The Best Tech ETF to Invest $1,000 in Right Now

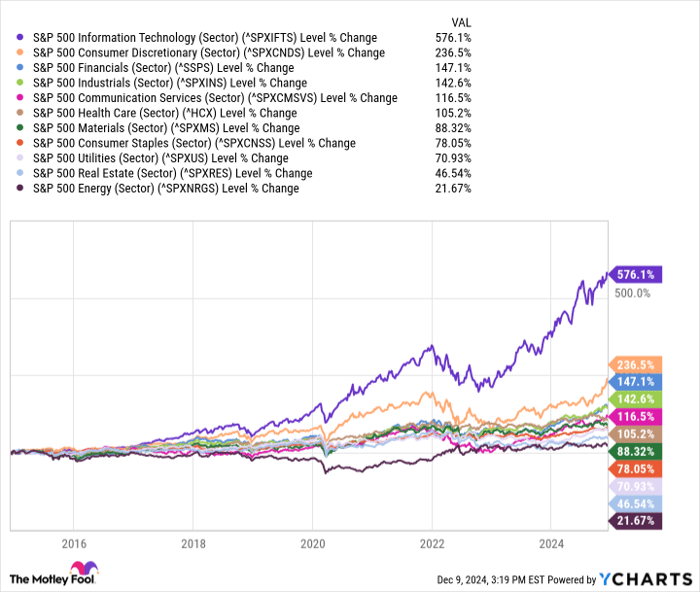

There hasn't been a more flourishing category in the stock market over the past decade than the information technology sector. In that span, the tech sector of the S&P 500 is up around 576%, while the next closest is the consumer discretionary sector at 237% (as of Dec. 9).

Considering how much technology has transformed the world around us, it's no surprise that the sector has been so successful (and profitable for investors). However, the explosion of mega-cap tech stocks has done a lot of heavy lifting for the sector, so it's not all sunshine across the board.

That said, if you have $1,000 to invest right now and want to add some tech stocks to your portfolio, the Vanguard Information Technology ETF (NYSEMKT: VGT) is a good choice.

So, what is the Vanguard Information Technology ETF?

This exchange-traded fund (ETF) contains small-, mid-, and large-cap companies operating in different industries within the tech sector. Here are the industries represented in the ETF and how much of it they account for (as of Oct. 31):

- Application software: 15.4%

- Communications equipment: 3.6%

- Electronic components: 1.4%

- Electronic equipment and instruments: 1.8%

- Electronic manufacturing services: 1.2%

- Internet services and infrastructure: 1.7%

- IT consulting and other services: 3.7%

- Semiconductor materials and equipment: 3.4%

- Semiconductors: 29.7%

- Systems software: 19.8%

- Technology distributors: 0.7%

- Technology hardware, storage and peripherals: 17.6%

With this ETF, you know you're getting exposure to the broad tech sector, covering some of its most important and thriving industries. Tech has many moving parts, so if you're looking to invest in it as a whole, this ETF is the way to go.

It contains younger, up-and-coming companies operating in more niche industries (like Snowflake with data warehousing) as well as tech titans that have been around for decades and have their hands in many different pots (like Microsoft). It's the best of both worlds.

This ETF has a history of outperforming the market

Past results never guarantee future performance, but it's often worth looking at historical results to get a sense of an investment's potential. Here's how $1,000 in the ETF has performed since it hit the market in January 2004:

When factoring in dividends, every $1,000 invested at the ETF's start would be worth over $15,000 today. That's impressive, considering the market's performance based on the S&P 500's returns over that span.

Even if we meet in the middle between the ETF's and S&P 500's performance and assume it averages 12% annual returns (emphasis on "assume"), a $1,000 investment today could be worth over $3,100 and $5,400 in 10 years and 15 years, respectively.

The ETF is heavily influenced by a few companies

One thing I would tell investors to be cautious about is the ETF's high concentration in Apple (NASDAQ: AAPL), Nvidia (NASDAQ: NVDA), and Microsoft stocks.

| Company | Percentage of the ETF |

|---|---|

| Apple | 15.76% |

| Nvidia | 15.40% |

| Microsoft | 13.35% |

Source: Vanguard. Percentages as of Oct. 31.

Three companies making up over 44% of a 314-stock ETF isn't the ideal portfolio balance because it typically ends in one extreme or the other. Either those three companies flourish and carry the ETF (which has been the case recently), or they hit a rough patch, which weighs down the ETF.

You can't predict how individual stocks will perform in the near term, but I don't have any true concerns about those companies' long-term potential. Apple continues to dominate consumer electronics and is the world's third most-profitable public company; Nvidia is at the forefront of artificial intelligence advancements; and Microsoft is the Swiss Army knife of the tech world, with its hand in almost every industry the sector has.

If there were three companies you could feel comfortable leading the charge for an ETF, those three are top of the list right now. You'll likely look back at a $1,000 investment today and be glad you made the move.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $361,233!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $46,681!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $505,079!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 9, 2024

Stefon Walters has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Apple, Microsoft, Nvidia, and Snowflake. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.