1 High-Yield Dividend ETF to Buy to Generate Passive Income

Generating passive income is a terrific way to supplement your salary or, for retirees, your Social Security income. A steady stream of cash helps to pay bills, build an investment portfolio, create a rainy-day fund, or maybe afford life's luxuries like traveling. For retirees, it is often a lifeline. The average Social Security benefit is less than $22,000 per year, certainly not enough to live the way most of us desire. High-yield exchange-traded funds (ETFs) are excellent passive income options, especially in a falling interest rate environment.

The high inflation rate caused by supply chain disruptions and economic stimulus related to COVID-19 made life difficult for many. However, Americans could earn more that 5% risk-free returns on certificates of deposit (CDs), U.S. Treasuries, bonds, and even some high-yield savings accounts after the Federal Reserve significantly raised the federal funds rate to counter inflation.

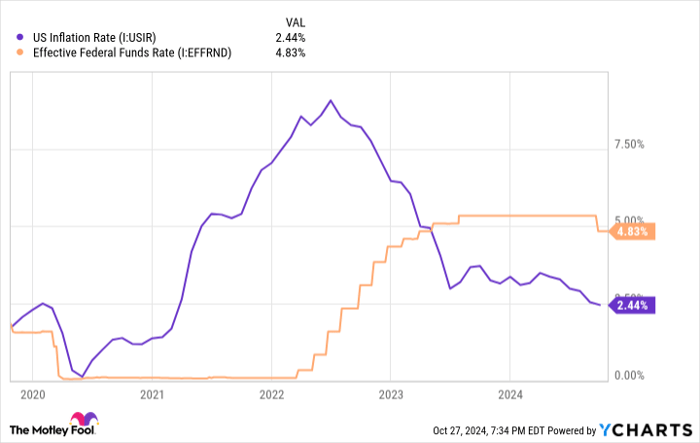

In the chart below, the orange line shows the rapid rise in interest rates, and the purple line shows the decline in inflation.

US Inflation Rate data by YCharts.

With inflation now less than 2.5%, the Federal Reserve is lowering interest rates. Many analysts expect more cuts this year and next, so yields on the investments cited above will keep falling.

It's time to look elsewhere for higher returns. Here is an ETF that will keep the cash rolling in.

SPDR Bloomberg High Yield Bond ETF

Just as we have individual credit scores, publicly traded companies also have credit ratings. The highest-rated are AAA, followed by AA, A, BBB, and so on through D. Bonds issued by companies with ratings below BBB are considered speculative and known as junk bonds. These bonds offer much higher yields to compensate the investor for buying these riskier securities.

There is more risk that these bond issuers will default on their obligations, meaning investors could lose their invested capital. However, S&P Global expects default rates to be less than 5% at the end of 2024. Still, choosing specific junk bonds is risky. Purchasing the SPDR Bloomberg High Yield Bond ETF (NYSEMKT: JNK), which holds more than 1,200 different bonds, eliminates the risk of picking one bond that goes belly up. In addition, 88% of the fund's holdings are BB or B rated, or just under the BBB rating separating speculative from investment grade bonds.

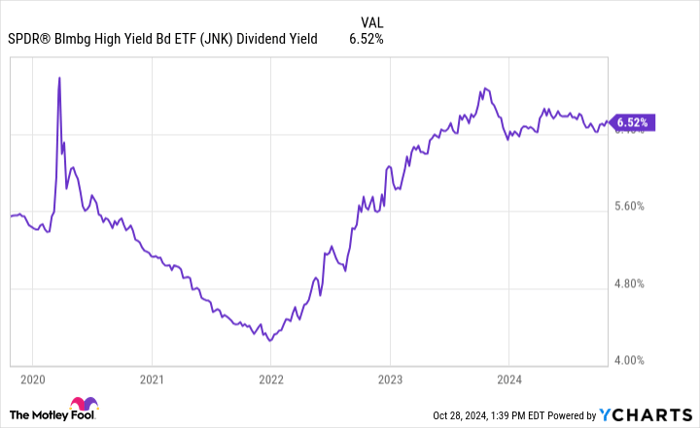

The fund currently yields 6.5%, near its five-year high.

JNK Dividend Yield data by YCharts.

The fund pays dividends monthly, which is an advantage for investors. You will have a monthly source of income, or you can reinvest each month to compound the gains.

Although the ETF significantly reduces the risk of junk bond investing, it doesn't eliminate it. Increases in default rates, perhaps caused by a severe financial crisis, could lower the dividend and hurt the fund's value.

The increased risk is the trade-off for much higher yields. Many investors find the higher yields of junk bonds well worth the risk. The SPDR Bloomberg High Yield Bond ETF is an excellent way to invest in these opportunities.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,492!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,204!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $409,559!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 28, 2024

Bradley Guichard has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.