12.1% from Q3 2023.

Image source: Getty Images.

A major theme for UPS this year has been the recovery in average daily volumes for both the core U.S. market and the international segment amid the resilient macroeconomic backdrop. While the top- and bottom-line figures are still well below company records, efforts to improve efficiency alongside price hikes have helped balance the shifting landscape. In terms of growth, UPS is targeting value-added services such as specialized, time-critical transportation for the healthcare sector while also continuing an expansion into emerging markets.

According to Wall Street consensus estimates, UPS is forecast to reach 0.2% annual revenue growth this year and gain steam into 2025 with a 4.3% growth rate. The rebound in EPS is expected to be even higher next year, climbing by 17% to $8.75, reversing the estimated 14.9% decline in 2024.

My takeaway is that UPS is back on track and well-positioned to emerge stronger than ever.

| Metric | 2023 | 2024 Estimate | 2025 Estimate |

| Revenue (in billions) | $91.0 | $91.2 | $95.1 |

| Revenue change (YOY) | (9.3%) | 0.20% | 4.30% |

| Adjusted EPS | $8.78 | $7.48 | $8.75 |

| Adjusted EPS change (YOY) | (32.1%) | (14.8%) | 17% |

Data source: Yahoo Finance. YOY = year over year.

A high-yield opportunity

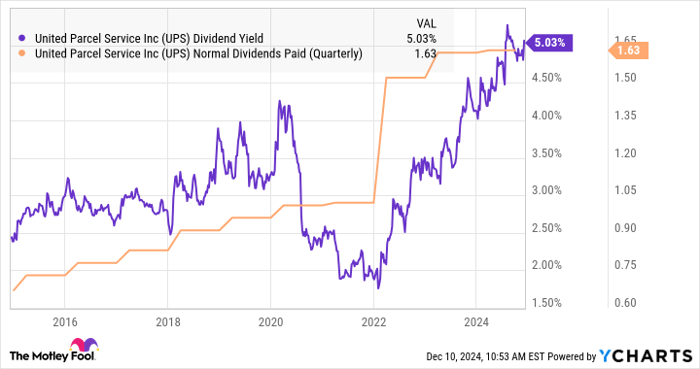

The headline numbers for UPS have been a bit messy, but what's important is that the company maintains overall solid fundamentals, with underlying profitability and significant free cash flow. These metrics go far in support of the $1.63 per share quarterly dividend, a payout amount that has been increased for 15 consecutive years.

The outlook for steady growth and even higher earnings should keep the distribution sustainable. So while a high-yield dividend can sometimes reflect financial distress, UPS stands out as an exception with all the pieces in place to continue rewarding shareholders. So whether the stock price surges higher now or later, UPS investors are getting paid a compelling 5% yield to wait while the turnaround story plays out.

UPS Dividend Yield data by YCharts

Final thoughts

What I like about UPS stock is its unique combination of value with plenty of upside potential. An expectation that economic conditions remain solid and even benefit from further Federal Reserve interest rate cuts makes the stock even more attractive into 2025 and beyond. For investors with a long-term time horizon, UPS is one stock worth buying and holding forever.

Should you invest $1,000 in United Parcel Service right now?

Before you buy stock in United Parcel Service, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and United Parcel Service wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $853,765!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 9, 2024

Dan Victor has no position in any of the stocks mentioned. The Motley Fool recommends United Parcel Service. The Motley Fool has a disclosure policy.