1 Unstoppable Vanguard ETF That Could Double Your Money in 2025 and Beyond

Building long-term wealth isn't necessarily easy, but investing in the stock market is one of the simplest ways to do it. With the right investment, it's possible to build a portfolio worth hundreds of thousands of dollars or more.

If you're looking for a low-effort way to potentially make a lot of money over time, investing in exchange-traded funds (ETFs) can be a smart option. An ETF allows you to buy dozens or hundreds of stocks at once, all within a single investment.

There are countless ETFs to choose from, covering various sectors of the market. While there's not necessarily a right or wrong place to invest, this Vanguard ETF could potentially double your money over time with next to no effort on your part.

A safer (yet powerful) growth fund

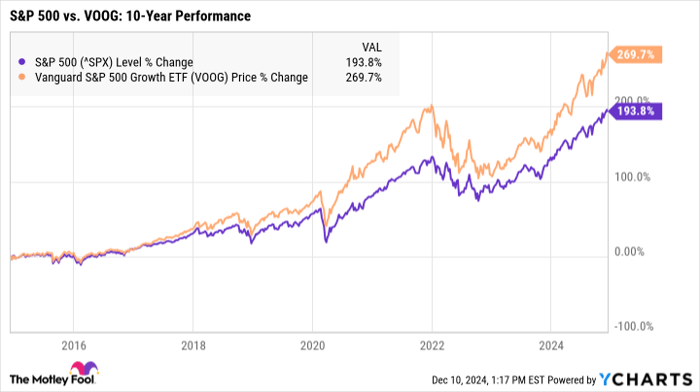

The Vanguard S&P 500 Growth ETF (NYSEMKT: VOOG) is essentially a hybrid between an S&P 500 ETF and a growth ETF, as it contains only the growth companies within the S&P 500 index (SNPINDEX: ^GSPC).

The S&P 500 is one of the pillars behind the stock market as a whole, and it contains stocks from the 500 largest publicly traded companies in the U.S. These stocks are among the strongest and healthiest in the world, making them more likely to survive periods of market turbulence.

Because the Vanguard S&P 500 Growth ETF only contains the growth stocks within the index, this fund has the potential to earn above-average returns while still remaining a relatively safe and stable investment compared to other growth ETFs.

Despite only containing growth stocks, this ETF is still relatively diversified. It includes 234 stocks from 11 different industries, though close to half of the fund is allocated to stocks in the tech sector. Greater diversification can limit your risk, especially if the market takes a turn for the worse.

How to double your money over time

As with any investment, the key to building wealth involves investing consistently and keeping a long-term outlook. Nobody knows how the market will perform over the coming weeks or months, but if you stay invested for several years or even decades, you're far more likely to see serious gains.

Over the past 10 years, the Vanguard S&P 500 Growth ETF has earned an average rate of return of 14.95% per year. At that rate, you'd double your money in around five years, assuming you're simply letting your money sit without making any additional contributions.

To really supercharge your earnings, you can consider investing a little each month. If you were to invest, say, $200 per month while earning a 14% average annual return, here's approximately how much you could accumulate over time:

| Number of Years | Total Portfolio Value |

|---|---|

| 10 | $46,000 |

| 15 | $105,000 |

| 20 | $218,000 |

| 25 | $436,000 |

| 30 | $856,000 |

| 35 | $1,665,000 |

Data source: Author's calculations via investor.gov.

Again, it's impossible to say how the stock market or this particular ETF will perform in the short term. But by staying in the market for at least a decade, you could double your money many times over. Over a lifetime, you could even earn well over $1 million in total.

All ETFs have unique advantages and disadvantages, but they can be a fantastic way to build long-term wealth with little effort. The Vanguard S&P 500 Growth ETF, specifically, could help you earn above-average returns over time, supercharging your savings while barely lifting a finger.

Should you invest $1,000 in Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF right now?

Before you buy stock in Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $827,780!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 9, 2024

Katie Brockman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.