This Could Drive General Motors to New Highs

General Motors (NYSE: GM) doesn't get enough credit, in my opinion, for its massive turnaround since the financial crisis and Great Recession. Way back when, Ford Motor Company (NYSE: F) received great fanfare (and justifiably so) for getting through the recession on its own dime. It then quickly shifted gears to produce new and desirable products, improve communication and operations, and return to near-record profits in short order.

These two Detroit juggernauts have now seemingly swapped places, with GM having built incredible momentum in 2024. A recent report has some projections that should have investors optimistic that the automaker can keep driving higher in the decade ahead.

All about the software

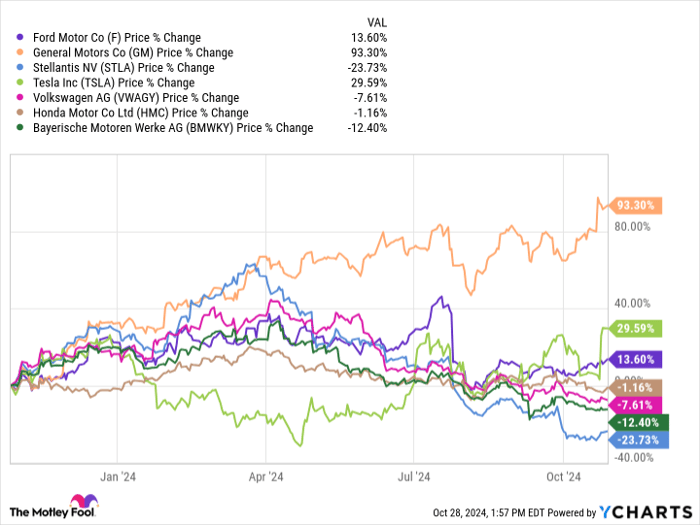

A quick look at the graph below shows just how well GM's stock has done this year versus competitors.

Despite its strong momentum in 2024, one aspect of GM that has been forsaken by investors is its Cruise operations, responsible for its robotaxi and driverless-vehicle strategy. But what investors might not realize is how lucrative the technology going into Cruise could become.

According to a report by the Oliver Wyman Forum, a think tank, the global market for advanced driver-assistance systems is likely to grow to $307 billion by 2035, from a meager $1.7 billion in 2023. More broadly, revenue from digital automotive services is forecast to grow 25% annually over the next decade, potentially reaching $610 billion in 2035, up from $42 billion in 2023. The report included 14 mobility services across car-as-a-service, micromobility, and digital services, among others.

Those pie-in-the-sky numbers are nice and all, but there's something a little more concrete for investors to be optimistic about: better margins. As more and more technology, driver assistance software, and subscription services (among other things) are added into vehicles, margins improve drastically.

Andreas Nienhaus, a partner for Oliver Wyman Forum's automotive and mobility business, told Automotive News that for automakers developing software, subscription services, and driver assistance technology:

"the economies of scale are huge. The more people who use this will provide [automakers] with more data ... and also just give [them] margin. You don't have a lot of hardware connected to it because it is built in the vehicle already."

A little proof?

We could be seeing proof of this already, in the form of rival Ford's commercial business. Management notes that its commercial customers are more likely to take software upgrades and subscription services, compared to mainstream consumers.

Ford Blue, which is its traditional business, generated $2 billion in earnings before interest and taxes (EBIT) during the first half of 2024 at a 4.3% margin. Ford's commercial business, Ford Pro, which recorded a 35% surge in subscriptions to Ford Pro software during the second quarter, reported $5.6 billion EBIT during the first half of 2024 on a much healthier 15.9% margin.

There are more factors at play in Ford Pro's surge in bottom-line profits and margins, but it's subscription services and upgrades certainly play a large role, especially considering those near 16% EBIT margins.

What it all means

So far, investors wouldn't be criticized for saying Cruise has been a distraction, headache, and money pit. However, the company has officially resumed operations in the U.S. market with a small fleet of vehicles in Arizona in April.

That was roughly six months after one of its self-driving cars hit a pedestrian in San Francisco. Since then, Cruise management has been overhauled with a new focus on safety.

It might be crazy to think but entirely possible that in a decade or two, Cruise could be the most valuable part of GM. Robotaxis could be the business of the future, and what this report makes clear is that even if robotaxis don't take over the road, the technology involved -- like software and driver assistance -- will be incredibly valuable to own.

Should you invest $1,000 in General Motors right now?

Before you buy stock in General Motors, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and General Motors wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $813,567!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 28, 2024

Daniel Miller has positions in Ford Motor Company and General Motors. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.