What Is a U.S. Government Shutdown — and Is It Bullish or Bearish for Bitcoin?

Introduction

TradingKey – In October 2025, the U.S. government entered a shutdown due to a budget impasse, halting federal operations, delaying economic data, and suspending regulatory activity — triggering volatility across global financial markets. As a high-sensitivity risk asset, the crypto market was among the first to react. This article explores the impact of the shutdown on digital assets and outlines potential trends and opportunities.

What Is a U.S. Government Shutdown?

A government shutdown occurs when Congress fails to pass a budget before the start of the fiscal year, forcing parts of the federal government to suspend operations due to lack of funding. The effects are felt across three key areas:

- Data Agencies Halt Operations – Institutions like the Bureau of Labor Statistics (BLS) and Bureau of Economic Analysis (BEA) stop publishing reports.

- Regulatory Bodies Scale Down – Agencies such as the SEC and CFTC operate with minimal staff, delaying approvals and enforcement.

- Public Services Disrupted – Federal employees go on unpaid leave, affecting services like Social Security, defense, and healthcare.

Since 1976, the U.S. has experienced multiple shutdowns, each with varying causes and consequences. In the past decade, shutdowns have become longer and more frequent, reflecting deepening political divisions. The current shutdown began on October 1, 2025, and remains unresolved.

Impact on the Crypto Market

The shutdown directly affects crypto through regulatory paralysis, economic uncertainty, and shifts in investor behavior — generally creating headwinds for digital assets.

Data Blackout Fuels Volatility

Key indicators like nonfarm payrolls, CPI, and PCE are delayed, leaving markets without guidance on Fed policy. Crypto prices, which are highly sensitive to interest rate expectations, become more volatile. In early October, Bitcoin (BTC) briefly surged past $125,000, but reversed sharply, falling below $110,000 by October 11.

Flight to Safety: Gold and Stablecoins

During the shutdown, gold (XAUUSD) hit a record high of $4,200, signaling a shift toward safe-haven assets. On October 14, the total market cap of stablecoins surpassed $310 billion, also a new high.

Regulatory Freeze Dampens Sentiment

With agencies like the SEC and CFTC operating at reduced capacity, crypto ETF approvals are delayed, undermining investor confidence. The lack of regulatory clarity may trigger additional sell pressure.

When Will the Shutdown End?

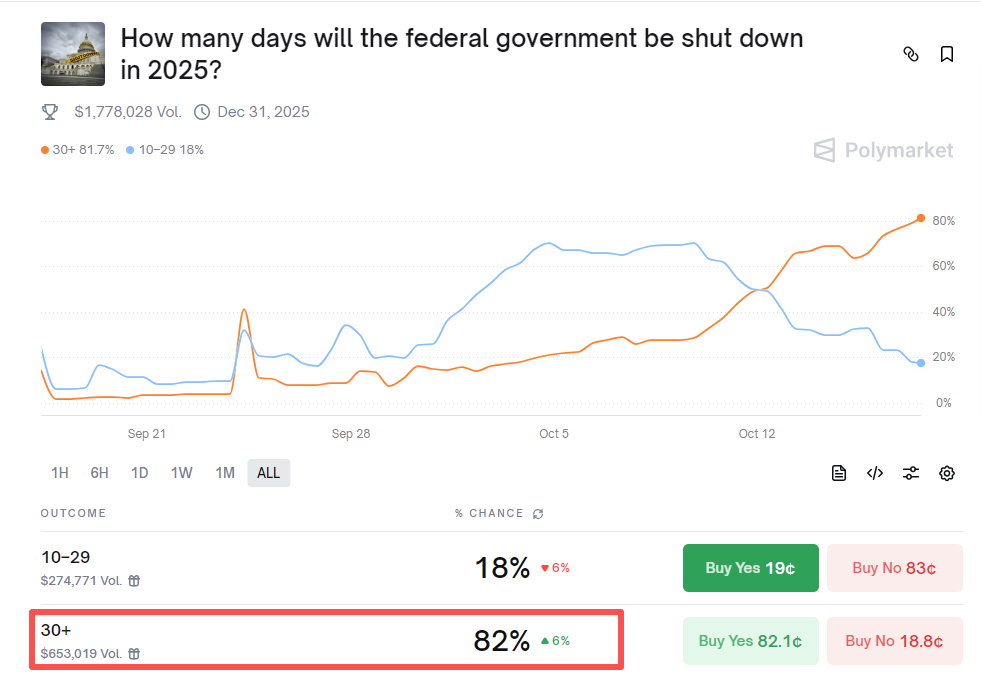

The last major shutdown lasted 34 days (Dec 2018–Jan 2019); the one before that lasted 16 days in 2013. The trend suggests longer durations. Morgan Stanley strategist Shaun Zhou estimates the current shutdown could last 10 to 29 days. On Polymarket, traders assign an 82% probability that the shutdown will exceed 30 days.

Investor Bets on Shutdown Duration – Source: Polymarket.

Investor Bets on Shutdown Duration – Source: Polymarket.

How Should Investors Respond?

The shutdown creates a dynamic of short-term volatility and long-term recovery. Crypto investors should balance risk management with strategic positioning. Here are some reference strategies:

Short-Term Tactics: Manage Volatility

Strategy | Description |

Reduce Leverage | Elevated volatility increases liquidation risk — avoid high-leverage positions. |

Increase Stablecoin Allocation | Assets like USDC, DAI, and USDT offer stability amid turbulence. |

Set Stop-Loss/Take-Profit | Define technical support/resistance levels to avoid emotional trading. |

Monitor On-Chain Data | Track fund flows, liquidation events, and sentiment indicators to assess risk exposure. |

Long-Term Tactics: Watch for Policy Resets

Strategy | Description |

Track ETF Progress | Once the SEC resumes operations, ETF reviews will restart — position early in assets like LTC, XRP, SOL. |

Follow Rate Policy | With delayed data, markets rely on expectations — watch for Fed rate cut signals. |

Accumulate on Dips | If irrational sell-offs occur, consider phased entries into BTC, ETH, and other majors. |

Conclusion

The U.S. government shutdown is a stress test of policy and sentiment. Crypto investors should respond with calm and flexible strategies. In the short term, uncertainty may drive volatility and negative sentiment. But over the long run, the crypto market’s structural resilience — especially as regulation resumes — still offers compelling opportunities.