e.l.f. Beauty Stock Down 45%: Time to Buy the Dip?

Shares of e.l.f. Beauty (NYSE: ELF) are up in the past week thanks to better-than-expected results for its fiscal 2025 second quarter. But the stock is still down about 45% from the all-time high it set earlier this year.

As a beauty brand upstart offeirng quality makeup and skincare products at an affordable price, e.l.f. Beauty stock has soared in recent years as it takes market share from legacy brands. The stock is up almost 680% in the last five years, despite the recent pullback.

Specifically, investors have been concerned about declining margins and increased marketing spending. Does that give long-term investors a buying opportunity?

Strong growth and raised market share

E.l.f. Beauty's revenue is up 471% in the last 10 years, with most of its growth coming after the COVID-19 pandemic. It has a good value proposition, selling makeup and skincare products at a fraction of typical prices, which it can do because of all the price increases legacy players in the space have implemented in the past few decades. Management was also smart to embrace modern marketing tools such as social media, leading to increased brand awareness among younger women.

The brand has enjoyed 23 consecutive quarters of market share gains. It is now focused abroad with sales outside of the United States up a whopping 91% year over year last quarter, significantly outpacing the 40% consolidated revenue growth for the company. It has entered the large European market with plans to expand as a global brand in the years to come. Important will be its likely embrace of the East Asian market, where beauty products are extremely popular. Success in Asia could supercharge growth for e.l.f. Beauty's business after it has gained so much market share in the United States.

Marketing spend concerns

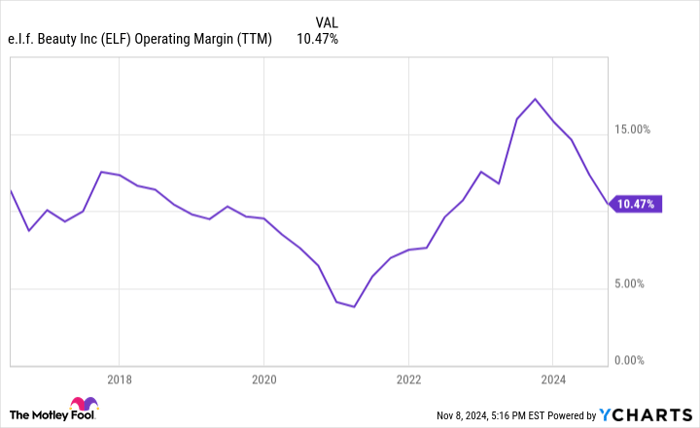

If e.l.f. Beauty's business is growing so quickly, why is the stock down? One reason: profit margins. The company has spent a lot on marketing over the years in order to increase brand awareness, which has led to historically strong revenue growth. Until a few quarters ago, this marketing budget looked wise as the company's operating margin kept rising and peaked above 15% at one point last year.

This expansion has turned into a contraction in the last few quarters with operating margin slipping to 10% as marketing spending grows faster than overall sales. This indicates that e.l.f. Beauty's marketing is getting less efficient, which is bad news for the business. The company is still generating a profit, but it may not be as profitable as investors previously thought.

Data by YCharts.

Is the stock cheap?

While e.l.f. Beauty shares have gotten a lot cheaper in recent quarters. that doesn't automatically make it a buy.

In fiscal 2025, management is expecting e.l.f. Beauty to generate around $1.32 billion in revenue, up 29%. This marks a slowdown from previous years, but that is to be expected as the company cannot sustain its market share gains forever, especially in the United States.

Forecasting growth over the next few years is tricky. International revenue growth should remain strong, while North America is likely to continue slowing down. Over the next three years, 20% revenue growth is a reasonable assumption if e.l.f. Beauty can keep its momentum going. At the same time, let's assume the company can return to delivering 15% operating margins with greater scale, and the gap between operating and net profit margins has historically averaged about two percentage points.

Under these assumptions, e.l.f. Beauty will generate $2.29 billion in revenue and $298 million in net income in fiscal 2028. Compared to its current market cap of $7.5 billion, that is a forward price-to-earnings ratio (P/E) of 25. That's enough of a premium to the broad market that despite e.l.f. Beauty's pullback this year, I don't think the stock is a buy today.

Should you invest $1,000 in e.l.f. Beauty right now?

Before you buy stock in e.l.f. Beauty, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and e.l.f. Beauty wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $904,692!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of November 11, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends e.l.f. Beauty. The Motley Fool has a disclosure policy.