1 Monster Growth Stock Down 70% to Buy Right Now

2024 has been a great year for high-growth stocks. The Nasdaq-100 Index is up 23.4% year to date, with many stocks flying more than 100%. Recent investor favorite Celsius Holdings (NASDAQ: CELH) has not followed this trend. The disruptive energy drink brand is down 70% from highs this year after seeing a massive slowdown in sales.

After achieving over 10% market share in the energy drink category in the U.S., Celsius stock rocketed more than 40,000% in 10 years, making it one of the best-performing stocks of the last decade. Now, with its market cap slipping to $6.6 billion, investors are getting nervous about further short-term losses for Celsius stock. For smart investors who care about the long term, these falling stock prices can present fantastic buying opportunities for historically strong growth stocks.

Here's why now is a great time to buy the dip on Celsius stock.

A healthier energy drink future

Celsius disrupted the energy drink market over the last 10 years by embracing sugar-free drinks. Its drinks, which are also infused with vitamins, are marketed as a health beverage. This positioned the traditional energy drink competitors with an unhealthy brand connotation. Embracing gym goers, women, and younger people, Celsius has consistently grown its market share in the energy drink category while also expanding the overall category. Celsius is not only competing with Red Bull, but also coffee, soda, and fruit juices.

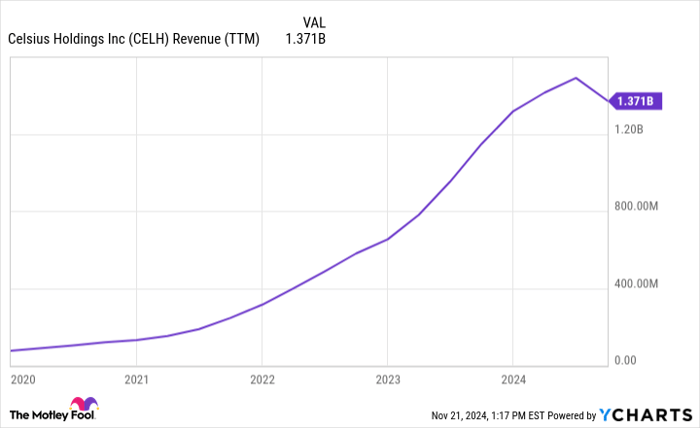

So far, the company has succeeded mightily with this strategy. Revenue was $1.37 billion over the last 12 months, up from under $100 million five years ago. Management estimates it has 11.8% market share in the U.S., taking share from the traditional players Monster Beverage and Red Bull. Now, it is taking this success in the U.S. and expanding internationally. It has entered the Canadian, U.K., Australian, and French markets over the last year or so, with plans for more countries in the coming years. International revenue grew 37% year over year last quarter to $18.6 million.

Understanding the Pepsi distribution headwind

Seeing these massive growth figures, investors may be wondering why Celsius stock has fallen 70% from highs set earlier this year. It all comes down to recent revenue growth figures and worries about the next few years.

In 2022, Celsius signed a distribution deal with PepsiCo. For the majority of sales in the U.S. -- with options to sell internationally -- Celsius will be selling into the Pepsi distribution network. Pepsi will then sell Celsius inventory into retail channels. During the beginning of the deal, Pepsi ordered as much Celsius as it could to catch up with its rapidly gaining market share. However, in recent quarters Pepsi realized that it had over-ordered Celsius inventory and is now normalizing these figures, which caused Celsius' revenue to fall 33% year over year in the third quarter.

This 33% revenue drop is obviously not something to ignore, but it does not mean Celsius is suddenly falling out of favor with consumers. It has maintained its 10% market share of the energy drink category, with year-to-date retail sales (i.e., the sell-through to actual customers) through the first three quarters already higher than all of 2023. Orders to Costco grew 15% in the third quarter, while orders to Amazon grew 21%.

I mention all of these data points to contextualize Celsius' revenue drop. This is a temporary concern and should normalize sometime in 2025. By then, the company will be growing along with its retail sales to customers once Pepsi stops under-ordering inventory in its distribution network.

CELH Revenue (TTM) data by YCharts

Is the stock a buy?

A 33% revenue drop for Celsius is scary, and clearly a lot of investors have been frightened away from the stock. However, if you still believe in the long-term viability of the Celsius brand, a share price below $30 looks appetizing.

Celsius has put up strong revenue growth in the last five years, up 1,720%. That will assuredly slow over the next five years but it still has room to steadily grow. Through steady market share gains past 10%, overall category growth, and pricing power, I think it is feasible for Celsius' revenue to double over the next five years.

That would bring annual sales to around $2.75 billion. Using Monster Beverage as a barometer, Celsius should be able to achieve 25% profit margins once the business matures, equating to $690 million in annual earnings power in five years. Compared to a current market cap of $6.6 billion, Celsius would have a price-to-earnings (P/E) ratio of less than 10 in five years.

I think the stock will trade at a much higher P/E in five years. For this reason, the stock looks like a great buy-the-dip candidate as the company gets ready to return to double-digit revenue growth in 2025.

Should you invest $1,000 in Celsius right now?

Before you buy stock in Celsius, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Celsius wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $869,885!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of November 18, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Brett Schafer has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Celsius, Costco Wholesale, and Monster Beverage. The Motley Fool has a disclosure policy.