This Growth Stock Is Up 50% in 6 Months and Can Still Go Higher

Many growth stocks have been picking up steam in recent weeks after the Federal Reserve cut rates by 50 basis points in September. The hope and expectation is that more rate cuts could be coming in the months ahead.

This can be positive news for growth investors. Not only can it be more affordable to raise cash, but debt-heavy businesses may have the opportunity to refinance their debt at lower rates, bringing down their interest costs in the process.

One stock that's been benefiting from a more favorable outlook with respect to interest rates is Carnival Corporation (NYSE: CCL). The cruise ship operator's stock has risen more than 50% in just the past six months, but there's plenty of reason to remain bullish on this travel stock for the long haul.

Carnival's high debt load could become less of a concern for investors

Demand for cruises has been strong this year, and Carnival has posted record numbers. But despite these positive developments, the stock has struggled at times to generate bullishness from investors. While the company's shares have been up big in recent months, they were trading at more than $50 before the pandemic; it's nowhere near those levels today.

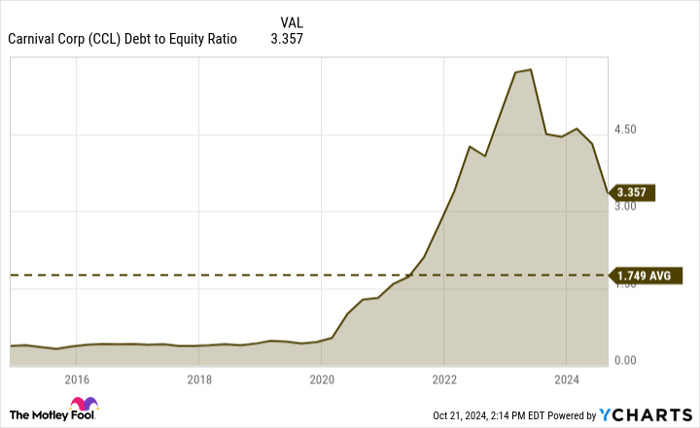

The big reason investors appear to be hesitant is Carnival's debt load. In the company's most recent quarter, which ended Aug. 31, its long-term debt and the current portion of its long-term debt (which is due within the next 12 months) came in at a combined $28.9 billion. An easy way to demonstrate the high level of debt the company is carrying is through its debt-to-equity ratio. While Carnival has been improving on the ratio, it remains well above what the stock has averaged over the past decade.

CCL Debt to Equity Ratio data by YCharts.

As interest rates come down, investors may be less concerned with Carnival's debt load, especially since it has been improving. Plus, if the company can refinance debt and bring down its interest expenses, that can help improve its bottom line, which can help Carnival more aggressively reduce its debt.

Over the nine-month period ended Aug. 31, Carnival's net income topped $1.6 billion, which is a massive improvement from the $26 million loss it posted during the same period last year.

Lower rates could ensure demand stays strong

Another potentially positive consequence of lower interest rates? As expenses start to come down for consumers, cruises could become more affordable. But it's not as if Carnival needs help with revenue growth -- advanced bookings for 2025 are higher than what they were for 2024, and that's even with prices increasing. It also noted a strong start to 2026.

If expenses come down for consumers and it becomes easier to finance a big vacation, it can lead to stronger demand for cruises for the foreseeable future. With demand already looking robust, Carnival's advanced bookings could fill up even longer into the future, which could help reduce the risk associated with the stock and concerns about business slowing down next year.

Carnival is a tempting stock with a lot of potential upside

If Carnival's stock were to double, it still wouldn't be at its pre-pandemic levels. Although the company's debt is high, it's not enough of a concern at this stage for this to be a bad stock to buy.

Carnival needed debt to get it through the pandemic, and its finances are in a much better state right now. It may take time for the business to get its debt-to-equity ratio down to more normal levels, but it looks like it's on a much better path now.

For patient investors, Carnival can potentially be an excellent stock to own for the long haul. Business is booming, and as rates come down, this already hot stock may rise even more.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,365!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,619!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $412,148!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 21, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy.