From Dividend Reset to Recovery: W.P. Carey's Strategy for Winning Back Wall Street's Trust

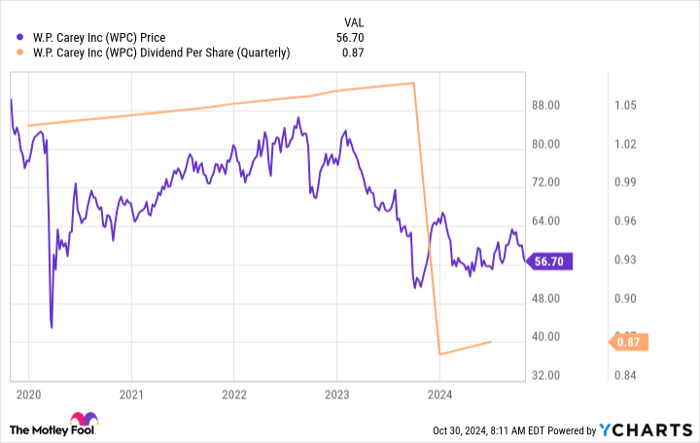

After 24 years, W.P. Carey's (NYSE: WPC) streak of annual dividend increases was about to hit an important milestone. However, the real estate investment trust (REIT) did something that seemingly made no sense -- it cut its dividend just months short of hitting 25 consecutive annual dividend hikes. Investors were not pleased, but W.P. Carey is hard at work trying to prove that this cut was really just a reset. Here's why this high-yield REIT is still worth buying.

What's wrong with offices?

The fact that W.P. Carey is a net-lease REIT is an important factor to consider in its decision to exit the office sector. Net-lease assets are generally single-tenant properties. Although the tenant is responsible for most property-level expenses, the big risk for the landlord is that the tenant may not renew the lease when it ends. Given the troubled state of the office sector after the coronavirus pandemic, the single-tenant risk of net lease office assets is particularly high right now.

Image source: Getty Images.

What's interesting about office properties is that they often require material investment in the asset at the end of a lease. The first reason for this is the size of the assets, which often are much larger than a single-tenant retail store. Also, the existing tenant will usually demand upgrades to entice them to stay. If the asset is vacated, there will most definitely be significant costs to upgrade the office and convince a new tenant to move in. Such spending will most likely be required if the office owner decides to sell, too. So, office properties are one of the higher-risk net-lease property types.

Sensing the shift in the market, Realty Income (NYSE: O) decided to spin off its office properties a few years ago. However, Realty Income is about four times larger than W.P. Carey. Jettisoning office properties, which accounted for a relatively small percentage of its rents, had little impact on that REIT's business because the property type just wasn't that material to its business. Offices made up 16% of rents at W.P. Carey before the decision to exit the property type.

A dividend reset had to be made at W.P. Carey

There's no way for a REIT to suddenly jettison 16% of its rent roll and not cut the dividend. But it is important to remember that this was a strategic decision meant to improve W.P. Carey's long-term prospects. The rest of the portfolio is, for the most part, performing reasonably well. The REIT was simply looking to shift its business in a more positive direction. This is why W.P. Carey started raising the dividend again the quarter after the cut. In fact, it has increased the dividend each quarter since the reduction.

It is, effectively, an effort to prove to investors that the cut wasn't made from a position of weakness. It was merely a reset, since the REIT has gotten right back onto the quarterly increase cadence that existed before the cut. Now that office is out of the portfolio, the REIT may actually be operating from a stronger position. Investors shouldn't miss the signal here; management is making a statement.

After resetting the dividend lower, the REIT could have simply changed the dividend pattern (perhaps letting it languish at the same level for years), and nobody would have blinked an eye. But it didn't do that. W.P. Carey chose to resume the same dividend pattern that existed before the reduction.

What's also notable is that exiting the office sector has left W.P. Carey with cash that it intends to invest in new properties. That will expand the business and provide it with the wherewithal to continue increasing the dividend over the long term. However, timing is an issue. Buying new properties is a process that can take months, and sometimes more than a year. It can't prove it is growing again as easily as it can prove that it is dedicated to returning value to shareholders via an increasing dividend.

Listen to W.P. Carey's obvious signals

It was probably a better choice to reset the dividend before hitting 25 annual increases than it would have been to reset the dividend after reaching that milestone. That doesn't make the dividend reduction any easier to swallow, but it helps to explain the seemingly odd timing. Now, the fact that W.P. Carey is already increasing the dividend again is a very good sign. That will become more obvious over time as it spends the cash the office exit generated on new properties. However, long-term income investors should probably take the company's early dividend signal to heart and buy this 6.2% yielding REIT while Wall Street's expectations are still clouded by the cut. The dividend reset is effectively hiding the positives that are increasingly on display.

Should you invest $1,000 in W.P. Carey right now?

Before you buy stock in W.P. Carey, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and W.P. Carey wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $853,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 28, 2024

Reuben Gregg Brewer has positions in Realty Income and W.P. Carey. The Motley Fool has positions in and recommends Realty Income. The Motley Fool has a disclosure policy.