Nuclear and Renewable Energy Stocks Have Lost Their Shine

After a strong run for some energy stocks in the fall, the rally fell flat this week with many nuclear and renewable energy stocks dropping.

According to data provided by S&P Global Market Intelligence, NuScale Power (NYSE: SMR) fell as much as 22.3% this week, Sunnova Energy (NYSE: NOVA) was down 21.5%, and FuelCell Energy (NASDAQ: FCEL) dropped 13.1% at its low. The stocks are down 15.9%, 20.8%, and 12.4% respectively as of 1:30 p.m. ET on Friday.

The momentum wears off eventually

Late summer and early fall trading centered around the data center and enormous energy needs companies would need to run artificial intelligence (AI) chips. Nuclear energy was thought to be a solution and solar energy could fill some of the need along with batteries given how quickly solar plants could be built.

But the euphoria around energy demand seems to be easing and that's why NuScale and Sunnova are down this week. NuScale could still be a big player in nuclear energy in the future, but it's years away from meaningful revenue.

Sunnova is one of the largest rooftop solar installers, which would make sense for data centers that need dedicated energy built quickly, but even that was a stretch because solar installations is a very competitive business.

Interest rates aren't helping

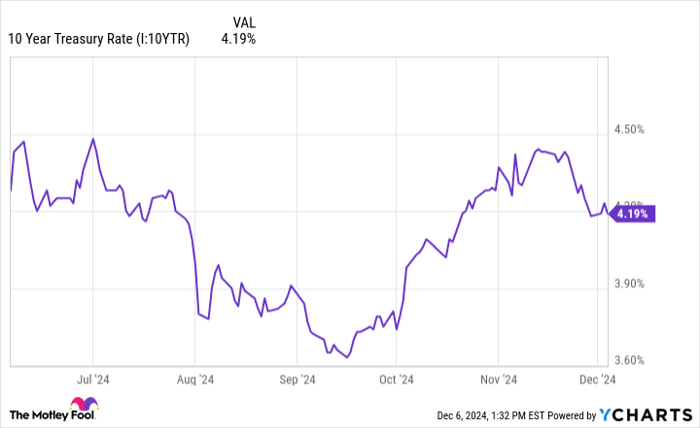

While the conventional wisdom a few months ago was that lower rates from the Federal Reserve would lead to lower borrowing rates for energy developers, that hasn't played out as hoped. You can see in the chart below that rates are up since September and are essentially flat over the past year.

10 Year Treasury Rate data by YCharts

Whether you're building a solar farm or a nuclear power plant, higher interest rates make the energy you produce more expensive. And renewable energy stocks often fall when rates rise. We're just seeing a delayed reaction to the news that's been obvious for weeks.

The market has given up on losing money

For as many hot stocks as there are today, a theme across the market is formerly hot energy stocks failing to get the valuations they got during the pandemic. Investors have given up on funding companies that seem to lose money year after year.

FuelCell Energy has seen that and even after a 1-for-30 stock split last month shares continue to decline. As the stock price goes lower it becomes even harder to raise money and can be a downward spiral for any company.

Fundamentals win over speculation

The theme here is that speculation drove energy stocks higher in the fall, but that momentum has been lost, leaving investors with the fundamental performance of these stocks. And you can see that none of them are profitable today.

NOVA Net Income (TTM) data by YCharts

Nuclear and renewable energy may be the future of the energy industry, but that doesn't mean every company involved is going to succeed. These are all established companies that are losing money and that's a bad sign for investors. I'll stay out of these speculative assets today, even after the discount in shares this week.

Should you invest $1,000 in NuScale Power right now?

Before you buy stock in NuScale Power, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and NuScale Power wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $889,004!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 2, 2024

Travis Hoium has no position in any of the stocks mentioned. The Motley Fool recommends NuScale Power. The Motley Fool has a disclosure policy.