How Much Will Estée Lauder Companies Pay Out in Dividends in 2025?

Estée Lauder Companies (NYSE: EL) recently cut its dividend, blaming challenges in the "complex prestige beauty landscape," especially in China and Asia's travel retail markets. The announcement in late October didn't go over well with the stock market, sending the company's shares down 11% since then.

With this development, I'll review Estée Lauder's dividend history, the reasons behind the cut, and its long-term sustainability.

Here's the latest on Estée Lauder's dividend

Estée Lauder, which went public in 1995 and began paying quarterly dividends in 1996, has a long history of rewarding shareholders. However, the company experienced a disappointing fiscal 2024, reporting $15.6 billion in net revenue and $390 million in net income -- declines of 2% and 61%, respectively, year over year. This pushed its payout ratio -- the percentage of profits distributed as dividends -- to an unsustainable 243%.

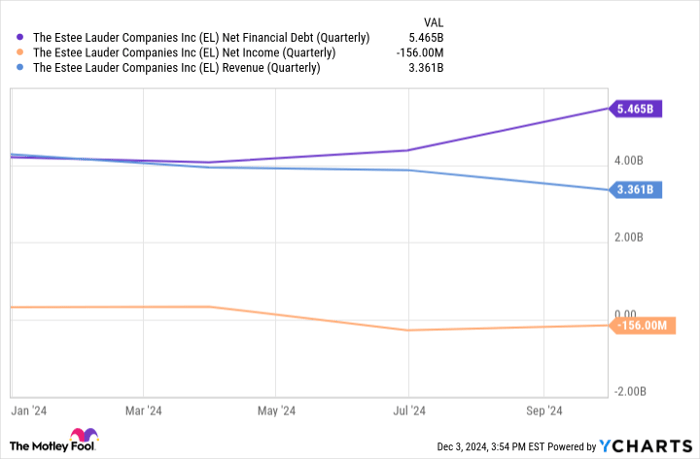

These financial pressures intensified in the first quarter of fiscal 2025. Compounding the strain were one-time costs, including a $159 million litigation settlement tied to talcum-related claims and $106 million in restructuring expenses, which led to a net loss of $156 million for the quarter.

While management had anticipated some restructuring costs, the result weighed on the balance sheet, with net debt surging 30% year over year, reaching $5.5 billion.

EL Net Financial Debt (Quarterly) data by YCharts.

To address these mounting challenges, Estée Lauder management cut its quarterly per-share dividend from $0.66 to $0.35. Assuming no change to its dividend policy in 2025, Estée Lauder will pay out $1.40 per share, equating to an annual yield of 1.9%.

As a result of the recent missteps, management withdrew its initial earnings-per-share guidance for fiscal 2025, which had been set between $2.52 and $2.76.

Investors hoping for a quick recovery in the stock may want to tread carefully, considering that a recent Hartford Funds study on dividend-paying stocks revealed that companies cutting or eliminating dividends historically underperform those that consistently grow them.

Should you invest $1,000 in Estée Lauder Companies right now?

Before you buy stock in Estée Lauder Companies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Estée Lauder Companies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $889,433!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 2, 2024

Collin Brantmeyer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.